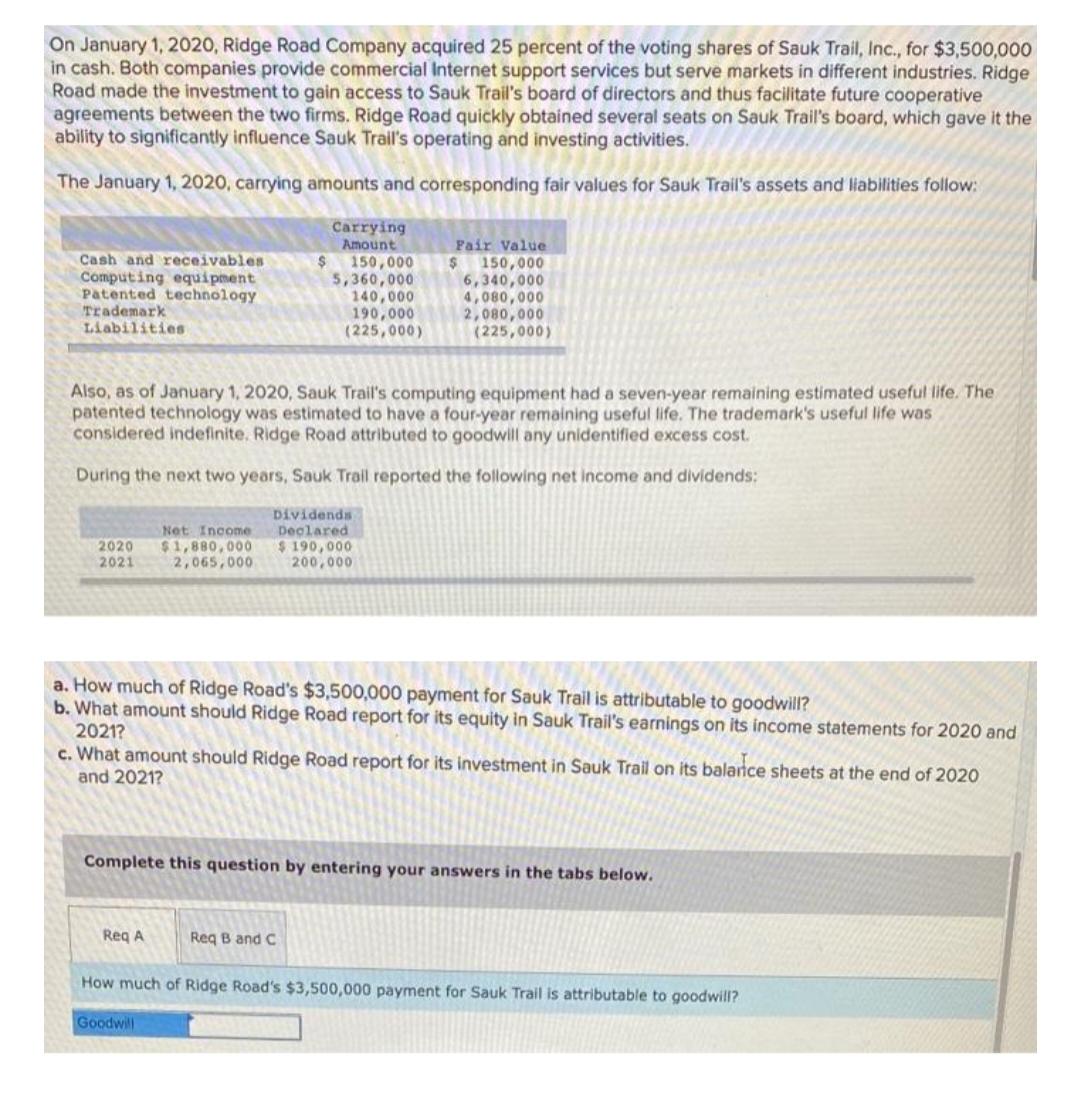

On January 1, 2020, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Inc., for $3,500,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the investment to gain access to Sauk Trail's board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail's board, which gave it the ability to significantly influence Sauk Trail's operating and investing activities. The January 1, 2020, carrying amounts and corresponding fair values for Sauk Trail's assets and liabilities follow: Cash and receivables Computing equipment Patented technology Trademark Liabilities 2020 2021 Also, as of January 1, 2020, Sauk Trail's computing equipment had a seven-year remaining estimated useful life. The patented technology was estimated to have a four-year remaining useful life. The trademark's useful life was considered indefinite. Ridge Road attributed to goodwill any unidentified excess cost. During the next two years, Sauk Trail reported the following net income and dividends: Dividends Declared $190,000 200,000 Net Income $1,880,000 2,065,000 Req A $ Carrying Amount Goodwill 150,000 5,360,000 140,000 190,000 (225,000) a. How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill? b. What amount should Ridge Road report for its equity in Sauk Trail's earnings on its income statements for 2020 and 2021? c. What amount should Ridge Road report for its investment in Sauk Trail on its balance sheets at the end of 2020 and 2021? Req B and C Fair Value $ 150,000 6,340,000 4,080,000 2,080,000 (225,000) Complete this question by entering your answers in the tabs below. How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill?

On January 1, 2020, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Inc., for $3,500,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the investment to gain access to Sauk Trail's board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail's board, which gave it the ability to significantly influence Sauk Trail's operating and investing activities. The January 1, 2020, carrying amounts and corresponding fair values for Sauk Trail's assets and liabilities follow: Cash and receivables Computing equipment Patented technology Trademark Liabilities 2020 2021 Also, as of January 1, 2020, Sauk Trail's computing equipment had a seven-year remaining estimated useful life. The patented technology was estimated to have a four-year remaining useful life. The trademark's useful life was considered indefinite. Ridge Road attributed to goodwill any unidentified excess cost. During the next two years, Sauk Trail reported the following net income and dividends: Dividends Declared $190,000 200,000 Net Income $1,880,000 2,065,000 Req A $ Carrying Amount Goodwill 150,000 5,360,000 140,000 190,000 (225,000) a. How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill? b. What amount should Ridge Road report for its equity in Sauk Trail's earnings on its income statements for 2020 and 2021? c. What amount should Ridge Road report for its investment in Sauk Trail on its balance sheets at the end of 2020 and 2021? Req B and C Fair Value $ 150,000 6,340,000 4,080,000 2,080,000 (225,000) Complete this question by entering your answers in the tabs below. How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:On January 1, 2020, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Inc., for $3,500,000

in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge

Road made the investment to gain access to Sauk Trail's board of directors and thus facilitate future cooperative

agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail's board, which gave it the

ability to significantly influence Sauk Trail's operating and investing activities.

The January 1, 2020, carrying amounts and corresponding fair values for Sauk Trail's assets and liabilities follow:

Cash and receivables

Computing equipment

Patented technology

Trademark

Liabilities

2020

2021

Also, as of January 1, 2020, Sauk Trail's computing equipment had a seven-year remaining estimated useful life. The

patented technology was estimated to have a four-year remaining useful life. The trademark's useful life was

considered indefinite. Ridge Road attributed to goodwill any unidentified excess cost.

During the next two years, Sauk Trail reported the following net income and dividends:

Dividends

Declared

$ 190,000

200,000

Net Income

$1,880,000

2,065,000

$

Req A

Carrying

Amount

150,000

5,360,000

140,000

190,000

(225,000)

a. How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill?

b. What amount should Ridge Road report for its equity in Sauk Trail's earnings on its income statements for 2020 and

2021?

Goodwill

Fair Value

$

150,000

6,340,000

4,080,000

2,080,000

(225,000)

c. What amount should Ridge Road report for its investment in Sauk Trail on its balance sheets at the end of 2020

and 2021?

Req B and C

Complete this question by entering your answers in the tabs below.

How much of Ridge Road's $3,500,000 payment for Sauk Trail is attributable to goodwill?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning