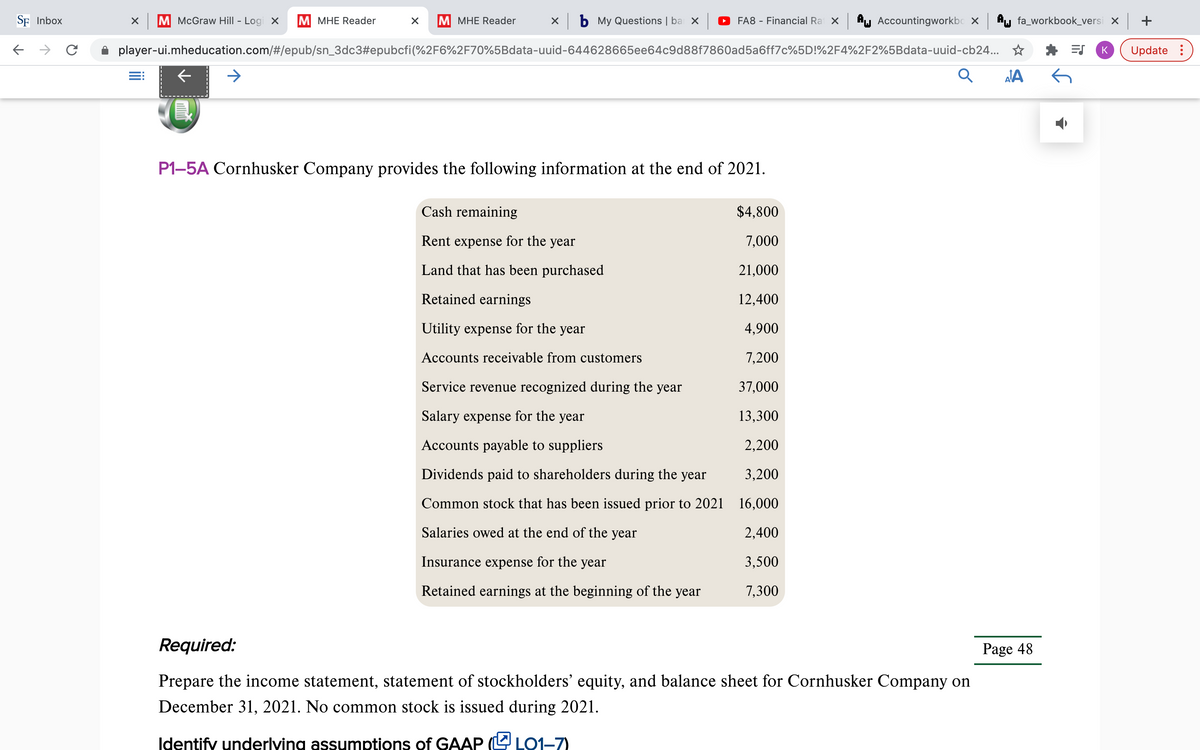

P1-5A Cornhusker Company provides the following information at the end of 2021. Cash remaining $4,800 Rent expense for the year 7,000 Land that has been purchased 21,000 Retained earnings 12,400 Utility expense for the year 4,900 Accounts receivable from customers 7,200 Service revenue recognized during the year 37,000 Salary expense for the year 13,300 Accounts payable to suppliers 2,200 Dividends paid to shareholders during the year 3,200 Common stock that has been issued prior to 2021 16,000 Salaries owed at the end of the year 2,400 Insurance expense for the year 3,500 Retained earnings at the beginning of the year 7,300

P1-5A Cornhusker Company provides the following information at the end of 2021. Cash remaining $4,800 Rent expense for the year 7,000 Land that has been purchased 21,000 Retained earnings 12,400 Utility expense for the year 4,900 Accounts receivable from customers 7,200 Service revenue recognized during the year 37,000 Salary expense for the year 13,300 Accounts payable to suppliers 2,200 Dividends paid to shareholders during the year 3,200 Common stock that has been issued prior to 2021 16,000 Salaries owed at the end of the year 2,400 Insurance expense for the year 3,500 Retained earnings at the beginning of the year 7,300

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

i dont know what would count as the revenue portion of the income statement. i need help just knowing where all these would go for and income statement, statement of

Transcribed Image Text:SE Inbox

M McGraw Hill - Logi X

M MHE Reader

МНE Reader

b My Questions | ba x

FA8 - Financial Rai x Au Accountingworkbo × Au fa_workbook_versi X +

player-ui.mheducation.com/#/epub/sn_3dc3#epubcfi(%2F6%2F70%5Bdata-uuid-644628665ee64c9d88f7860ad5a6ff7c%5D!%2F4%2F2%5Bdata-uuid-cb24... *

Update :

A

P1-5A Cornhusker Company provides the following information at the end of 2021.

Cash remaining

$4,800

Rent expense for the year

7,000

Land that has been purchased

21,000

Retained earnings

12,400

Utility expense for the year

4,900

Accounts receivable from customers

7,200

Service revenue recognized during the year

37,000

Salary expense for the year

13,300

Accounts payable to suppliers

2,200

Dividends paid to shareholders during the year

3,200

Common stock that has been issued prior to 2021 16,000

Salaries owed at the end of the year

2,400

Insurance expense for the year

3,500

Retained earnings at the beginning of the year

7,300

Required:

Page 48

Prepare the income statement, statement of stockholders' equity, and balance sheet for Cornhusker Company on

December 31, 2021. No common stock is issued during 2021.

Identify underlving assumptions of GAAP (E LO1–7)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you