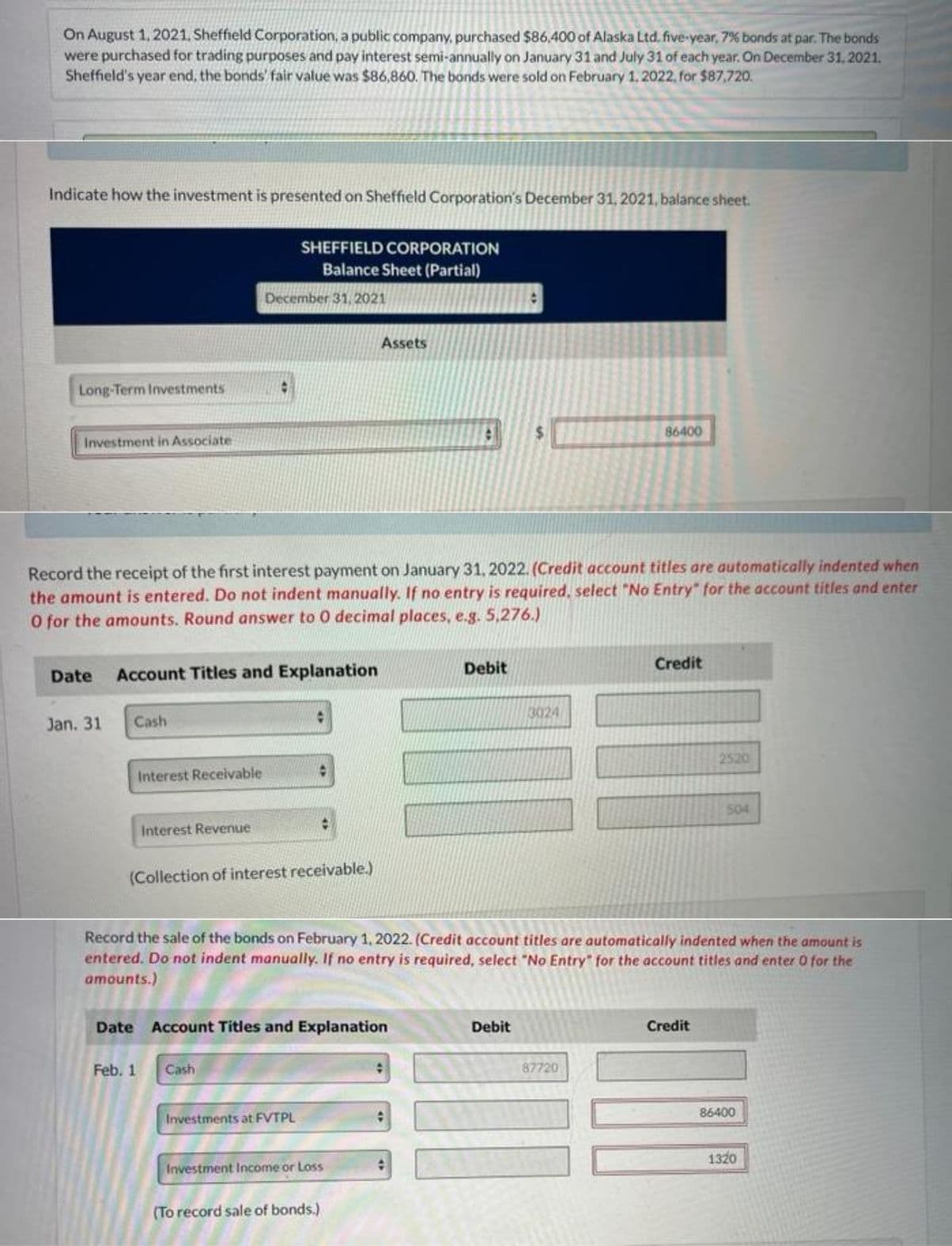

On August 1, 2021, Sheffield Corporation, a public company, purchased $86,400 of Alaska Ltd. five-year, 7% bonds at par. The bonds were purchased for trading purposes and pay interest semi-annually on January 31 and July 31 of each year. On December 31, 2021. Sheffield's year end, the bonds' fair value was $86,860. The bonds were sold on February 1, 2022, for $87,720. ndicate how the investment is presented on Sheffield Corporation's December 31, 2021, balance sheet. SHEFFIELD CORPORATION Balance Sheet (Partial) December 31, 2021

On August 1, 2021, Sheffield Corporation, a public company, purchased $86,400 of Alaska Ltd. five-year, 7% bonds at par. The bonds were purchased for trading purposes and pay interest semi-annually on January 31 and July 31 of each year. On December 31, 2021. Sheffield's year end, the bonds' fair value was $86,860. The bonds were sold on February 1, 2022, for $87,720. ndicate how the investment is presented on Sheffield Corporation's December 31, 2021, balance sheet. SHEFFIELD CORPORATION Balance Sheet (Partial) December 31, 2021

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 16E

Related questions

Question

Transcribed Image Text:On August 1, 2021, Sheffield Corporation, a public company, purchased $86,400 of Alaska Ltd. five-year, 7% bonds at par. The bonds

were purchased for trading purposes and pay interest semi-annually on January 31 and July 31 of each year. On December 31, 2021.

Sheffield's year end, the bonds' fair value was $86,860. The bonds were sold on February 1, 2022, for $87,720.

Indicate how the investment is presented on Sheffield Corporation's December 31, 2021, balance sheet.

Long-Term Investments

Investment in Associate

Jan. 31

Date Account Titles and Explanation

Cash

Interest Receivable

Record the receipt of the first interest payment on January 31, 2022. (Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter

O for the amounts. Round answer to 0 decimal places, e.g. 5,276.)

Interest Revenue

SHEFFIELD CORPORATION

Balance Sheet (Partial)

December 31, 2021

(Collection of interest receivable.)

Feb. 1

Cash

Date Account Titles and Explanation

Investments at FVTPL

Assets

Investment Income or Loss

9

(To record sale of bonds.)

Debit

Record the sale of the bonds on February 1, 2022. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the

amounts.)

86400

3024

101

III

Debit

Credit

87720

2520

Credit

504

86400

1320

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning