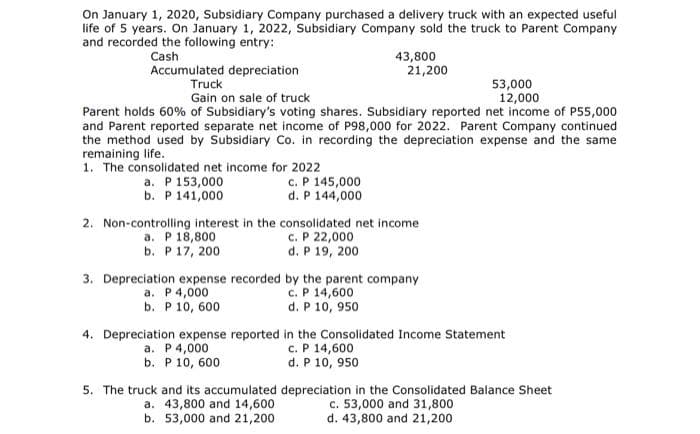

On January 1, 2020, Subsidiary Company purchased a delivery truck with an expected useful life of 5 years. On January 1, 2022, Subsidiary Company sold the truck to Parent Company and recorded the following entry: Cash 43,800 21,200 Accumulated depreciation Truck Gain on sale of truck 53,000 12,000 Parent holds 60% of Subsidiary's voting shares. Subsidiary reported net income of P55,000 and Parent reported separate net income of P98,000 for 2022. Parent Company continued the method used by Subsidiary Co. in recording the depreciation expense and the same remaining life. 1. The consolidated net income for 2022 a. P 153,000 b. P 141,000 c. P 145,000 d. P 144,000 2. Non-controlling interest in the consolidated net income a. P 18,800 b. P 17, 200 c. P 22,000 d. P 19, 200 3. Depreciation expense recorded by the parent company a. P4,000 b. P 10, 600 C.P 14,600 d. P 10, 950 4. Depreciation expense reported in the Consolidated Income Statement c. P 14,600 d. P 10, 950 a. P4,000 b. P 10, 600 5. The truck and its accumulated depreciation in the Consolidated Balance Sheet a. 43,800 and 14,600 b. 53,000 and 21,200 c. 53,000 and 31,800 d. 43,800 and 21,200

On January 1, 2020, Subsidiary Company purchased a delivery truck with an expected useful life of 5 years. On January 1, 2022, Subsidiary Company sold the truck to Parent Company and recorded the following entry: Cash 43,800 21,200 Accumulated depreciation Truck Gain on sale of truck 53,000 12,000 Parent holds 60% of Subsidiary's voting shares. Subsidiary reported net income of P55,000 and Parent reported separate net income of P98,000 for 2022. Parent Company continued the method used by Subsidiary Co. in recording the depreciation expense and the same remaining life. 1. The consolidated net income for 2022 a. P 153,000 b. P 141,000 c. P 145,000 d. P 144,000 2. Non-controlling interest in the consolidated net income a. P 18,800 b. P 17, 200 c. P 22,000 d. P 19, 200 3. Depreciation expense recorded by the parent company a. P4,000 b. P 10, 600 C.P 14,600 d. P 10, 950 4. Depreciation expense reported in the Consolidated Income Statement c. P 14,600 d. P 10, 950 a. P4,000 b. P 10, 600 5. The truck and its accumulated depreciation in the Consolidated Balance Sheet a. 43,800 and 14,600 b. 53,000 and 21,200 c. 53,000 and 31,800 d. 43,800 and 21,200

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On January 1, 2020, Subsidiary Company purchased a delivery truck with an expected useful

life of 5 years. On January 1, 2022, Subsidiary Company sold the truck to Parent Company

and recorded the following entry:

Cash

43,800

21,200

Accumulated depreciation

Truck

53,000

12,000

Gain on sale of truck

Parent holds 60% of Subsidiary's voting shares. Subsidiary reported net income of P55,000

and Parent reported separate net income of P98,000 for 2022. Parent Company continued

the method used by Subsidiary Co. in recording the depreciation expense and the same

remaining life.

1. The consolidated net income for 2022

a. P 153,000

b. P 141,000

c. P 145,000

d. P 144,000

2. Non-controlling interest in the consolidated net income

a. P 18,800

b. P 17, 200

c. P 22,000

d. P 19, 200

3. Depreciation expense recorded by the parent company

a. P4,000

b. P 10, 600

c. P 14,600

d. P 10, 950

4. Depreciation expense reported in the Consolidated Income Statement

c. P 14,600

d. P 10, 950

a. P 4,000

b. P 10, 600

5. The truck and its accumulated depreciation in the Consolidated Balance Sheet

c. 53,000 and 31,800

d. 43,800 and 21,200

a. 43,800 and 14,600

b. 53,000 and 21,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub