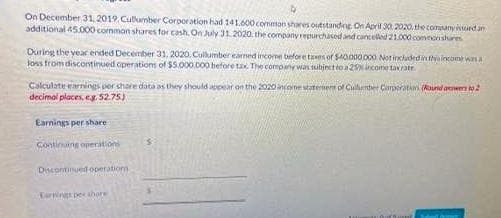

On December 31, 2019. Cullumber Corporation had 141.600 common shares outstanding On April 30, 2020, the company issued. additional 45.000 common shares for cash. On July 31 2020 the company repurchased and cancelled 21.000.commonshares During the year ended December 31, 2020, Cullumber earned income before txes of $40.000.000 Not included in this income was a loss from discontinued operations of $5.000.000 before tax. The company was subject to a 29% income tax rate Calculate earnings per share data as they should appear on the 2020 income statement of Cullumber Corporation (Round aners to 2 decimal places, eg.52.75) Earnings per share Continuing operation Discontinued operations Carnings peshore

On December 31, 2019. Cullumber Corporation had 141.600 common shares outstanding On April 30, 2020, the company issued. additional 45.000 common shares for cash. On July 31 2020 the company repurchased and cancelled 21.000.commonshares During the year ended December 31, 2020, Cullumber earned income before txes of $40.000.000 Not included in this income was a loss from discontinued operations of $5.000.000 before tax. The company was subject to a 29% income tax rate Calculate earnings per share data as they should appear on the 2020 income statement of Cullumber Corporation (Round aners to 2 decimal places, eg.52.75) Earnings per share Continuing operation Discontinued operations Carnings peshore

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On December 31, 2019. Cullumber Corporation had 141.600 common shares outstanding On April 30, 2020, the company issued an

additional 45.000 common shares for cash, On July 31, 2020, the company repurchased and cancelled 21.000 common shares

During the year ended December 31, 2020, Cullumber earned income before taxes of $40.000.000 Not included in this income was a

loss from discontinued operations of $5.000.000 before tax. The company was subject to a 29% income tax rate

Calculate earnings per chare data as they should appear on the 2020 inconstaterers of Cullumber Corporation (Round or to 2

decimal places, eg. 52.75)

Earnings per share

Continuing operation

Discontinued operations

Carnings pe shore

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning