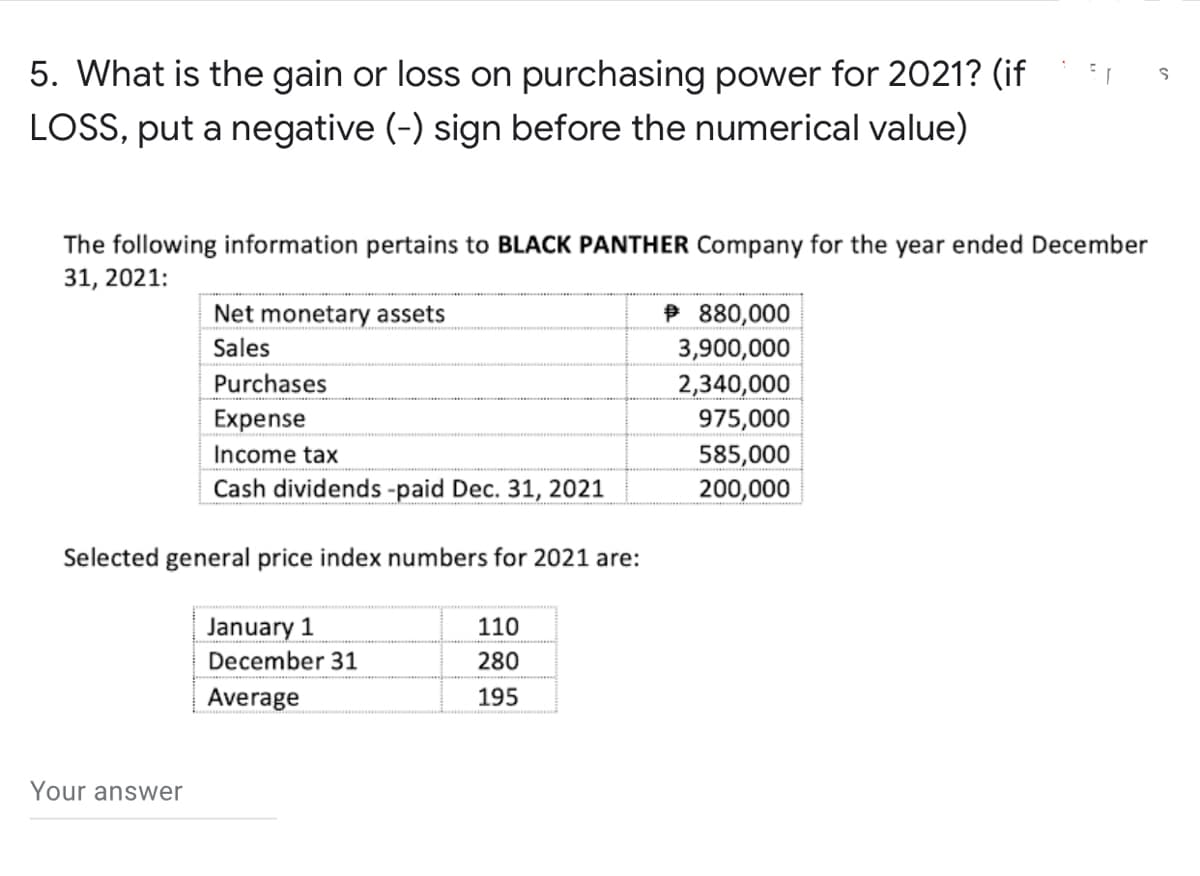

S 5. What is the gain or loss on purchasing power for 2021? (if LOSS, put a negative (-) sign before the numerical value) The following information pertains to BLACK PANTHER Company for the year ended December 31, 2021: Net monetary assets 880,000 Sales 3,900,000 Purchases 2,340,000 Expense 975,000 Income tax 585,000 Cash dividends -paid Dec. 31, 2021 200,000 Selected general price index numbers for 2021 are: January 1 110 December 31 280 Average 195

S 5. What is the gain or loss on purchasing power for 2021? (if LOSS, put a negative (-) sign before the numerical value) The following information pertains to BLACK PANTHER Company for the year ended December 31, 2021: Net monetary assets 880,000 Sales 3,900,000 Purchases 2,340,000 Expense 975,000 Income tax 585,000 Cash dividends -paid Dec. 31, 2021 200,000 Selected general price index numbers for 2021 are: January 1 110 December 31 280 Average 195

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:S

5. What is the gain or loss on purchasing power for 2021? (if

LOSS, put a negative (-) sign before the numerical value)

The following information pertains to BLACK PANTHER Company for the year ended December

31, 2021:

Net monetary assets

880,000

Sales

3,900,000

Purchases

2,340,000

Expense

975,000

Income tax

585,000

Cash dividends -paid Dec. 31, 2021

200,000

Selected general price index numbers for 2021 are:

January 1

110

December 31

280

Average

195

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning