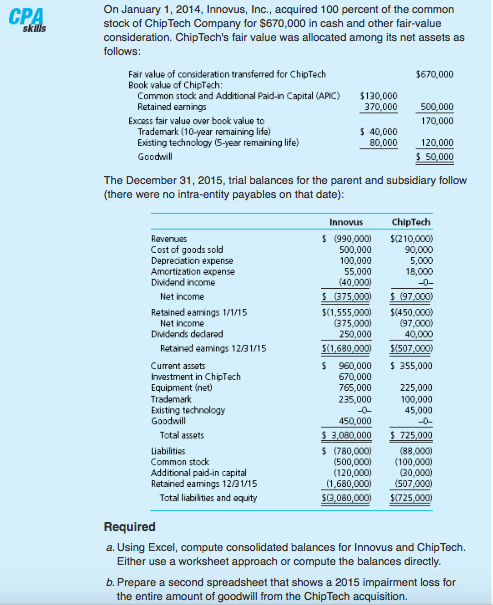

On January 1, 2014, Innovus, Inc., acquired 100 percent of the common stock of ChipTech Company for $670,000 in cash and other fair-value consideration. ChipTech's fair value was allocated among its net assets as CPA skills follows: Fair value of consideration transferred for ChipTech Book value of ChipTech: Common stock and Additional Paid-in Capital (APIC) Retained earnings $670,000 $130,000 370,000 500,000 Excess fair value over book value to 170,000 Trademark (10-year remaining life) Existing technology (5-year remaining life) $ 40,000 80,000 120,000 Goodwill 50,000 The December 31, 2015, trial balances for the parent and subsidiary follow (there were no intra-entity payables on that date): ChipTech Innovus S (990,000) 500,000 100,000 55,000 (40,000) S(210,000) 90,000 5,000 18,000 -0- Ravenues Cost of goods sold Depreciation expense Amortization expense Dividend income S(97,000) S (375,000) Net income Retained earmings 1/1/15 S(1,555,000) 375,000) 250,000 $(450,000) (97,000) 40,000 Net income Dividends dedared Retained eamings 12/31/15 S(1,680,000) $(507,000) Currant assets Investment in ChipTech Equipment (net) Trademark Existing technology Goodwill S 960,000 670,000 765,000 235,000 355,000 225,000 100,000 45,000 450,000 0 S 3,080,000 S (780,000) (500,000) (120,000) (1,680,000) Total assets 725,000 Liabilities Common stock Additional paid-in capital Retained eamings 12/31/15 (88.000) (100,000) (30,000) (507,000) Total liabilities and equity $(3,080,000) $725,000) Required a. Using Excel, compute consolidated balances for Innovus and ChipTech Either use a worksheet approach or compute the balances directly b. Prepare a second spreadsheet that shows a 2015 impairment loss for the entire amount of goodwill from the ChipTech acquisition.

On January 1, 2014, Innovus, Inc., acquired 100 percent of the common stock of ChipTech Company for $670,000 in cash and other fair-value consideration. ChipTech's fair value was allocated among its net assets as CPA skills follows: Fair value of consideration transferred for ChipTech Book value of ChipTech: Common stock and Additional Paid-in Capital (APIC) Retained earnings $670,000 $130,000 370,000 500,000 Excess fair value over book value to 170,000 Trademark (10-year remaining life) Existing technology (5-year remaining life) $ 40,000 80,000 120,000 Goodwill 50,000 The December 31, 2015, trial balances for the parent and subsidiary follow (there were no intra-entity payables on that date): ChipTech Innovus S (990,000) 500,000 100,000 55,000 (40,000) S(210,000) 90,000 5,000 18,000 -0- Ravenues Cost of goods sold Depreciation expense Amortization expense Dividend income S(97,000) S (375,000) Net income Retained earmings 1/1/15 S(1,555,000) 375,000) 250,000 $(450,000) (97,000) 40,000 Net income Dividends dedared Retained eamings 12/31/15 S(1,680,000) $(507,000) Currant assets Investment in ChipTech Equipment (net) Trademark Existing technology Goodwill S 960,000 670,000 765,000 235,000 355,000 225,000 100,000 45,000 450,000 0 S 3,080,000 S (780,000) (500,000) (120,000) (1,680,000) Total assets 725,000 Liabilities Common stock Additional paid-in capital Retained eamings 12/31/15 (88.000) (100,000) (30,000) (507,000) Total liabilities and equity $(3,080,000) $725,000) Required a. Using Excel, compute consolidated balances for Innovus and ChipTech Either use a worksheet approach or compute the balances directly b. Prepare a second spreadsheet that shows a 2015 impairment loss for the entire amount of goodwill from the ChipTech acquisition.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:On January 1, 2014, Innovus, Inc., acquired 100 percent of the common

stock of ChipTech Company for $670,000 in cash and other fair-value

consideration. ChipTech's fair value was allocated among its net assets as

CPA

skills

follows:

Fair value of consideration transferred for ChipTech

Book value of ChipTech:

Common stock and Additional Paid-in Capital (APIC)

Retained earnings

$670,000

$130,000

370,000

500,000

Excess fair value over book value to

170,000

Trademark (10-year remaining life)

Existing technology (5-year remaining life)

$ 40,000

80,000

120,000

Goodwill

50,000

The December 31, 2015, trial balances for the parent and subsidiary follow

(there were no intra-entity payables on that date):

ChipTech

Innovus

S (990,000)

500,000

100,000

55,000

(40,000)

S(210,000)

90,000

5,000

18,000

-0-

Ravenues

Cost of goods sold

Depreciation expense

Amortization expense

Dividend income

S(97,000)

S (375,000)

Net income

Retained earmings 1/1/15

S(1,555,000)

375,000)

250,000

$(450,000)

(97,000)

40,000

Net income

Dividends dedared

Retained eamings 12/31/15

S(1,680,000)

$(507,000)

Currant assets

Investment in ChipTech

Equipment (net)

Trademark

Existing technology

Goodwill

S 960,000

670,000

765,000

235,000

355,000

225,000

100,000

45,000

450,000

0

S 3,080,000

S (780,000)

(500,000)

(120,000)

(1,680,000)

Total assets

725,000

Liabilities

Common stock

Additional paid-in capital

Retained eamings 12/31/15

(88.000)

(100,000)

(30,000)

(507,000)

Total liabilities and equity

$(3,080,000)

$725,000)

Required

a. Using Excel, compute consolidated balances for Innovus and ChipTech

Either use a worksheet approach or compute the balances directly

b. Prepare a second spreadsheet that shows a 2015 impairment loss for

the entire amount of goodwill from the ChipTech acquisition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning