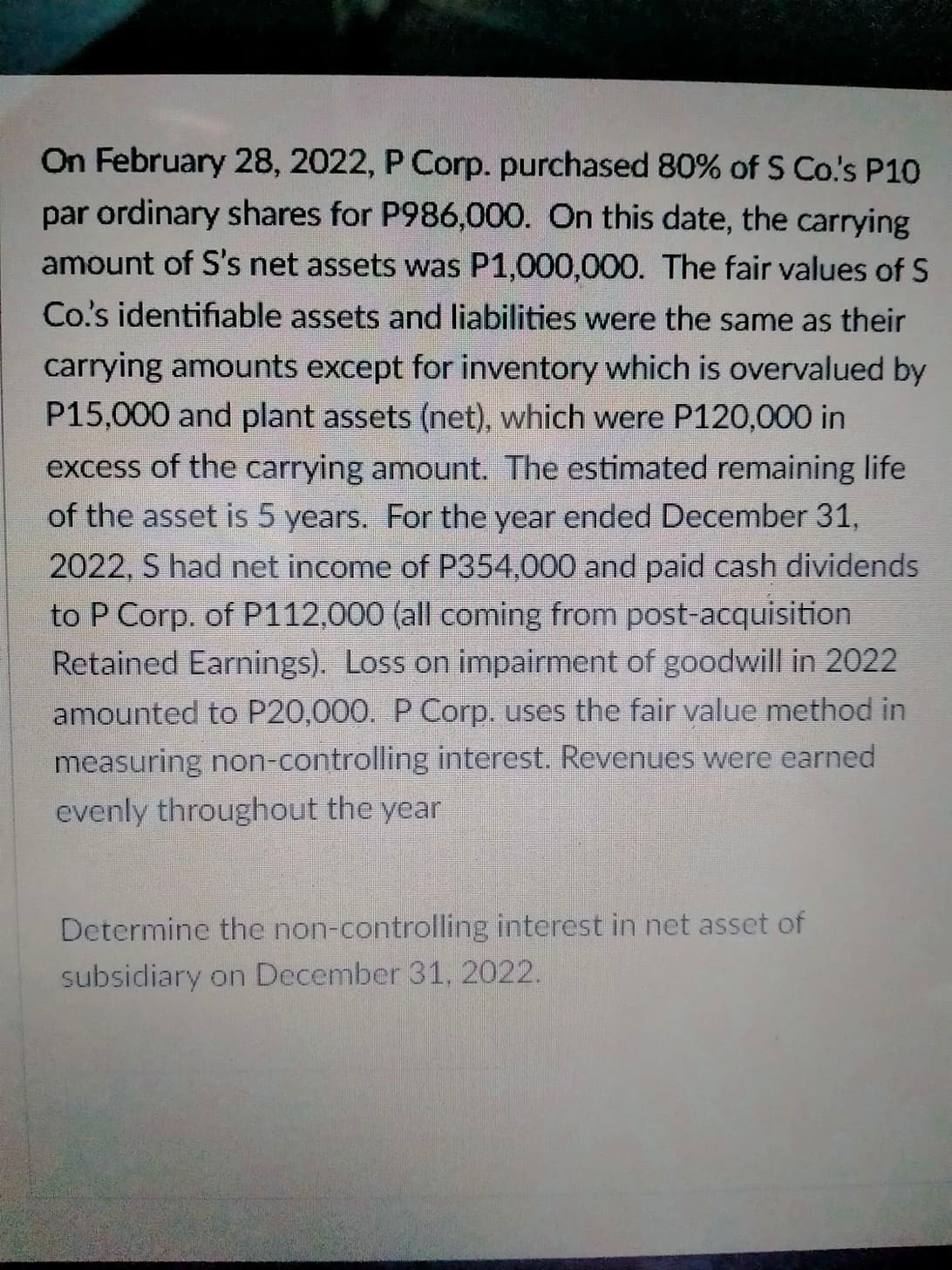

On February 28, 2022, P Corp. purchased 80% of S Co's P10 par ordinary shares for P986,000. On this date, the carrying amount of S's net assets was P1,000,000. The fair values of S Co's identifiable assets and liabilities were the same as their carrying amounts except for inventory which is overvalued by P15,000 and plant assets (net), which were P120,000 in excess of the carrying amount. The estimated remaining life of the asset is 5 years. For the year ended December 31, 2022, S had net income of P354,000 and paid cash dividends to P Corp. of P112,000 (all coming from post-acquisition Retained Earnings). Loss on impairment of goodwill in 2022 amounted to P20,000. P Corp. uses the fair value method in measuring non-controlling interest. Revenues were earned evenly throughout the year Determine the non-controlling interest in net asset of subsidiary on December 31, 2022.

On February 28, 2022, P Corp. purchased 80% of S Co's P10 par ordinary shares for P986,000. On this date, the carrying amount of S's net assets was P1,000,000. The fair values of S Co's identifiable assets and liabilities were the same as their carrying amounts except for inventory which is overvalued by P15,000 and plant assets (net), which were P120,000 in excess of the carrying amount. The estimated remaining life of the asset is 5 years. For the year ended December 31, 2022, S had net income of P354,000 and paid cash dividends to P Corp. of P112,000 (all coming from post-acquisition Retained Earnings). Loss on impairment of goodwill in 2022 amounted to P20,000. P Corp. uses the fair value method in measuring non-controlling interest. Revenues were earned evenly throughout the year Determine the non-controlling interest in net asset of subsidiary on December 31, 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

question 21, help pls

Transcribed Image Text:On February 28, 2022, P Corp. purchased 80% of S Co's P10

par ordinary shares for P986,000. On this date, the carrying

amount of S's net assets was P1,000,000. The fair values of S

Co's identifiable assets and liabilities were the same as their

carrying amounts except for inventory which is overvalued by

P15,000 and plant assets (net), which were P120,000 in

excess of the carrying amount. The estimated remaining life

of the asset is 5 years. For the year ended December 31,

2022, S had net income of P354,000 and paid cash dividends

to P Corp. of P112,000 (all coming from post-acquisition

Retained Earnings). Loss on impairment of goodwill in 2022

amounted to P20,000.

Corp. uses the fair value method in

measuring non-controlling interest. Revenues were earned

evenly throughout the year

Determine the non-controlling interest in net asset of

subsidiary on December 31, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning