On July 1, 2020, West Company purchased for cash, four $10,000 bonds of North Corporation at a market rate of 4%. The bonds pay 5% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as trading securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discounts or premiums. Ignore income taxes. Amortization Schedule a. Prepare a bond amortization schedule for the life of the bonds using the effective interest method. Note: Round each amount entered into the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Adjust market interest in the final year of the bond term for any net rounding difference. Date Stated Interest Market Interest Premium Amortization Bond Amortized Cost Jul. 1, 2020 Answer Jan. 1, 2021 Answer Answer Answer Answer Jul. 1, 2021 Answer Answer Answer Answer Jan. 1, 2022 Answer Answer Answer Answer Jul. 1, 2022 Answer Answer Answer Answer Jan. 1, 2023 Answer Answer Answer Answer Jul. 1, 2023 Answer Answer Answer Answer Total Answer Answer Answer b. Record the entry for the purchase of the bonds by West Company on July 1, 2020. c. Record the adjusting entries by West Company on December 31, 2020 to accrue interest revenue and record the unrealized gain or loss. The fair value of the bonds on December 31, 2020, was $49,800. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Dr. Cr. b. Jul. 1, 2020 Answer Answer c. Dec. 31, 2020 Answer Answer Answer Dec. 31, 2020 Answer Answer d. Record the receipt of interest on January 1, 2021. e. Record the sale of all of the bonds on January 2, 2021, for $49,800. f. Record the adjustment to the Fair Value Adjustment account on December 31, 2021, assuming no additional TS investments. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

On July 1, 2020, West Company purchased for cash, four $10,000 bonds of North Corporation at a market rate of 4%. The bonds pay 5% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as trading securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discounts or premiums. Ignore income taxes.

- Amortization Schedule

a. Prepare a bond amortization schedule for the life of the bonds using the effective interest method.

Note: Round each amount entered into the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Adjust market interest in the final year of the bond term for any net rounding difference.

| Date | Stated Interest |

Market Interest |

Premium Amortization |

Bond Amortized Cost |

|---|---|---|---|---|

| Jul. 1, 2020 | Answer | |||

| Jan. 1, 2021 | Answer | Answer | Answer | Answer |

| Jul. 1, 2021 | Answer | Answer | Answer | Answer |

| Jan. 1, 2022 | Answer | Answer | Answer | Answer |

| Jul. 1, 2022 | Answer | Answer | Answer | Answer |

| Jan. 1, 2023 | Answer | Answer | Answer | Answer |

| Jul. 1, 2023 | Answer | Answer | Answer | Answer |

| Total | Answer | Answer | Answer |

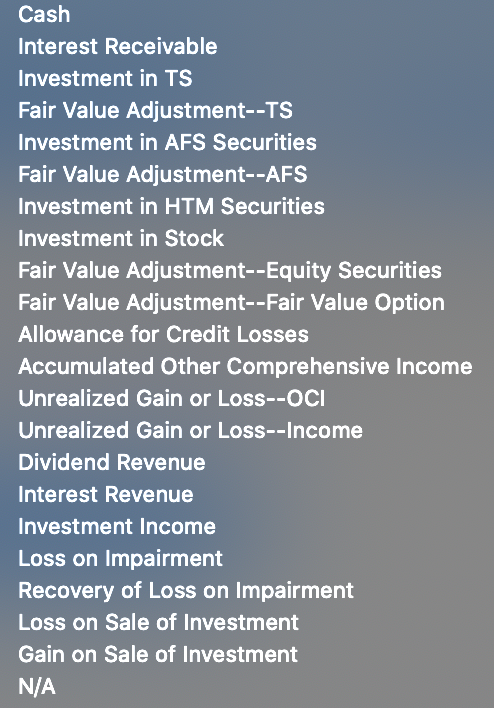

b. Record the entry for the purchase of the bonds by West Company on July 1, 2020.

c. Record the

Note: List multiple debits or credits (when applicable) in alphabetical order.

Note: Round each amount to the nearest whole dollar.

Note: If a line in a

| Date | Account Name | Dr. | Cr. | |

|---|---|---|---|---|

| b. | Jul. 1, 2020 | Answer | ||

| Answer | ||||

| c. | Dec. 31, 2020 | Answer | ||

| Answer | ||||

| Answer | ||||

| Dec. 31, 2020 | Answer | |||

| Answer | ||||

d. Record the receipt of interest on January 1, 2021.

e. Record the sale of all of the bonds on January 2, 2021, for $49,800.

f. Record the adjustment to the Fair Value Adjustment account on December 31, 2021, assuming no additional TS investments.

Note: List multiple debits or credits (when applicable) in alphabetical order.

Note: Round each amount to the nearest whole dollar.

Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

| Date | Account Name | Dr. | Cr. | |

|---|---|---|---|---|

| d. | Jan. 1, 2021 | Answer | Answer | |

| Answer | Answer | |||

| e. | Jan. 2, 2021 | Answer | Answer | |

| Answer | Answer | |||

| Jan. 2, 2021 | Answer | Answer | ||

| Answer | Answer | |||

| Answer | Answer | |||

| f. | Dec. 31, 2021 | Answer | Answer | |

| Answer | Answer |

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images