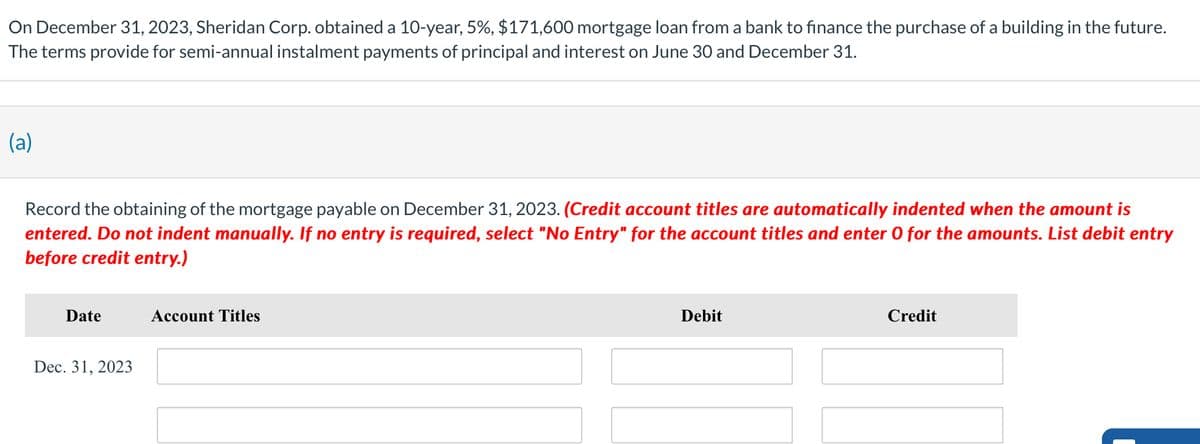

On December 31, 2023, Sheridan Corp. obtained a 10-year, 5%, $171,600 mortgage loan from a bank to finance the purchase of a building in the future. The terms provide for semi-annual instalment payments of principal and interest on June 30 and December 31. (a) Record the obtaining of the mortgage payable on December 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Dec. 31, 2023 Debit Credit

On December 31, 2023, Sheridan Corp. obtained a 10-year, 5%, $171,600 mortgage loan from a bank to finance the purchase of a building in the future. The terms provide for semi-annual instalment payments of principal and interest on June 30 and December 31. (a) Record the obtaining of the mortgage payable on December 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Dec. 31, 2023 Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 3MC: On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9%...

Related questions

Question

te.3

Transcribed Image Text:On December 31, 2023, Sheridan Corp. obtained a 10-year, 5%, $171,600 mortgage loan from a bank to finance the purchase of a building in the future.

The terms provide for semi-annual instalment payments of principal and interest on June 30 and December 31.

(a)

Record the obtaining of the mortgage payable on December 31, 2023. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry

before credit entry.)

Date

Account Titles

Dec. 31, 2023

Debit

Credit

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College