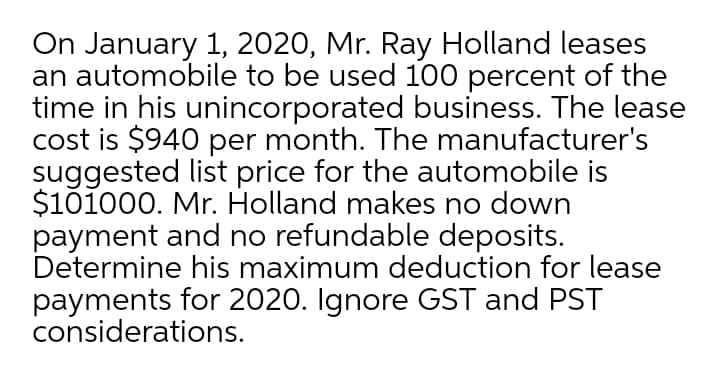

On January 1, 2020, Mr. Ray Holland leases an automobile to be used 100 percent of the time in his unincorporated business. The lease cost is $940 per month. The manufacturer's suggested list price for the automobile is $101000. Mr. Holland makes no down payment and no refundable deposits. Determine his maximum deduction for lease payments for 2020. Ignore GST and PST considerations.

Q: (a)Prepare a lease payments schedule for Mark’s payments (b)Show the journal entries for the year…

A: Lease: Lease is a contractual agreement whereby the right to use an asset for a particular period…

Q: On July 1, 2019, the Manaow Corp., signs a 10-year non-cancelable lease agreement for a storage…

A: A lease is a capital lease under IFRS 16, if the asset under lease is taken covering almost all of…

Q: On January 1, Espinoza Moving and Storage leased a truck for a four-year period, at which time…

A:

Q: Cullumber Company leases a building to Marin, Inc. on January 1, 2020. The following facts pertain…

A: If you meet any criteria of below, then considered as a finance lease, otherwise considered as an…

Q: Swifty Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does…

A: In this question, we will record lease rent of 44000 at the end of the year and depreciation of…

Q: On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to…

A: It will be classified as sale type finance lease transaction: a. The Lease term is for major part…

Q: On January 1, 2021, Rick’s Pawn Shop leased a truck from Corey Motors for a six-year period with an…

A: Journal entries in the books of lessor and lessee at the time of reassessment are as follows:

Q: Crosley Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020. The…

A: a.Compute the amount of the lease receivable.

Q: Record the improvements to the truck by Marlon’s. Record the entry, if any, by the lessor to account…

A: Lease liability refers to obligation of the company requires to pay periodic lease payment on the…

Q: On January 1, 2020, Swifty Animation sold a truck to Peete Finance for $49,000 and immediately…

A: The company should be needs to record the leaseback transactions.

Q: On January 2, 2019, Chats leased an office space for an annual rental of P600,000 payable every…

A: Lease liability The firm opt for the lease system which are incurred the management of the capital…

Q: Giannis Corporation leases a building to Jabari, Inc. on January 1, 2020. The following facts…

A: Required conditions need to satisfy for a Capital/ Finance lease: Any three of the below four…

Q: n January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party)…

A: since the lessee is aware of the implicit rate used by the lesser, the lower implicit rate or…

Q: On January 1, 2021, Rick’s Pawn Shop leased a truck from Corey Motors for a six-year period with an…

A:

Q: Brent Corporation owns equipment that cost $80,000 and has a useful life of 8 years with no salvage…

A:

Q: On December 1, 2021, Carlos entered into a lease on a building for use in his business for $1,000…

A: As per relevant tax laws, in case lease payments in advance for 12 months, then such advance can be…

Q: On January 1, 2019. Eric, the lessee, and Betty, the lessor, signed a noncancelable lease agreement…

A: Lease: It is an agreement wherein one party allows another to use the assets for the specified…

Q: Prepare Pina’ journal entries on January 1, 2020 (commencement of the operating lease), and on…

A: Pine Corporation's Journal Entries 01-Jan-20 Right of use asset 57721.8 Lease…

Q: On January 1,2020, Andrea signs a 5-year noncancelable lease agreement to lease a heavy equipment to…

A: Annual Lease Payment: Lease payments are payments made in accordance with a lease agreement, in…

Q: On January 1, 2021, Rick’s Pawn Shop leased a truck from Corey Motors for a six-year period with an…

A: The economic incentive is nothing but motivating to get the preferences of needs, desires. The main…

Q: the kerwins are selling their home in order to assist in providing their input for a house they have…

A: Calculation of the amount Kerwins must pay for signing the sale agreement for their new house is…

Q: Bulls, Inc. leases a piece of equipment to Bucks Company on January 1, 2020. The contract stipulates…

A: Lease: Lease is a contractual agreement whereby the right to use an asset for a particular period of…

Q: Walsh's Journal Entries Date Account Titles and Explanation Debit Credit (To record the lease) (To…

A: Lessor and Lessee agreements: A lease of immovable property is a transfer of a right to enjoy such…

Q: Windsor Leasing Company signs a lease agreement on January 1, 2020, to lease warehouse equipment to…

A: Lease agreement is an agreement between two parties in which one party provides its asset for use to…

Q: Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated, During 2020, he was…

A: Given : Fair market value = 35,000 Drove total = 22,000 miles Used car = 26,000 miles Per mile = 5.5…

Q: On January 1, 2019, Stacie signed a lease agreement with Amy. Amy will use the equipment and make…

A: There are two expenses associated with the lease of an asset. Lease Rental Expense and, Interest…

Q: Merville is a dealer in real properties. Merville requires 20% downpayment, and the balance is…

A: Answer: We have Gross profit = 40% of Selling price Selling price of lot 1 in 2019= P 1,350,000…

Q: On January 1, 2020, Swifty Animation sold a truck to Peete Finance for $49,000 and immediately…

A: Journal entry is a primary entry that records the financial transactions initially.

Q: Larkspur Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment…

A: Since the factor tables have not been given in the question, the present value factor and present…

Q: 1, 2019 is P4,478,000. The building has an estimated economic life of 12 years. Unguaranteed…

A: A lease is a capital lease under IFRS 16, if the asset under lease is taken covering almost all of…

Q: On January 1, 2020 Venti Company rented out an apartment to Barbatos Company for an operating lease…

A: Journal entry in the books of Barbatos(lessee) Date particulars Debit Credit Dec. 31, 2020…

Q: On January 2, 2019, Ivan got the franchise of PPP Inc. The franchise agreement provides a P500,000…

A: For Calculating the Earned Franchise Fees which are included with the details of the down payment…

Q: Larkspur Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company.…

A: Solution Part B-…

Q: On January 1, 2019, Ashly Farms leased a hay baler from Agrico Company. The lease requires Ashly to…

A:

Q: Cullumber Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020.…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: On January 2, 2019, Charminster Corporation leased six computers for use in its engineering…

A:

Q: On January 1, 2021, Maroon Company entered into a five-year nonrenewable operating lease, commencing…

A: A lease is an agreement where the owner of the asset transfers the right of use of the asset to the…

Q: Larkspur Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment…

A: 1)

Q: Pina Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does…

A: Solution - journal entries…

Q: On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party)…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: On January 1, 2018, JOSH Corporation leased out an office space for 15 years to PH Corporation at an…

A: Lease is a type of contract which provides the lessee the right to use the asset of the lessor and…

Q: On December 1, 2020, Carlos entered into a lease on a building for use in his business for $1,500…

A: Lease is defined as the contractual arrangement that calls for the lessee to pay for using the asset…

Q: On January 1, 2020, Indigo Animation sold a truck to Peete Finance for $48,000 and immediately…

A: Leases is a form of agreement or arrangement between two parties, under which one party provides its…

Q: Carol has a closed-end lease agreement in which the lessor has estimated that the value of the…

A: A closed-end agreement is a lease contract that, at the end of the agreement, places no…

Q: On December 1, 2021, Carlos entered into a lease on a building for use in his business for $1,500…

A: According to the 12-month rule, the expenses paid in advance (in our case rent expense $18,000) can…

Q: Marin Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment to…

A: Journal entries In the books of Marin leasing company Date Accounts title and explanation…

Q: e lease is noncancelable and has a term of 8 years. • The annual rentals are $39,200, payable at the…

A: 1. Requirement 1 Lessor should classify the above lease as finance lease reason: 1. The lessee holds…

Q: : How much is the interest expense for 2021? QUESTION 2: How much is the gain or loss on partial…

A: 1. If only 1 floor is rented - The annual lease payments will be reduced to P400,000 - The…

Q: Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease…

A: Leasing- It refers to the agreement under which the lessor allows to take advantage of the assets to…

Q: On January 1, 2020, Martinez Animation sold a truck to Peete Finance for $44,000 and immediately…

A: Lease is the contract that binds the parties in which one party agreed to rent the property owned…

Step by step

Solved in 2 steps

- Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.

- On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring payments of 10,000 at the beginning of each year. The machine cost 40,000 and has a useful life of 8 years with no residual value. Kerns implicit interest rate is 10%, and present value factors are as follows: Present value for an annuity due of 1 at 10% for 6 periods4.791 Present value for an annuity due of 1 at 10% for 8 periods5.868 Kern appropriately recorded the lease as a sales-type lease. At the inception of the lease, the Lease Receivable account balance should be: a. 60,000 b. 58,680 c. 48,000 d. 47,910Lorene, Inc., owns an apartment complex. The terms of Lorenes lease agreement require new tenants to pay the first and last months rent and a cleaning deposit at the inception of the lease. The cleaning deposit is returned when tenants move out and leave their apartment in good condition. If the apartment is not in good condition, Lorene hires a cleaning company and uses the tenants deposit to pay the cleaning bill, with any excess deposit returned. During the current year, Lorene receives monthly rents totaling 28,000, last months rent deposits from new tenants of 8,000, and cleaning deposits of 7,000. Lorene keeps 5,000 in cleaning deposits to pay the cleaning company bill on apartments that are not left in good shape (the 5,000 is the actual cost that is paid in cash to the cleaning company) and returns 4,000 in deposits. Lorenes expenses related to the rental property (other than the cleaning costs) are 14,000. What is Lorene, Inc.s gross income from the rental property if Lorene is a cash basis taxpayer? an accrual basis taxpayer?Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method