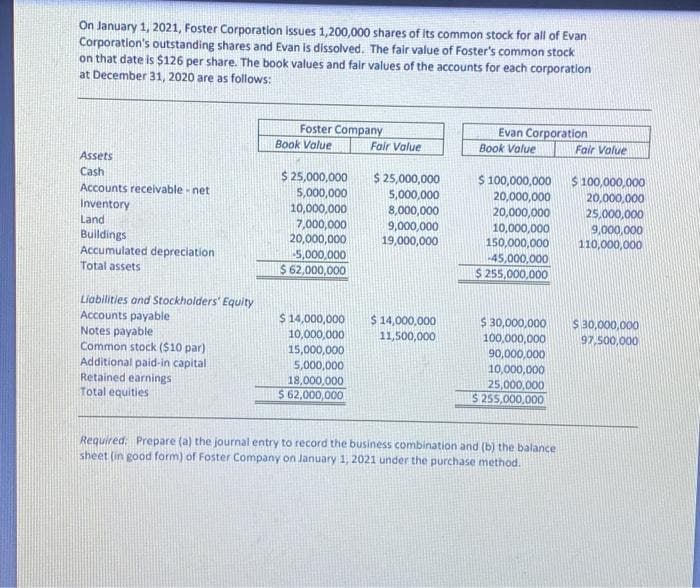

On January 1, 2021, Foster Corporation issues 1,200,000 shares of Its common stock for all of Evan Corporation's outstanding shares and Evan is dissolved. The fair value of Foster's common stock on that date is 126 per share. The book values and fair values of the accounts for each corporation at December 31, 2020 are as follows: Foster Company Book Value Evan Corporation Fair Value Book Value Fair Value Assets $ 25,000,000 5,000,000 $ 25,000,000 5,000,000 8,000,000 $ 100,000,000 $ 100,000,000 20,000,000 25,000,000 9,000,000 110,000,000 Cash Accounts receivable - net 20,000,000 20,000,000 10,000,000 150,000,000 45,000,000 S 255,000,000 Inventory 10,000,000 7,000,000 20,000,000 5,000,000 $ 62,000,000 Land 9,000,000 19,000,000 Buildings Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Common stock ($10 par) Additional paid-in capital Retained earnings Total equities $ 14,000,000 10,000,000 $ 14,000,000 11,500,000 $ 30,000,000 $ 30,000,000 100,000,000 90,000,000 10,000,000 25,000,000 S 255,000,000 97.500,000 15,000,000 5,000,000 18,000,000 $ 62,000,000 Required: Prepare (a) the journal entry to record the business combination and (b) the balance sheet (in good form) of Foster Company on January 1, 2021 under the purchase method.

On January 1, 2021, Foster Corporation issues 1,200,000 shares of Its common stock for all of Evan Corporation's outstanding shares and Evan is dissolved. The fair value of Foster's common stock on that date is 126 per share. The book values and fair values of the accounts for each corporation at December 31, 2020 are as follows: Foster Company Book Value Evan Corporation Fair Value Book Value Fair Value Assets $ 25,000,000 5,000,000 $ 25,000,000 5,000,000 8,000,000 $ 100,000,000 $ 100,000,000 20,000,000 25,000,000 9,000,000 110,000,000 Cash Accounts receivable - net 20,000,000 20,000,000 10,000,000 150,000,000 45,000,000 S 255,000,000 Inventory 10,000,000 7,000,000 20,000,000 5,000,000 $ 62,000,000 Land 9,000,000 19,000,000 Buildings Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Common stock ($10 par) Additional paid-in capital Retained earnings Total equities $ 14,000,000 10,000,000 $ 14,000,000 11,500,000 $ 30,000,000 $ 30,000,000 100,000,000 90,000,000 10,000,000 25,000,000 S 255,000,000 97.500,000 15,000,000 5,000,000 18,000,000 $ 62,000,000 Required: Prepare (a) the journal entry to record the business combination and (b) the balance sheet (in good form) of Foster Company on January 1, 2021 under the purchase method.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 34P

Related questions

Question

Please answer required a and b

Transcribed Image Text:On January 1, 2021, Foster Corporation issues 1,200,000 shares of its common stock for all of Evan

Corporation's outstanding shares and Evan is dissolved. The fair value of Foster's common stock

on that date is 126 per share. The book values and fair values of the accounts for each corporation

at December 31, 2020 are as follows:

Foster Company

Evan Corporation

Book Value

Book Value

Fair Value

Fair Value

Assets

$ 100,000,000

20,000,000

20,000,000

10,000,000

150,000,000

-45,000,000

$ 255,000,000

Cash

$ 100,000,000

$ 25,000,000

5,000,000

8,000,000

9,000,000

19,000,000

$ 25,000,000

5,000,000

Accounts receivable - net

20,000,000

25,000,000

9,000,000

110,000,000

Inventory

Land

10,000,000

7,000,000

20,000,000

5,000,000

$ 62,000,000

Buildings

Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

Common stock ($10 par)

Additional paid-in capital

Retained earnings

Total equities

$ 14,000,000

11,500,000

$ 30,000,000

$ 30,000,000

97,500,000

$ 14,000,000

10,000,000

15,000,000

5,000,000

18,000,000

$ 62,000,000

100,000,000

90,000,000

10,000,000

25,000,000

S 255,000,000

Required: Prepare (a) the journal entry to record the business combination and (b) the balance

sheet (in good form) of Foster Company on January 1, 2021 under the purchase method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning