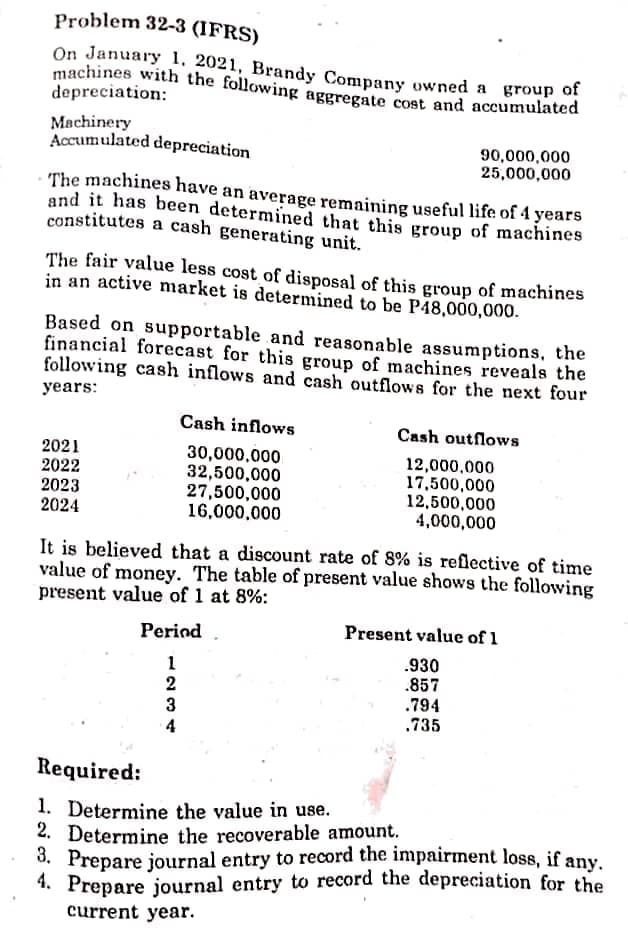

On January 1, 2021, Brandy Company owned a group of machines with the following aggregate cost and accumulated depreciation: Machinery Accumulated depreciation 90,000,000 25,000,000 The machines have an average remaining useful life of 4 years and it has been determined that this group of machines constitutes a cash generating unit. The fair value less cost of disposal of this group of machines in an active market is determined to be P48,000,000. Based on supportable and reasonable assumptions, the financial forecast for this group of machines reveals the following cash inflows and cash outflows for the next four years: Cash inflows Cash outflows 2021 2022 2023 2024 30,000,000 32,500,000 27,500,000 16,000,000 12,000,000 17,500,000 12,500,000 4,000,000 It is believed that a discount rate of 8% is reflective of time value of money. The table of present value shows the following present value of 1 at 8%: Perind Present value of 1 .930 .857 .794 .735 1 2 3 Required: 1. Determine the value in use. 2. Determine the recoverable amount. 3. Prepare journal entry to record the impairment loss, if any nocord the denregiotio

On January 1, 2021, Brandy Company owned a group of machines with the following aggregate cost and accumulated depreciation: Machinery Accumulated depreciation 90,000,000 25,000,000 The machines have an average remaining useful life of 4 years and it has been determined that this group of machines constitutes a cash generating unit. The fair value less cost of disposal of this group of machines in an active market is determined to be P48,000,000. Based on supportable and reasonable assumptions, the financial forecast for this group of machines reveals the following cash inflows and cash outflows for the next four years: Cash inflows Cash outflows 2021 2022 2023 2024 30,000,000 32,500,000 27,500,000 16,000,000 12,000,000 17,500,000 12,500,000 4,000,000 It is believed that a discount rate of 8% is reflective of time value of money. The table of present value shows the following present value of 1 at 8%: Perind Present value of 1 .930 .857 .794 .735 1 2 3 Required: 1. Determine the value in use. 2. Determine the recoverable amount. 3. Prepare journal entry to record the impairment loss, if any nocord the denregiotio

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 5P: Group and Composite Depreciation Chcadle Company purchased a fleet of 20 delivery trucks for 8,000...

Related questions

Question

100%

hel me answer this thank you in advance

Transcribed Image Text:machines with the following aggregate cost and accumulated

On January 1, 2021, Brandy Company owned a group of

Problem 32-3 (IFRS)

depreciation:

Machinery

Accumulated depreciation

90,000,000

25,000,000

The machines have an average remaining useful life of 4 years

and it has been determined that this group of machines

constitutes a cash generating unit.

The fair value less cost of disposal of this group of machines

in an active market is determined to be P48,000,000.

Based on supportable and reasonable assumptions, the

financial forecast for this group of machines reveals the

following cash inflows and cash outflows for the next four

years:

Cash inflows

Cash outflows

2021

2022

2023

2024

30,000,000

32,500,000

27,500,000

16,000,000

12,000,000

17,500,000

12,500,000

4,000,000

It is believed that a discount rate of 8% is reflective of time

value of money. The table of present value shows the following

present value of 1 at 8%:

Perind

Present value of 1

.930

.857

.794

.735

4

Required:

1. Determine the value in use.

2. Determine the recoverable amount.

3. Prepare journal entry to record the impairment loss, if any.

4. Prepare journal entry to record the depreciation for the

current year.

123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning