On December 31, Year 1, BIG Company had accrued salaries of $9,800. Required a. Record in general journal format the adjustment required as of December 31, Year 1. b. Show the above adjustment in a horizontal statements model. c-1. Determine the amount of net income BIG would report on the Year 1 income statement, assuming that BIG received $22,900 of cash revenue. c-2. What is the amount of net cash flow from operating activities for Year 1? d. What amount of salaries payable would BIG report on the December 31, Year 1, balance sheet?

On December 31, Year 1, BIG Company had accrued salaries of $9,800. Required a. Record in general journal format the adjustment required as of December 31, Year 1. b. Show the above adjustment in a horizontal statements model. c-1. Determine the amount of net income BIG would report on the Year 1 income statement, assuming that BIG received $22,900 of cash revenue. c-2. What is the amount of net cash flow from operating activities for Year 1? d. What amount of salaries payable would BIG report on the December 31, Year 1, balance sheet?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2PA: The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal...

Related questions

Question

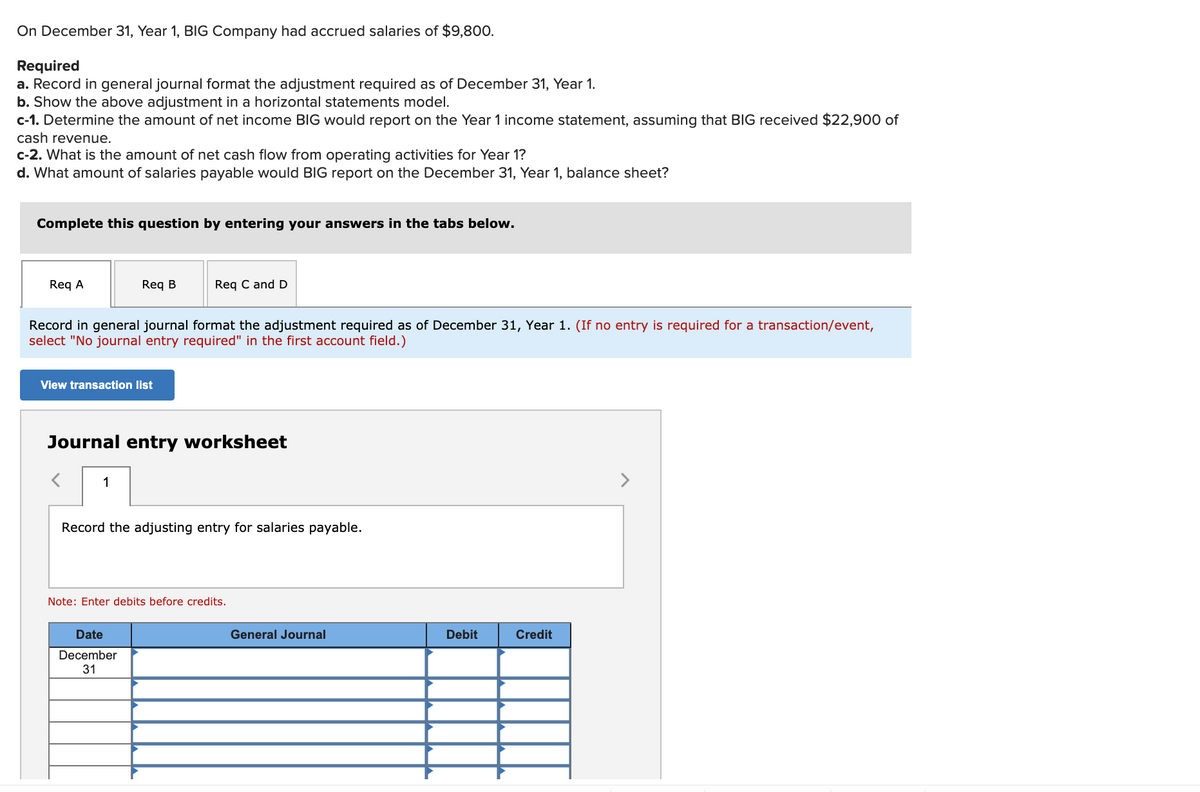

Transcribed Image Text:On December 31, Year 1, BIG Company had accrued salaries of $9,800.

Required

a. Record in general journal format the adjustment required as of December 31, Year 1.

b. Show the above adjustment in a horizontal statements model.

c-1. Determine the amount of net income BIG would report on the Year 1 income statement, assuming that BlIG received $22,900 of

cash revenue.

c-2. What is the amount of net cash flow from operating activities for Year 1?

d. What amount of salaries payable would BIG report on the December 31, Year 1, balance sheet?

Complete this question by entering your answers in the tabs below.

Req A

Req B

Req C and D

Record in general journal format the adjustment required as of December 31, Year 1. (If no entry is required for a transaction/event,

select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the adjusting entry for salaries payable.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage