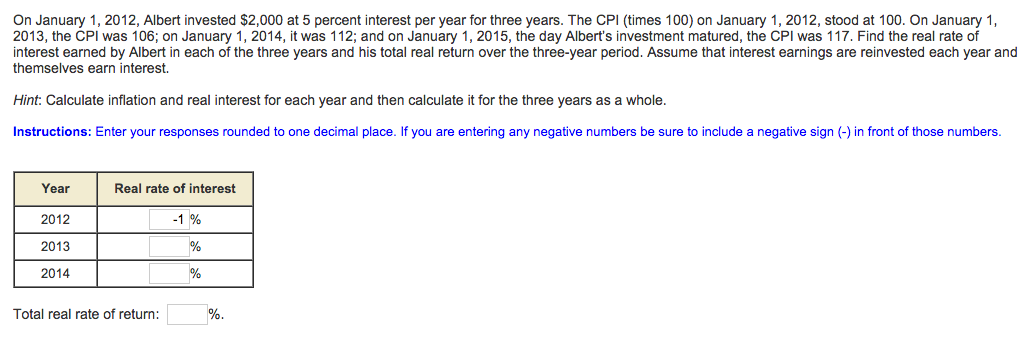

On January 1, 2012, Albert invested $2,000 at 5 percent interest per year for three years. The CPI (times 100) on January 1, 2012, stood at 100. On January 1, 2013, the CPI was 106; on January 1, 2014, it was 112; and on January 1, 2015, the day Albert's investment matured, the CPI was 117. Find the real rate of interest earned by Albert in each of the three years and his total real return over the three-year period. Assume that interest earnings are reinvested each year and themselves earn interest. Hint: Calculate inflation and real interest for each year and then calculate it for the three years as a whole. Instructions: Enter your responses rounded to one decimal place. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Year 2012 2013 2014 Real rate of interest Total real rate of return: -1% % % %.

On January 1, 2012, Albert invested $2,000 at 5 percent interest per year for three years. The CPI (times 100) on January 1, 2012, stood at 100. On January 1, 2013, the CPI was 106; on January 1, 2014, it was 112; and on January 1, 2015, the day Albert's investment matured, the CPI was 117. Find the real rate of interest earned by Albert in each of the three years and his total real return over the three-year period. Assume that interest earnings are reinvested each year and themselves earn interest. Hint: Calculate inflation and real interest for each year and then calculate it for the three years as a whole. Instructions: Enter your responses rounded to one decimal place. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Year 2012 2013 2014 Real rate of interest Total real rate of return: -1% % % %.

Chapter13: Inflation

Section: Chapter Questions

Problem 2SQP

Related questions

Question

Transcribed Image Text:On January 1, 2012, Albert invested $2,000 at 5 percent interest per year for three years. The CPI (times 100) on January 1, 2012, stood at 100. On January 1,

2013, the CPI was 106; on January 1, 2014, it was 112; and on January 1, 2015, the day Albert's investment matured, the CPI was 117. Find the real rate of

interest earned by Albert in each of the three years and his total real return over the three-year period. Assume that interest earnings are reinvested each year and

themselves earn interest.

Hint: Calculate inflation and real interest for each year and then calculate it for the three years as a whole.

Instructions: Enter your responses rounded to one decimal place. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers.

Year

2012

2013

2014

Real rate of interest

Total real rate of return:

-1%

%

%

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning