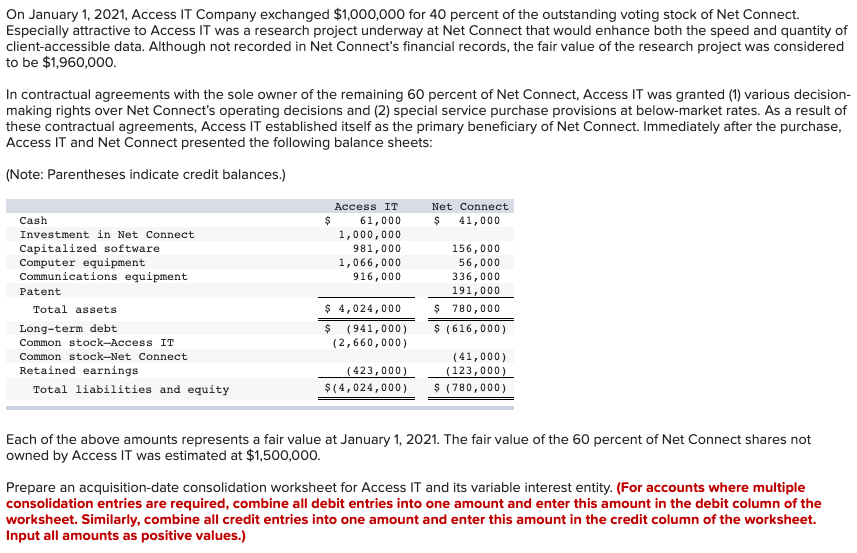

On January 1, 2021, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of client-accessible data. Although not recorded in Net Connect's financial records, the fair value of the research project was considered to be $1,960,000. In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision- making rights over Net Connect's operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase, Access IT and Net Connect presented the following balance sheets:

On January 1, 2021, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of client-accessible data. Although not recorded in Net Connect's financial records, the fair value of the research project was considered to be $1,960,000. In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision- making rights over Net Connect's operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase, Access IT and Net Connect presented the following balance sheets:

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 37RQSC

Related questions

Question

100%

Transcribed Image Text:On January 1, 2021, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect.

Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of

client-accessible data. Although not recorded in Net Connect's financial records, the fair value of the research project was considered

to be $1,960,000.

In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision-

making rights over Net Connect's operating decisions and (2) special service purchase provisions at below-market rates. As a result of

these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase,

Access IT and Net Connect presented the following balance sheets:

(Note: Parentheses indicate credit balances.)

Access IT

Net Connect

61,000

1,000,000

Cash

41,000

Investment in Net Connect

Capitalized software

Computer equipment

Communications equipment

981,000

156,000

1,066,000

916,000

56,000

336,000

191,000

Patent

Total assets

$ 4,024,000

780,000

$ (941,000)

(2,660,000)

Long-term debt

(616,000)

Common stock-Access IT

Common stock-Net Connect

(41,000)

Retained earnings

(423,000)

(123,000)

Total liabilities and equity

$(4,024,000)

(780,000)

Each of the above amounts represents a fair value at January 1, 2021. The fair value of the 60 percent of Net Connect shares not

owned by Access IT was estimated at $1,500,000.

Prepare an acquisition-date consolidation worksheet for Access IT and its variable interest entity. (For accounts where multiple

consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the

worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.

Input all amounts as positive values.)

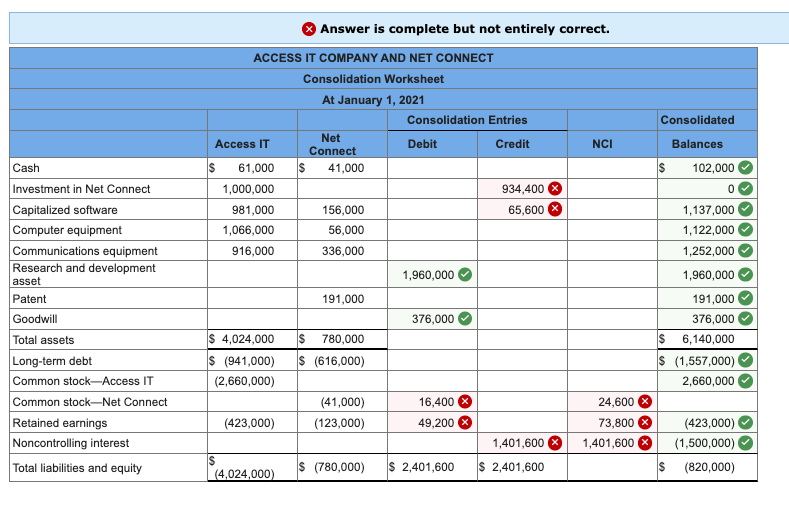

Transcribed Image Text:Answer is complete but not entirely correct.

ACCESS IT COMPANY AND NET CONNECT

Consolidation Worksheet

At January 1, 2021

Consolidation Entries

Consolidated

Net

Connect

Access IT

Debit

Credit

NCI

Balances

Cash

IS

61,000

41,000

102,000

Investment in Net Connect

1,000,000

934,400

Capitalized software

981,000

156,000

65,600

1,137,000

Computer equipment

1,066,000

56,000

1,122,000

Communications equipment

Research and development

asset

916,000

336,000

1,252,000

1,960,000

1,960,000

Patent

191,000

191,000

Goodwill

376,000

376,000

Total assets

$ 4,024,000

$ 780,000

IS

6,140,000

Long-term debt

Common stock-Access IT

$ (941,000)

$ (616,000)

$ (1,557,000)

(2,660,000)

2,660,000

Common stock-Net Connect

Retained earnings

Noncontrolling interest

Total liabilities and equity

(41,000)

16,400

24,600

(423,000)

(123,000)

49,200

73,800

(423,000)

1,401,600 X

1,401,600

(1,500,000)

$ (780,000)

$ 2,401,600

$ 2,401,600

(820,000)

(4,024,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning