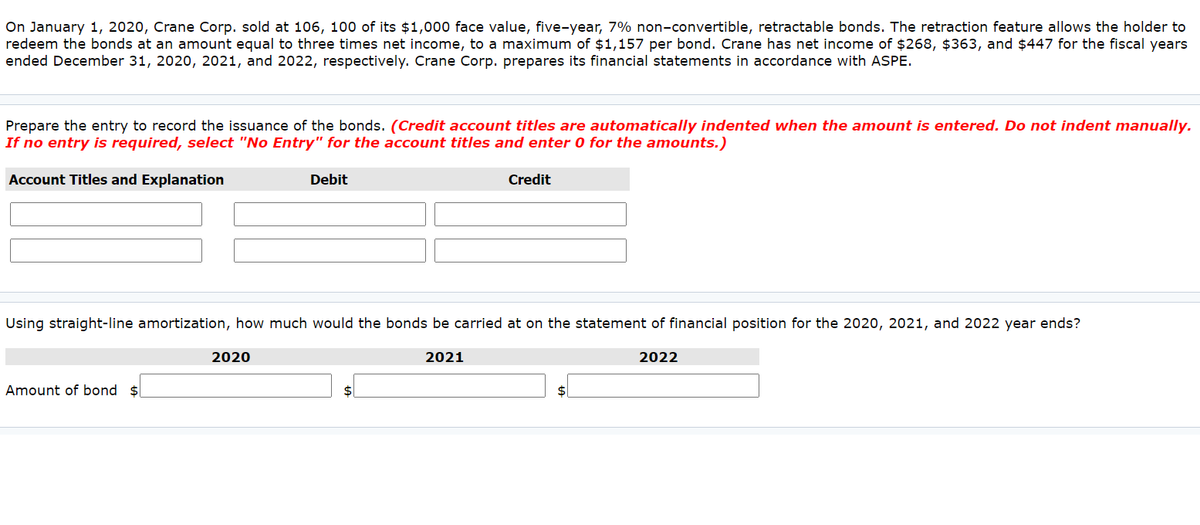

On January 1, 2020, Crane Corp. sold at 106, 100 of its $1,000 face value, five-year, 7% non-convertible, retractable bonds. The retraction feature allows the holder to redeem the bonds at an amount equal to three times net income, to a maximum of $1,157 per bond. Crane has net income of $268, $363, and $447 for the fiscal years ended December 31, 2020, 2021, and 2022, respectively. Crane Corp. prepares its financial statements in accordance with ASPE. Prepare the entry to record the issuance of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Using straight-line amortization, how much would the bonds be carried at on the statement of financial position for the 2020, 2021, and 2022 year ends? 2020 2021 2022 Amount of bond $

On January 1, 2020, Crane Corp. sold at 106, 100 of its $1,000 face value, five-year, 7% non-convertible, retractable bonds. The retraction feature allows the holder to redeem the bonds at an amount equal to three times net income, to a maximum of $1,157 per bond. Crane has net income of $268, $363, and $447 for the fiscal years ended December 31, 2020, 2021, and 2022, respectively. Crane Corp. prepares its financial statements in accordance with ASPE. Prepare the entry to record the issuance of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Using straight-line amortization, how much would the bonds be carried at on the statement of financial position for the 2020, 2021, and 2022 year ends? 2020 2021 2022 Amount of bond $

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 3C

Related questions

Question

Transcribed Image Text:On January 1, 2020, Crane Corp. sold at 106, 100 of its $1,000 face value, five-year, 7% non-convertible, retractable bonds. The retraction feature allows the holder to

redeem the bonds at an amount equal to three times net income, to a maximum of $1,157 per bond. Crane has net income of $268, $363, and $447 for the fiscal years

ended December 31, 2020, 2021, and 2022, respectively. Crane Corp. prepares its financial statements in accordance with ASPE.

Prepare the entry to record the issuance of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.

If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Using straight-line amortization, how much would the bonds be carried at on the statement of financial position for the 2020, 2021, and 2022 year ends?

2020

2021

20

Amount of bond $

$1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning