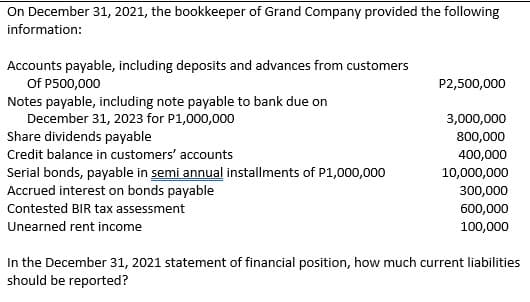

On December 31, 2021, the bookkeeper of Grand Company provided the following information: Accounts payable, including deposits and advances from customers Of P500,000 Notes payable, including note payable to bank due on December 31, 2023 for P1,000,000 Share dividends payable Credit balance in customers' accounts Serial bonds, payable in semi annual installments of P1,000,000 Accrued interest on bonds payable P2,500,000 3,000,000 800,000 400,000 10,000,000 300,000 Contested BIR tax assessment 600,000 100,000 Unearned rent income In the December 31, 2021 statement of financial position, how much current liabilities should be reported?

On December 31, 2021, the bookkeeper of Grand Company provided the following information: Accounts payable, including deposits and advances from customers Of P500,000 Notes payable, including note payable to bank due on December 31, 2023 for P1,000,000 Share dividends payable Credit balance in customers' accounts Serial bonds, payable in semi annual installments of P1,000,000 Accrued interest on bonds payable P2,500,000 3,000,000 800,000 400,000 10,000,000 300,000 Contested BIR tax assessment 600,000 100,000 Unearned rent income In the December 31, 2021 statement of financial position, how much current liabilities should be reported?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 10RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

100%

Transcribed Image Text:On December 31, 2021, the bookkeeper of Grand Company provided the following

information:

Accounts payable, including deposits and advances from customers

Of P500,000

Notes payable, including note payable to bank due on

December 31, 2023 for P1,000,000

Share dividends payable

P2,500,000

3,000,000

800,000

Credit balance in customers' accounts

400,000

Serial bonds, payable in semi annual installments of P1,000,000

Accrued interest on bonds payable

10,000,000

300,000

Contested BIR tax assessment

600,000

Unearned rent income

100,000

In the December 31, 2021 statement of financial position, how much current liabilities

should be reported?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning