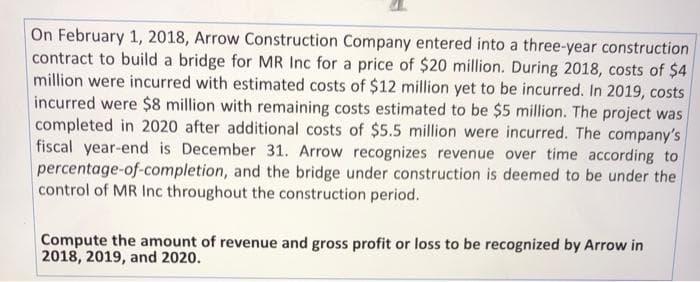

Un February 1, 2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for MR Inc for a price of $20 million. During 2018, costs of $4 million were incurred with estimated costs of $12 million yet to be incurred. In 2019, costs incurred were $8 million with remaining costs estimated to be $5 million. The project was completed in 2020 after additional costs of $5.5 million were incurred. The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage-of-completion, and the bridge under construction is deemed to be under the control of MR Inc throughout the construction period. Compute the amount of revenue and gross profit or loss to be recognized by Arrow in 2018, 2019, and 2020.

Un February 1, 2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for MR Inc for a price of $20 million. During 2018, costs of $4 million were incurred with estimated costs of $12 million yet to be incurred. In 2019, costs incurred were $8 million with remaining costs estimated to be $5 million. The project was completed in 2020 after additional costs of $5.5 million were incurred. The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage-of-completion, and the bridge under construction is deemed to be under the control of MR Inc throughout the construction period. Compute the amount of revenue and gross profit or loss to be recognized by Arrow in 2018, 2019, and 2020.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 18PC

Related questions

Question

Transcribed Image Text:On February 1, 2018, Arrow Construction Company entered into a three-year construction

contract to build a bridge for MR Inc for a price of $20 million. During 2018, costs of $4

million were incurred with estimated costs of $12 million yet to be incurred. In 2019, costs

incurred were $8 million with remaining costs estimated to be $5 million. The project was

completed in 2020 after additional costs of $5.5 million were incurred. The company's

fiscal year-end is December 31. Arrow recognizes revenue over time according to

percentage-of-completion, and the bridge under construction is deemed to be under the

control of MR Inc throughout the construction period.

Compute the amount of revenue and gross profit or loss to be recognized by Arrow in

2018, 2019, and 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning