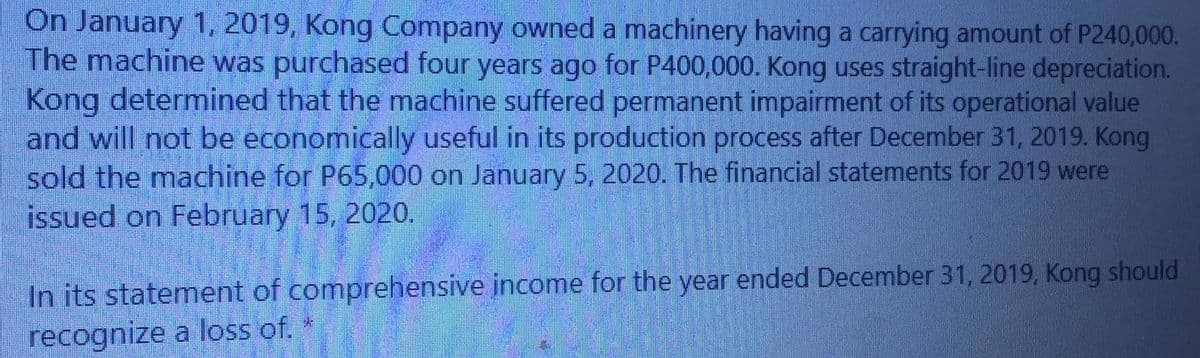

On January 1, 2019, Kong Company owned a machinery having a carrying amount of P240,000. The machine was purchased four years ago for P400,000. Kong uses straight-line depreciation. Kong determined that the machine suffered permanent impairment of its operational value and will not be economically useful in its production process after December 31, 2019. Kong sold the machine for P65,000 on January 5, 2020. The financial statements for 2019 were issued on February 15, 2020. In its statement of comprehensive income for the year ended December 31, 2019, Kong should recognize a loss of.

On January 1, 2019, Kong Company owned a machinery having a carrying amount of P240,000. The machine was purchased four years ago for P400,000. Kong uses straight-line depreciation. Kong determined that the machine suffered permanent impairment of its operational value and will not be economically useful in its production process after December 31, 2019. Kong sold the machine for P65,000 on January 5, 2020. The financial statements for 2019 were issued on February 15, 2020. In its statement of comprehensive income for the year ended December 31, 2019, Kong should recognize a loss of.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

In its statement of comprehensive income for the year ended December 31, 2019 , Kong should recognize a loss of ?

Transcribed Image Text:On January 1, 2019, Kong Company owned a machinery having a carrying amount of P240,000.

The machine was purchased four years ago for P400,000. Kong uses straight-line depreciation.

Kong determined that the machine suffered permanent impairment of its operational value

and will not be economically useful in its production process after December 31, 2019. Kong

sold the machine for P65,000 on January 5, 2020. The financial statements for 2019 were

issued on February 15, 2020.

In its statement of comprehensive income for the year ended December 31, 2019, Kong should

recognize a loss of.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College