On January 1, 2018, Prairie Enterprises purchased a parcel of land for $12,300 cash. At the time of purchase, the company planned to use the land for a warehouse site. In 2020, Prairie Enterprises changed its plans and sold the land. Required eBook a. Assume that the land was sold for $13,653 in 2020. Hint (1) Show the effect of the sale on the accounting equation. Ask (2) What amount would Prairie report on the 2020 income statement related to the sale of the land? Print (3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land? b. Assume that the land was sold for $11,562 in 2020. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the 2020 income statement related to the sale of the land? (3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land? Complete this question by entering your answers in the tabs below. Req A1 Req A2 and A3 Req B1 Reg B2 and B3 (1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 and A3 Reg B1 Req B2 and B3 (1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) PRAIRIE ENTERPRISES 2020 Accounting Equation Stockholders' Equity Retained Earnings Assets Cash Land Common Stock Reg A1 Req A2 and A3

On January 1, 2018, Prairie Enterprises purchased a parcel of land for $12,300 cash. At the time of purchase, the company planned to use the land for a warehouse site. In 2020, Prairie Enterprises changed its plans and sold the land. Required eBook a. Assume that the land was sold for $13,653 in 2020. Hint (1) Show the effect of the sale on the accounting equation. Ask (2) What amount would Prairie report on the 2020 income statement related to the sale of the land? Print (3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land? b. Assume that the land was sold for $11,562 in 2020. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the 2020 income statement related to the sale of the land? (3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land? Complete this question by entering your answers in the tabs below. Req A1 Req A2 and A3 Req B1 Reg B2 and B3 (1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 and A3 Reg B1 Req B2 and B3 (1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) PRAIRIE ENTERPRISES 2020 Accounting Equation Stockholders' Equity Retained Earnings Assets Cash Land Common Stock Reg A1 Req A2 and A3

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

Having an issue with this problem.

Thank you

Transcribed Image Text:On January 1, 2018, Prairie Enterprises purchased a parcel of land for $12,300 cash. At the time of purchase, the company planned to

use the land for a warehouse site. In 2020, Prairie Enterprises changed its plans and sold the land.

Required

eBook

a. Assume that the land was sold for $13,653 in 2020.

Hint

(1) Show the effect of the sale on the accounting equation.

Ask

(2) What amount would Prairie report on the 2020 income statement related to the sale of the land?

Print

(3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land?

b. Assume that the land was sold for $11,562 in 2020.

(1) Show the effect of the sale on the accounting equation.

(2) What amount would Prairie report on the 2020 income statement related to the sale of the land?

(3) What amount would Prairie report on the 2020 statement of cash flows related to the sale of the land?

Complete this question by entering your answers in the tabs below.

Req A1

Req A2 and A3

Req B1

Reg B2 and B3

(1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus

sign.)

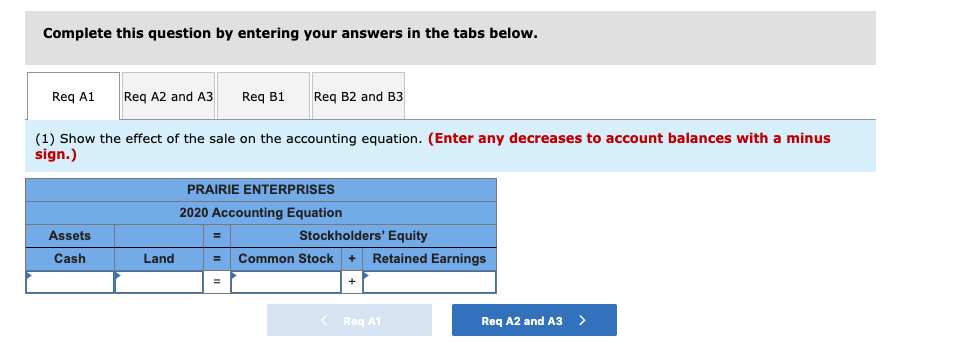

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Reg A1

Reg A2 and A3

Reg B1

Req B2 and B3

(1) Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus

sign.)

PRAIRIE ENTERPRISES

2020 Accounting Equation

Stockholders' Equity

Retained Earnings

Assets

Cash

Land

Common Stock

Reg A1

Req A2 and A3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT