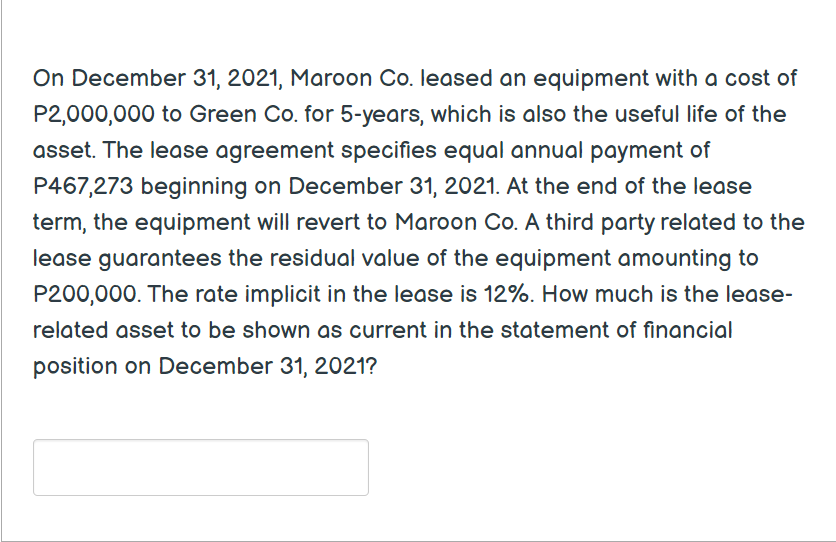

On December 31, 2021, Maroon Co. leased an equipment with a cost of P2,000,000 to Green Co. for 5-years, which is also the useful life of the asset. The lease agreement specifies equal annual payment of P467,273 beginning on December 31, 2021. At the end of the lease term, the equipment will revert to Maroon Co. A third party related to the lease guarantees the residual value of the equipment amounting to P200,000. The rate implicit in the lease is 12%. How much is the lease- related asset to be shown as current in the statement of financial position on December 31, 2021?

Q: XYZ Company manufactures picture frames of all sizes and shapes and uses job order costing system.…

A: Overhead means the amount of expenses incurred in factory which is not directly linked with…

Q: Which one of the following is not a factor that helps determine a company's credit rating? Its…

A: A credit rating can be defined as the evaluation of a person or entity’s ability to pay obligations.…

Q: Suppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are…

A: Calculation of net assets value are as follows

Q: Levar Corporation has two operating divisions-a Consumer Division and a Commercial Division. The…

A: Order Fulfillment Department cost that should be charged to the Commercial Division at year end =…

Q: Riley Corp. acquired equipment on January 2, Year 1, at a cost of $570,000 with an estimated useful…

A: In straight line method the depreciation expense will be same for each year of its useful life.…

Q: Selling price (per unit) R 116 Units in opening inventory 600 Units manufactured 2 550 Units sold 3…

A: Marginal costing method: It is also called the Variable costing method. In this method, all the…

Q: Susan Wilson operates a popular summer camp for elementary school children. Projections for the…

A: Calculation of above requirement are as follows.

Q: The beginning inventory, purchases, and sales for Myrl Sign Company for the month of April are…

A: The cost of goods sold includes the total cost of goods sold during the period, and ending inventory…

Q: Roush Inc. has 100,000 shares of $5 par value common stock issued and outstanding. On July 1, 2019…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Surewin Company provided the following information at year-end: Cash…

A: Current assets are those assets which can be sold, consumed or exhausted in the normal operating…

Q: Given the following cash transactions relating to Weatherford Company, what is the net cash flows…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Essentials of Federal Income Taxation 9. Guaranteed Payments and Allocation of Partnership Income.…

A: The guaranteed payment is the payment like salary for service provided, return on time invested, and…

Q: SLO-3.3. Liabilities are reported on the OIncome Statement Ostatement of Owner's Equity Ostatement…

A: Basic accounting equation is Total Assets = Total liabilities + Owners Equity

Q: The auto repair shop of Quality Motor Company uses standards to control the labor time and labor…

A: Formula: Labor rate variance = (Actual hourly rate - Standard rate per hour)*Actual hours worked…

Q: Gordon Helps and Associates Company makes two products. Information regarding one of those products…

A: Cost is the amount incurred on the making of a good. It includes the cost incurred on production as…

Q: The following data apply to Stratford Ltd: Direct materials inventory, beginning of the year $5,500…

A: Direct material used during the year = Direct Material inventory, Beginning of the year + Direct…

Q: The following is the adjusted trial balance of Sierra Company. Sierra Company Adjusted Trial Balance…

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as of the…

Q: a. Compute and characterize any gain or loss Dave may have to recognize as a result of his admission…

A: Solution:- Computation and characterize any gain or loss Dave may have to recognize as a result of…

Q: The management of Kunkel Company is considering the purchase of a $27,000 machine that would reduce…

A: Solution: Initial investment = $27,000 Annual cash inflows = $6,500 Useful life = 5 years Required…

Q: Which statement is most TRUE regarding Corporate Social Responsibility (CSR) Reporting as of April,…

A: Answer:- CSR meaning:- Corporate social responsibility is a kind of business paradigm in which…

Q: Explain four types of standard in Performance Management Accounting.

A: performance management standard or those standard that has been set up by the regulating body to…

Q: Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working…

A: Calculation of above requirement with all necessary working are as follows

Q: Which of the following is not a potential entity level tax for an S corporation that was formerly a…

A: The S Corporation is one of the constitution in US Taxation along with C Corporation. S Corporation…

Q: Match the following paper payment types with the correct description.

A: Payment types means various modes of payment which are used for the purpose of making payment to…

Q: inery has been sold for 280,000. Show the accounting entries for each year up to Year 5 us

A: Brief Accounting of assets, Depreciation, Sinking fund method

Q: 36. What order should the products be made in, in order to maximize profits? Ess Co. manufactures…

A: Lets understand the basics. When there is scarcity of any resources then management try to allocate…

Q: Tyrion Company sells motorcycle helmets. In 2021, Tyrion sold 4,000,000 helmets before discovering a…

A: There are two lawsuits filed against the company by December 31, 2021. The court has not settled the…

Q: List the five basic steps in calculate the full production cost per unit using the ABC method

A: ABC is a modern approach whereby overhead costs are bifurcated based on the utilization of…

Q: A project requires a $41,000 initial investment and is expected to generate end-of-period annual…

A: Introduction:- Net present value means as follows under:- Net present value is a tool of Capital…

Q: Which of the following statement about the closing inventory for last month is correct

A: LIFO and FIFO both are the methods which are used by the company to determine the value of the…

Q: After learning how to value a stock in his Corporate Finance class, Mark Stark decided to put his…

A: The constant growth rate model determines the cost of capital by assuming that the dividend will…

Q: Bee Company's net income for 2018, 2019, and 2020 were P100,000; P145,000; and P185,000…

A: If there were any omissions, determine it pertains to an accrual or deferral of an asset or…

Q: A company has the following information available that was used to report inventory using the…

A: Most of ending inventory is to be reported at cost index 1.06

Q: 5. VVV Co. manufactures electric motor drills. During July 2020, Job 007 for the production of 600…

A: 1.Computation of total cost transferred to finished goods inventory: •Calculate the total…

Q: In determining changes to a partner's outside basis, which of the following statements is false? All…

A: The basis in a partnership firm can be inside or outside. The key difference is that inside basis is…

Q: Variable cost ratio is 60%. While breakeven ratio is 65%. Net income is P42,000. Fixed cost must be

A: Break even point= fixed cost / contribution Contribution ratio = fixed cost /65% Given variable…

Q: An organizations stock records show the following transactions for a specific item during last…

A: Weighted average method is one of the method used for inventory valuation, under which total costs…

Q: es should be made? a.debit Allowance for Doubtful Accounts, $800; credit Bad Debt Expense, $800…

A: Bad debts are very important in accounts.They form a part of profit & loss statement in…

Q: Ortiz Co. had the following account balances: Sales revenue $ 440,000 Cost of goods sold 220,000…

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: Rizzo Co. has Net Income of $279,000 for 2024. Over the past two years, the company had outstanding…

A: Earning per share represents the earnings of the company held in hands of each shareholder of the…

Q: XYZ company provided the folowing information: $30,000 3,000 Accounts payable Seling expenses 4,000…

A: Solution .. Sales = $30,000 Costs of goods sold = $13,500 Gross profit = ?

Q: January 1 Issued 40,000 ordinary shares at P130 per share. February 1 Issued 30,000 ordinary for…

A: In simple or easy terms shares refers to ownership in the company.The people or investors who hold…

Q: Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM’s defined…

A: she is to receive 2 percent of the average salary of her three highest consecutive calendar years of…

Q: Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities…

A: The question is based on the concept of Cash flow statement. Cash flow Statement is the statement…

Q: December 31, 2020 Sy General Services has an estimated uncollectible 1% of its accounts receivable.…

A: According to principle of conservatism, a business can make provision for future losses or expected…

Q: The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for…

A: Depreciation Cost of the machine - salvage value/ useful life of the asset It is seen that there is…

Q: The School of Accounting (SOA) at State University is planning its annual fundraising campaign for…

A: In order to determine how many work hours will be required to produce the product the business…

Q: • Bianca Capital issued 500, $1,000 convertible bonds at 103. Each bond will be converted to 10…

A: Bond retirement occurs when an organization repurchases bonds that something that previously issued…

Q: A budget is a historical record of the previous year’s financial activities; True or False

A: A budget is a forecast of revenue and expenses for a specific future period of time that is usually…

Q: In a period, opening stock is 12,600 units and closing stock is 14, 100 units. The profit using…

A: In order to determine the fixed overhead absorption rate, the budgeted fixed overheads are required…

NEED ASAAAAP

Step by step

Solved in 2 steps

- Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line methodDetermining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)