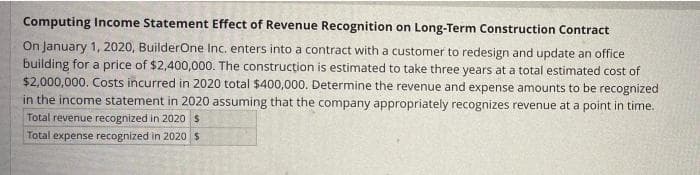

On January 1, 2020, BuilderOne Inc. enters into a contract with a customer to redesign and update an office building for a price of $2,400,000. The construcțion is estimated to take three years at a total estimated cost of $2,000,000. Costs incurred in 2020 total $400,000. Determine the revenue and expense amounts to be recognized in the income statement in 2020 assuming that the company appropriately recognizes revenue at a point in time. Total revenue recognized in 2020 S Total expense recognized in 2020 s

On January 1, 2020, BuilderOne Inc. enters into a contract with a customer to redesign and update an office building for a price of $2,400,000. The construcțion is estimated to take three years at a total estimated cost of $2,000,000. Costs incurred in 2020 total $400,000. Determine the revenue and expense amounts to be recognized in the income statement in 2020 assuming that the company appropriately recognizes revenue at a point in time. Total revenue recognized in 2020 S Total expense recognized in 2020 s

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 24E

Related questions

Question

Plz give correct explanation.

Transcribed Image Text:Computing Income Statement Effect of Revenue Recognition on Long-Term Construction Contract

On January 1, 2020, BuilderOne Inc. enters into a contract with a customer to redesign and update an office

building for a price of $2,400,000. The construcțion is estimated to take three years at a total estimated cost of

$2,000,000. Costs incurred in 2020 total $400,000. Determine the revenue and expense amounts to be recognized

in the income statement in 2020 assuming that the company appropriately recognizes revenue at a point in time.

Total revenue recognized in 2020 s

Total expense recognized in 2020 s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT