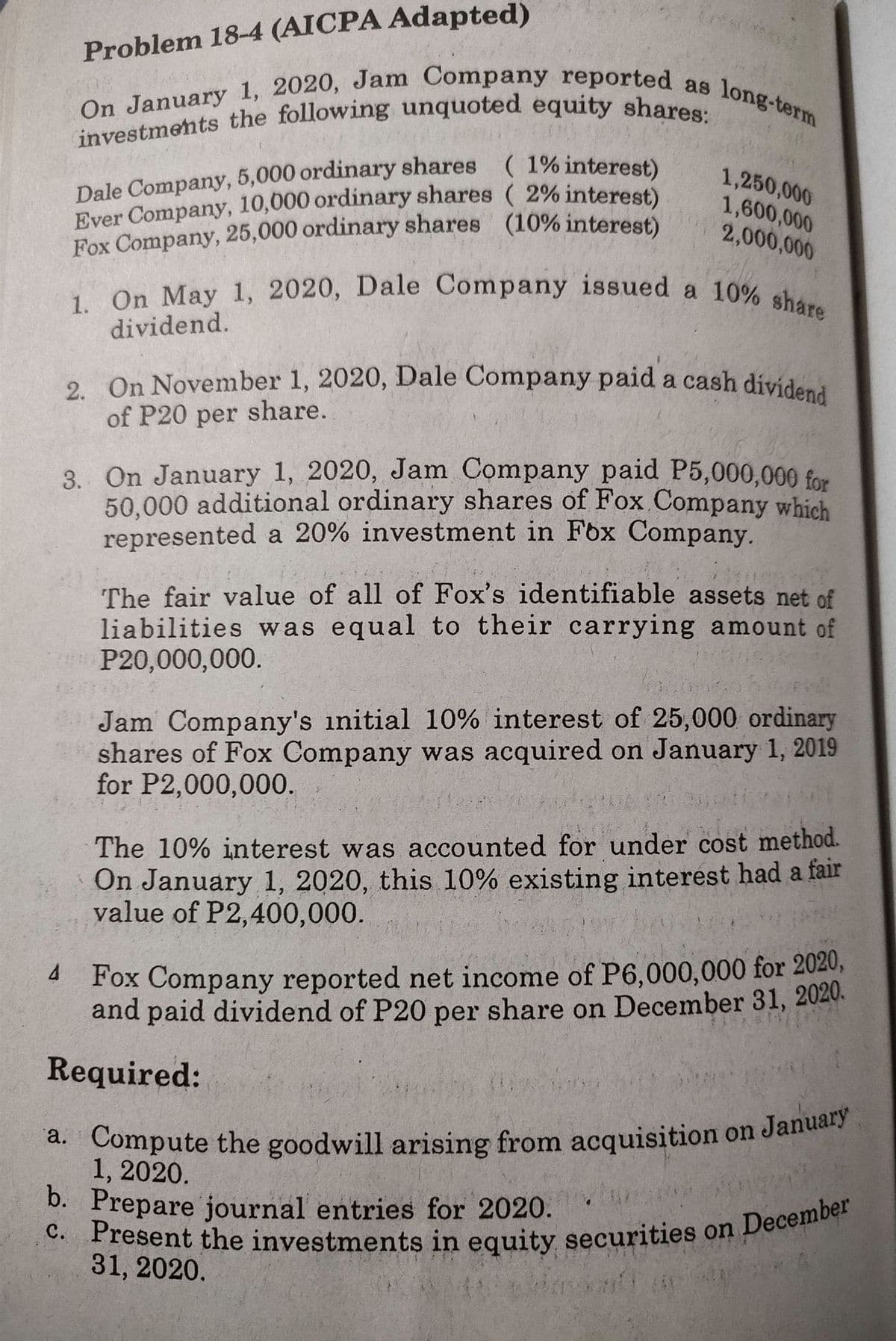

On January 1, 2020, Jam Company reported as investments the following unquoted equity shares: long-term Dale Company, 5,000 ordinary shares (1% interest) Ever Company, 10,000 ordinary shares ( 2% interest) Fox Company, 25,000 ordinary shares (10% interest) 1,250,000 1,600,000 2,000,000 1. On May 1, 2020, Dale Company issued a 10% share dividend. 2. On November 1, 2020, Dale Company paid a cash dividend of P20 per share. 3. On January 1, 2020, Jam Company paid P5,000,000 for 50,000 additional ordinary shares of Fox Company which represented a 20% investment in Fbx Company. The fair value of all of Fox's identifiable assets net of liabilities was equal to their carrying amount of P20,000,000. Jam Company's initial 10% interest of 25,000 ordinary shares of Fox Company was acquired on January 1, 2019 for P2,000,000. The 10% interest was accounted for under cost method. On January 1, 2020, this 10% existing interest had a fair value of P2,400,000. Fox Company reported net income of P6,000,000 for 2020, and paid dividend of P20 per share on December 31, 2020. Required: a. Compute the goodwill arising from acquisition on January 1, 2020. b. Prepare journal entries for 2020. c. Present the investments in equity securities on December 31, 2020.

On January 1, 2020, Jam Company reported as investments the following unquoted equity shares: long-term Dale Company, 5,000 ordinary shares (1% interest) Ever Company, 10,000 ordinary shares ( 2% interest) Fox Company, 25,000 ordinary shares (10% interest) 1,250,000 1,600,000 2,000,000 1. On May 1, 2020, Dale Company issued a 10% share dividend. 2. On November 1, 2020, Dale Company paid a cash dividend of P20 per share. 3. On January 1, 2020, Jam Company paid P5,000,000 for 50,000 additional ordinary shares of Fox Company which represented a 20% investment in Fbx Company. The fair value of all of Fox's identifiable assets net of liabilities was equal to their carrying amount of P20,000,000. Jam Company's initial 10% interest of 25,000 ordinary shares of Fox Company was acquired on January 1, 2019 for P2,000,000. The 10% interest was accounted for under cost method. On January 1, 2020, this 10% existing interest had a fair value of P2,400,000. Fox Company reported net income of P6,000,000 for 2020, and paid dividend of P20 per share on December 31, 2020. Required: a. Compute the goodwill arising from acquisition on January 1, 2020. b. Prepare journal entries for 2020. c. Present the investments in equity securities on December 31, 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Dale Company, 5,000 ordinary shares (1% interest)

c. Present the investments in equity securities on December

a. Compute the goodwill arising from acquisition on January

On January 1, 2020, Jam Company reported as long-term

2. On November 1, 2020, Dale Company paid a cash dividend

1. On May 1, 2020, Dale Company issued a 10% share

Problem 18-4 (AICPA Adapted)

as long-term

Ever Company, 10,000 ordinary shares ( 2% interest)

Fox Company, 25,000 ordinary shares (10% interest)

1,250,000

1,600,000

2,000,000

dividend.

of P20 per share.

3. On January 1, 2020, Jam Company paid P5,000,000 for

50,000 additional ordinary shares of Fox Company which

represented a 20% investment in Fox Company.

The fair value of all of Fox's identifiable assets net of

liabilities was equal to their carrying amount of

P20,000,000.

Jam Company's initial 10% interest of 25,000 ordinary

shares of Fox Company was acquired on January 1, 2019

for P2,000,000.

The 10% interest was accounted for under cost method.

On January 1, 2020, this 10% existing interest had a fair

value of P2,400,000.

4 Fox Company reported net income of P6,000,000 for 2020,

and paid dividend of P20 per share on December 31, 2020.

Required:

1, 2020.

b. Prepare journal entries for 2020.

31, 2020.

Transcribed Image Text:Prepare journal entries on December 31, 2020 and December

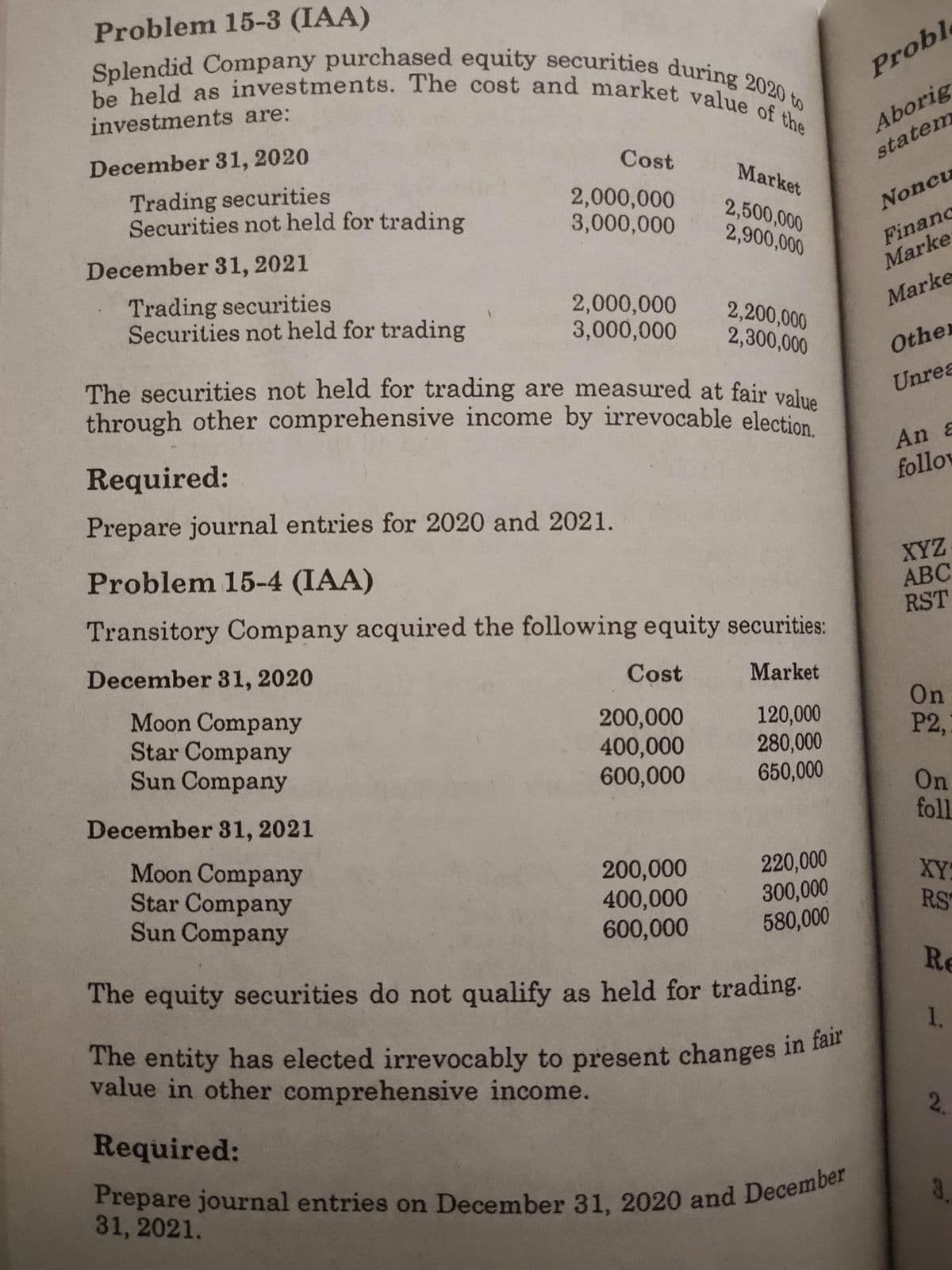

Splendid Company purchased equity securities during 2020 to

The entity has elected irrevocably to present changes in fair

be held as investments. The cost and market value of the

Problem 15-3 (IAA)

Proble

Aborig

statem

investments are:

December 31, 2020

Cost

Market

Trading securities

Securities not held for trading

2,000,000

3,000,000

2,500,000

2,900,000

Noncu

Financ

Marke

December 31, 2021

Trading securities

Securities not held for trading

2,000,000

3,000,000

Marke

2,200,000

2,300,000

Othe

The securities not held for trading are measured at fair value

through other comprehensive income by irrevocable election

Unrea

Required:

An &

follov

Prepare journal entries for 2020 and 2021.

XYZ

АВС

RST

Problem 15-4 (IAA)

Transitory Company acquired the following equity securities:

December 31, 2020

Cost

Market

Moon Company

Star Company

Sun Company

200,000

400,000

600,000

120,000

280,000

650,000

On

P2,

On

December 31, 2021

foll

Moon Company

Star Company

Sun Company

200,000

400,000

600,000

220,000

300,000

580,000

XY:

RS

The equity securities do not qualify as held for trading.

Re

1.

The entity has elected irrevocably to present changes in tan

value in other comprehensive income.

2.

Required:

31, 2021.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning