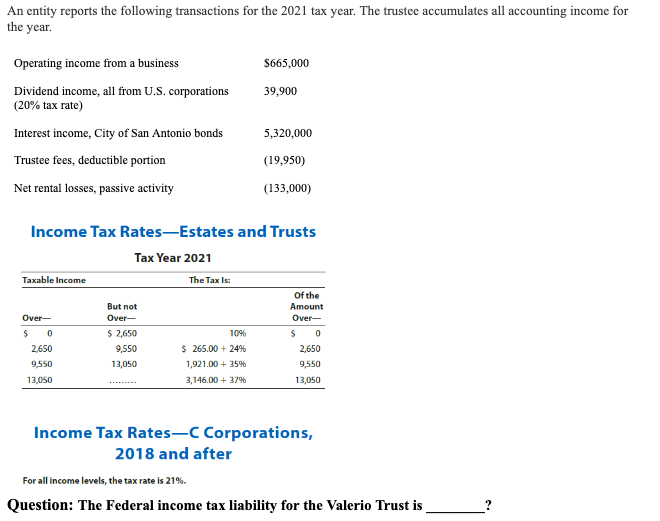

An entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $665,000 39,900 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 5,320,000 Trustee fees, deductible portion (19,950) Net rental losses, passive activity (133,000)

An entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $665,000 39,900 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 5,320,000 Trustee fees, deductible portion (19,950) Net rental losses, passive activity (133,000)

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:An entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for

the

year.

Operating income from a business

$665,000

39,900

Dividend income, all from U.S. corporations

(20% tax rate)

Interest income, City of San Antonio bonds

5,320,000

Trustee fees, deductible portion

(19,950)

Net rental losses, passive activity

(133,000)

Income Tax Rates-Estates and Trusts

Tax Year 2021

Taxable Income

The Tax Is:

Of the

But not

Amount

Over-

Over-

Over-

$

0

$ 2,650

10%

$

0

2,650

9,550

$ 265.00 +24%

2,650

9,550

13,050

1,921.00 + 35%

9,550

13,050

3,146.00 + 37%

13,050

Income Tax Rates-C Corporations,

2018 and after

For all income levels, the tax rate is 21%.

Question: The Federal income tax liability for the Valerio Trust is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you