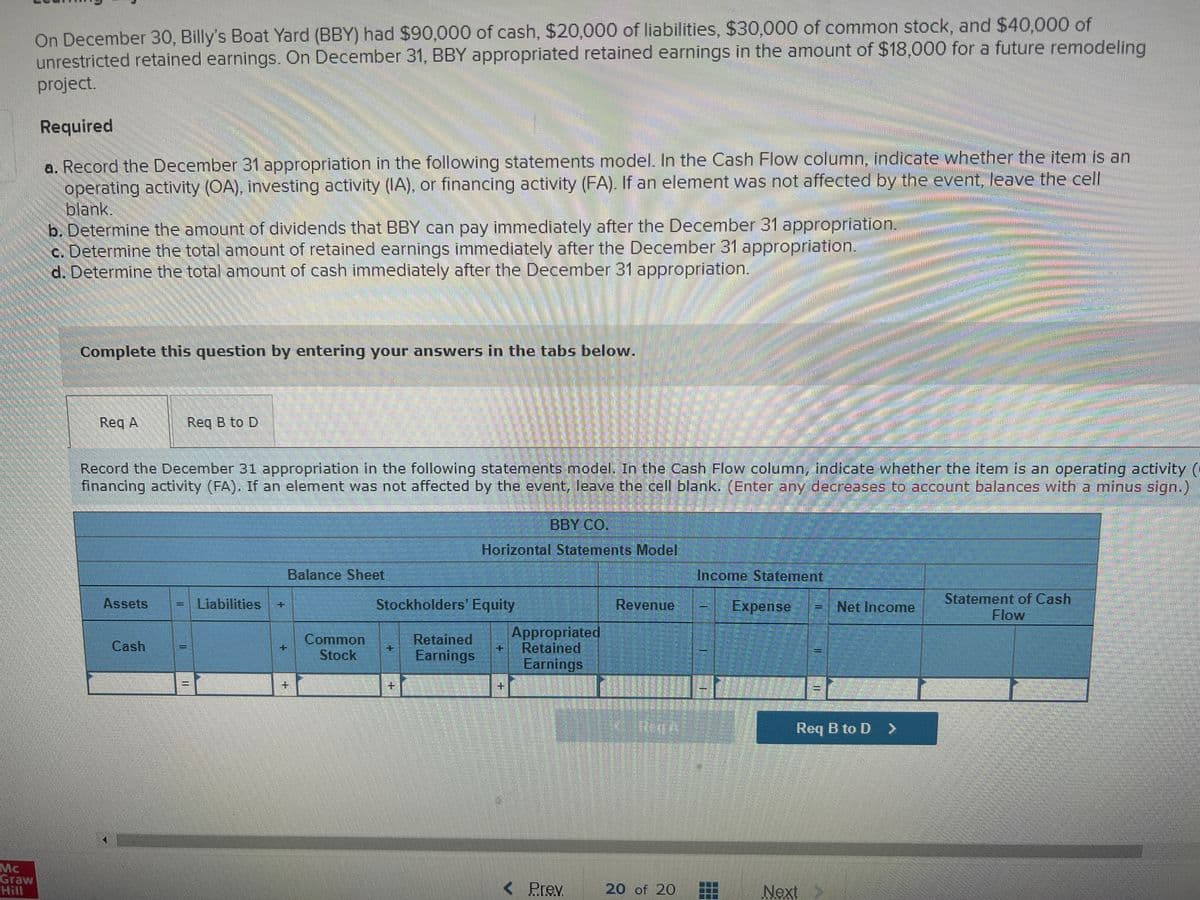

On December 30, Billy's Boat Yard (BBY) had $90,000 of cash, $20,000 of liabilities, $30,000 of common stock, and $40,000 of unrestricted retained earnings. On December 31, BBY appropriated retained earnings in the amount of $18,000 for a future remodeling project. Required a. Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount of dividends that BBY can pay immediately after the December 31 appropriation. c. Determine the total amount of retained earnings immediately after the December 31 appropriation. d. Determine the total amount of cash immediately after the December 31 appropriation. Complete this question by entering your answers in the tabs below. Req A Reg B to D Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an operating activity ( financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) BBY CO. Horizontal Statements Model Balance Sheet Income Statement Liabilities Stockholders' Equity Statement of Cash Flow Assets Revenue Expense Net Income Common Stock Appropriated Retained Earnings Retained Cash Earnings + + RegA Req B to D >

On December 30, Billy's Boat Yard (BBY) had $90,000 of cash, $20,000 of liabilities, $30,000 of common stock, and $40,000 of unrestricted retained earnings. On December 31, BBY appropriated retained earnings in the amount of $18,000 for a future remodeling project. Required a. Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount of dividends that BBY can pay immediately after the December 31 appropriation. c. Determine the total amount of retained earnings immediately after the December 31 appropriation. d. Determine the total amount of cash immediately after the December 31 appropriation. Complete this question by entering your answers in the tabs below. Req A Reg B to D Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an operating activity ( financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) BBY CO. Horizontal Statements Model Balance Sheet Income Statement Liabilities Stockholders' Equity Statement of Cash Flow Assets Revenue Expense Net Income Common Stock Appropriated Retained Earnings Retained Cash Earnings + + RegA Req B to D >

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter6: Statement Of Cash Flows

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On December 30, Billy's Boat Yard (BBY) had $90,000 of cash, $20,000 of liabilities, $30,000 of common stock, and $40,000 of

unrestricted retained earnings. On December 31, BBY appropriated retained earnings in the amount of $18,000 for a future remodeling

project.

Required

a. Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an

operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell

blank.

b. Determine the amount of dividends that BBY can pay immediately after the December 31 appropriation.

c. Determine the total amount of retained earnings immediately after the December 31 appropriation.

d. Determine the total amount of cash immediately after the December 31 appropriation.

Complete this question by entering your answers in the tabs below.

Req A

Req B to D

Record the December 31 appropriation in the following statements model. In the Cash Flow column, indicate whether the item is an operating activity (

financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.)

ВBY CO,

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of Cash

Flow

Assets

Liabilities

Stockholders' Equity

Revenue

Expense

= Net Income

Common

Stock

Appropriated

Retained

Earnings

Retained

Cash

Earnings

+.

+.

Req B to D >

Mc

Graw

Hill

< Prev.

20 of 20

Next

一

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,