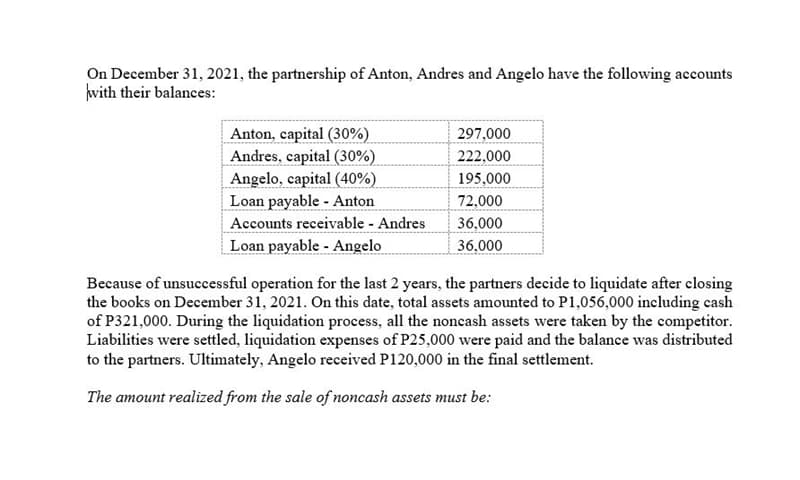

On December 31, 2021, the partnership of Anton, Andres and Angelo have the following accounts with their balances: Anton, capital (30%) 297,000 Andres, capital (30%) 222,000 Angelo, capital (40%) 195,000 Loan payable - Anton 72,000 Accounts receivable - Andres 36,000 Loan payable - Angelo 36,000 Because of unsuccessful operation for the last 2 years, the partners decide to liquidate after closing the books on December 31, 2021. On this date, total assets amounted to P1,056,000 including cash of P321,000. During the liquidation process, all the noncash assets were taken by the competitor. Liabilities were settled, liquidation expenses of P25,000 were paid and the balance was distributed to the partners. Ultimately, Angelo received P120,000 in the final settlement.

On December 31, 2021, the partnership of Anton, Andres and Angelo have the following accounts with their balances: Anton, capital (30%) 297,000 Andres, capital (30%) 222,000 Angelo, capital (40%) 195,000 Loan payable - Anton 72,000 Accounts receivable - Andres 36,000 Loan payable - Angelo 36,000 Because of unsuccessful operation for the last 2 years, the partners decide to liquidate after closing the books on December 31, 2021. On this date, total assets amounted to P1,056,000 including cash of P321,000. During the liquidation process, all the noncash assets were taken by the competitor. Liabilities were settled, liquidation expenses of P25,000 were paid and the balance was distributed to the partners. Ultimately, Angelo received P120,000 in the final settlement.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 49P

Related questions

Question

Transcribed Image Text:On December 31, 2021, the partnership of Anton, Andres and Angelo have the following accounts

with their balances:

Anton, capital (30%)

297,000

Andres, capital (30%)

222,000

Angelo, capital (40%)

195,000

Loan payable Anton

72,000

Accounts receivable - Andres

36,000

Loan payable - Angelo

36,000

Because of unsuccessful operation for the last 2 years, the partners decide to liquidate after closing

the books on December 31, 2021. On this date, total assets amounted to P1,056,000 including cash

of P321,000. During the liquidation process, all the noncash assets were taken by the competitor.

Liabilities were settled, liquidation expenses of P25,000 were paid and the balance was distributed

to the partners. Ultimately, Angelo received P120,000 in the final settlement.

The amount realized from the sale of noncash assets must be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,