Swifty Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does not transfer ownership, contain a bargain purchase option, and is not a specialized asset. It covers 3 years of the equipment’s 8-year useful life, and the present value of the lease payments is less than 90% of the fair value of the asset leased. The annual lease payment is $44,000 at the beginning of each year, and Swifty’s incremental borrowing rate is 5%, which is the same as the lessor’s implicit rate. Prepare all the necessary journal entries for Falls Company (the lessor) for 2020, assuming the equipment is carried at a cost of $304,000.

Swifty Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does not transfer ownership, contain a bargain purchase option, and is not a specialized asset. It covers 3 years of the equipment’s 8-year useful life, and the present value of the lease payments is less than 90% of the fair value of the asset leased. The annual lease payment is $44,000 at the beginning of each year, and Swifty’s incremental borrowing rate is 5%, which is the same as the lessor’s implicit rate. Prepare all the necessary journal entries for Falls Company (the lessor) for 2020, assuming the equipment is carried at a cost of $304,000.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.2: Calculating Depreciation Expense

Problem 1AYU

Related questions

Question

100%

Swifty Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does not transfer ownership, contain a bargain purchase option, and is not a specialized asset. It covers 3 years of the equipment’s 8-year useful life, and the present value of the lease payments is less than 90% of the fair value of the asset leased. The annual lease payment is $44,000 at the beginning of each year, and Swifty’s incremental borrowing rate is 5%, which is the same as the lessor’s implicit rate.

Prepare all the necessary

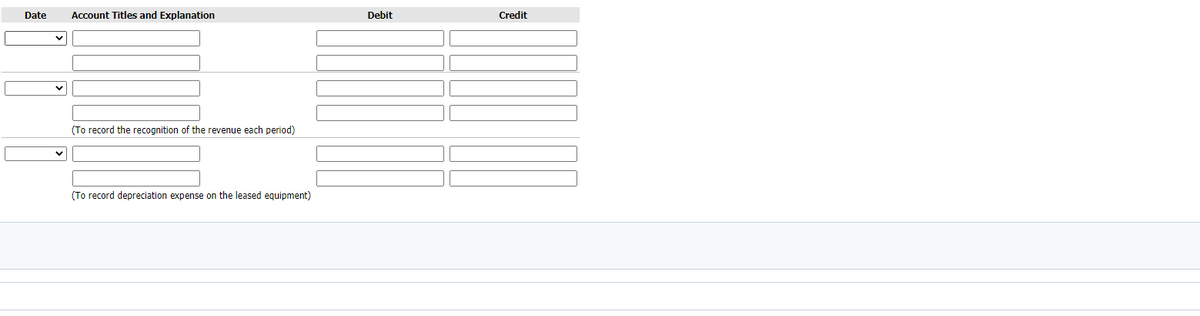

Transcribed Image Text:Date

Account Titles and Explanation

Debit

Credit

(To record the recognition of the revenue each period)

(To record depreciation expense on the leased equipment)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning