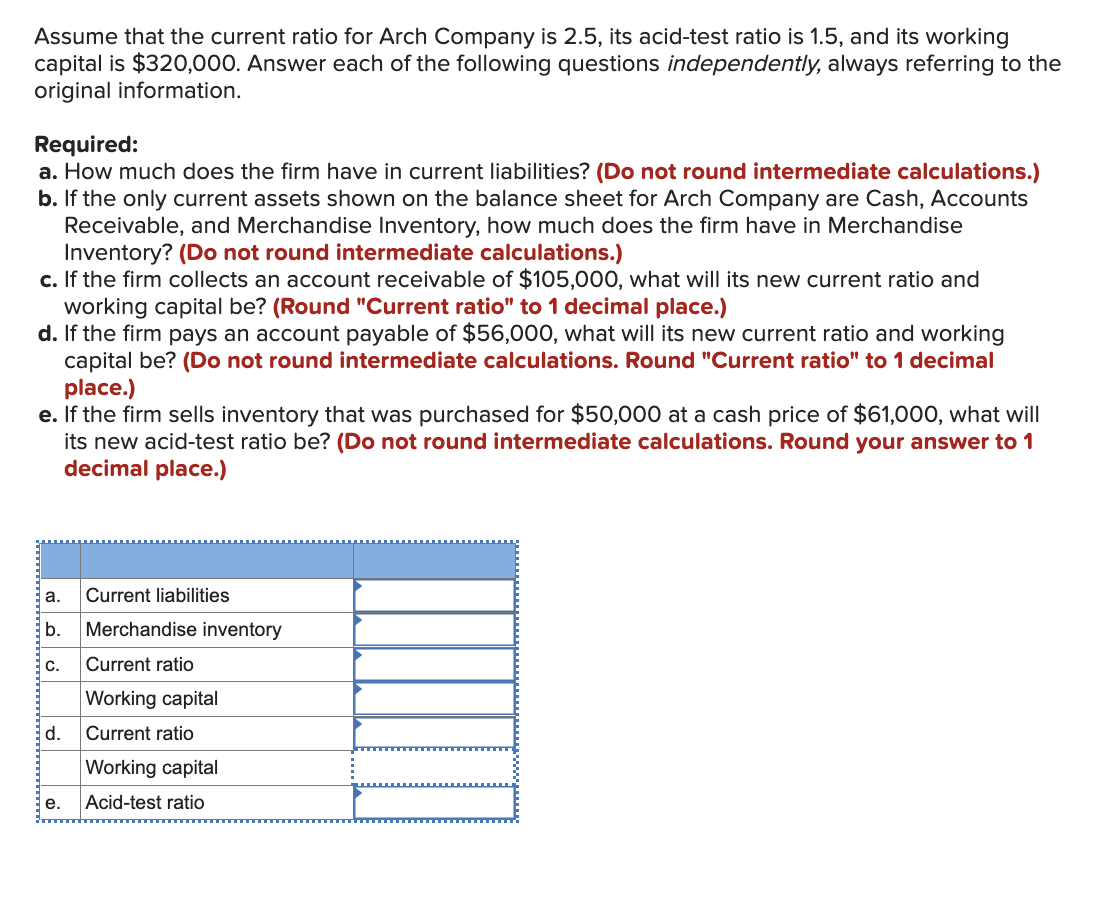

Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working capital is $320,000. Answer each of the following questions independently, always referring to the original information. Required: a. How much does the firm have in current liabilities? (Do not round intermediate calculations.) b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.) c. If the firm collects an account receivable of $105,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.) d. If the firm pays an account payable of $56,000, what will its new current ratio and working capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal place.) e. If the firm sells inventory that was purchased for $50,000 at a cash price of $61,000, what will

Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working capital is $320,000. Answer each of the following questions independently, always referring to the original information. Required: a. How much does the firm have in current liabilities? (Do not round intermediate calculations.) b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.) c. If the firm collects an account receivable of $105,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.) d. If the firm pays an account payable of $56,000, what will its new current ratio and working capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal place.) e. If the firm sells inventory that was purchased for $50,000 at a cash price of $61,000, what will

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4TP: You are considering two possible companies for investment purposes. The following data is available...

Related questions

Question

Transcribed Image Text:Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working

capital is $320,000. Answer each of the following questions independently, always referring to the

original information.

Required:

a. How much does the firm have in current liabilities? (Do not round intermediate calculations.)

b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts

Receivable, and Merchandise Inventory, how much does the firm have in Merchandise

Inventory? (Do not round intermediate calculations.)

c. If the firm collects an account receivable of $105,000, what will its new current ratio and

working capital be? (Round "Current ratio" to 1 decimal place.)

d. If the firm pays an account payable of $56,000, what will its new current ratio and working

capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal

place.)

e. If the firm sells inventory that was purchased for $50,000 at a cash price of $61,000, what will

its new acid-test ratio be? (Do not round intermediate calculations. Round your answer to 1

decimal place.)

a.

Current liabilities

b. Merchandise inventory

C.

Current ratio

Working capital

d.

Current ratio

Working capital

e.

Acid-test ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning