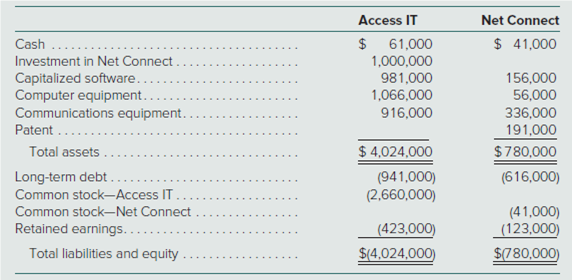

Access IT Net Connect Cash $ 61,000 $ 41,000 Investment in Net Connect 1,000,000 Capitalized software.. Computer equipment.. Communications equipment. Patent . 981,000 1,066,000 916,000 156,000 56,000 336,000 191,000 Total assets $ 4,024,000 $780,000 Long-term debt . Common stock-Access IT (941,000) (2,660,000) (616,000) Common stock-Net Connect (41,000) Retained earnings.... (423,000) (123,000) Total liabilities and equity $(4,024,000) $(780,000)

On January 1, 2018, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of client-accessible data. Although not recorded in Net Connect’s financial records, the fair value of the research project was considered to be $1,960,000.

In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision-making rights over Net Connect’s operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase, Access IT and Net Connect presented the following balance sheets:

Each of the above amounts represents a fair value at January 1, 2018. The fair value of the 60 percent of Net Connect shares not owned by Access IT was $1,500,000.

Prepare an acquisition-date consolidation worksheet for Access IT and its variable interest entity.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images