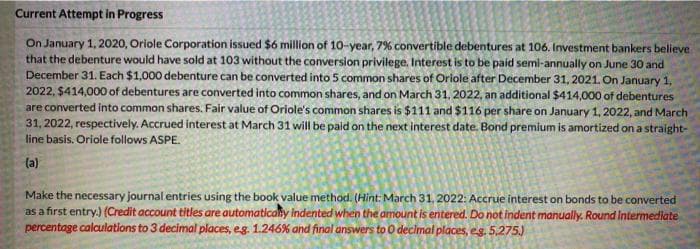

On January 1, 2020, Oriole Corporation issued $6 million of 10-year, 7% convertible debentures at 106. Investment bankers believe that the debenture would have sold at 103 without the conversion privilege, Interest is to be paid semi-annually on June 30 and December 31. Each $1,000 debenture can be converted into 5 common shares of Oriole after December 31, 2021. On January 1, 2022, $414,000 of debentures are converted into common shares, and on March 31, 2022, an additional $414,000 of debentures are converted into common shares. Fair value of Oriole's common shares is $111 and $116 per share on January 1, 2022, and March 31, 2022, respectively. Accrued interest at March 31 will be paid on the next interest date. Bond premium is amortized on a straight- line basis. Oriole follows ASPE. (a) Make the necessary journal entries using the book value method. (Hint: March 31, 2022: Accrue interest on bonds to be converted

On January 1, 2020, Oriole Corporation issued $6 million of 10-year, 7% convertible debentures at 106. Investment bankers believe that the debenture would have sold at 103 without the conversion privilege, Interest is to be paid semi-annually on June 30 and December 31. Each $1,000 debenture can be converted into 5 common shares of Oriole after December 31, 2021. On January 1, 2022, $414,000 of debentures are converted into common shares, and on March 31, 2022, an additional $414,000 of debentures are converted into common shares. Fair value of Oriole's common shares is $111 and $116 per share on January 1, 2022, and March 31, 2022, respectively. Accrued interest at March 31 will be paid on the next interest date. Bond premium is amortized on a straight- line basis. Oriole follows ASPE. (a) Make the necessary journal entries using the book value method. (Hint: March 31, 2022: Accrue interest on bonds to be converted

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 4P

Related questions

Question

100%

Transcribed Image Text:Current Attempt in Progress

On January 1, 2020, Oriole Corporation issued $6 million of 10-year, 7% convertible debentures at 106. Investment bankers believe

that the debenture would have sold at 103 without the conversion privilege. Interest is to be paid semi-annually on June 30 and

December 31. Each $1,000 debenture can be converted into 5 common shares of Oriole after December 31, 2021. On January 1,

2022, $414,000 of debentures are converted into common shares, and on March 31, 2022, an additional $414,000 of debentures

are converted into common shares. Fair value of Oriole's common shares is $111 and $116 per share on January 1, 2022, and March

31, 2022, respectively. Accrued interest at March 31 will be paid on the next interest date. Bond premium is amortized on a straight-

line basis. Oriole follows ASPE.

(a)

Make the necessary journal entries using the book value method. (Hint: March 31, 2022: Accrue interest on bonds to be converted

as a first entry.) (Credit account titles are automaticaly indented when the amount is entered. Do not indent manually. Round Intermediate

percentage calculations to 3 decimal places, eg. 1.246% and final answers to O declmat places, e.g. 5,275.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning