On January 1, 2021, Gundy Enterprises purchases an office building for $261,000, paying $51,000 doWH ane remaining $210,000, signing a 7%, 10-year mortgage. Installment payments of $2,438.28 are due at the end of each month, with the first payment due on January 31, 2021. the 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, selec No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 lecimal places.) View transaction list

On January 1, 2021, Gundy Enterprises purchases an office building for $261,000, paying $51,000 doWH ane remaining $210,000, signing a 7%, 10-year mortgage. Installment payments of $2,438.28 are due at the end of each month, with the first payment due on January 31, 2021. the 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, selec No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 lecimal places.) View transaction list

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.37MCE

Related questions

Question

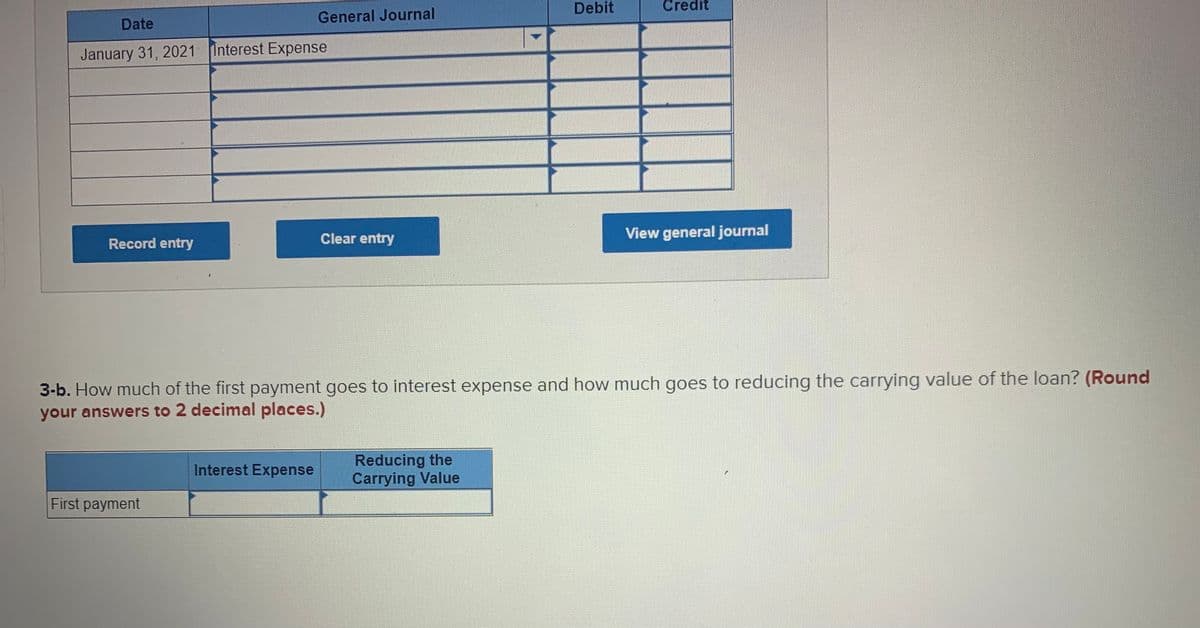

Transcribed Image Text:Debit

Credit

General Journal

Date

January 31, 2021 Interest Expense

Clear entry

View general journal

Record entry

3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round

your answers to 2 decimal places.)

Reducing the

Carrying Value

Interest Expense

First payment

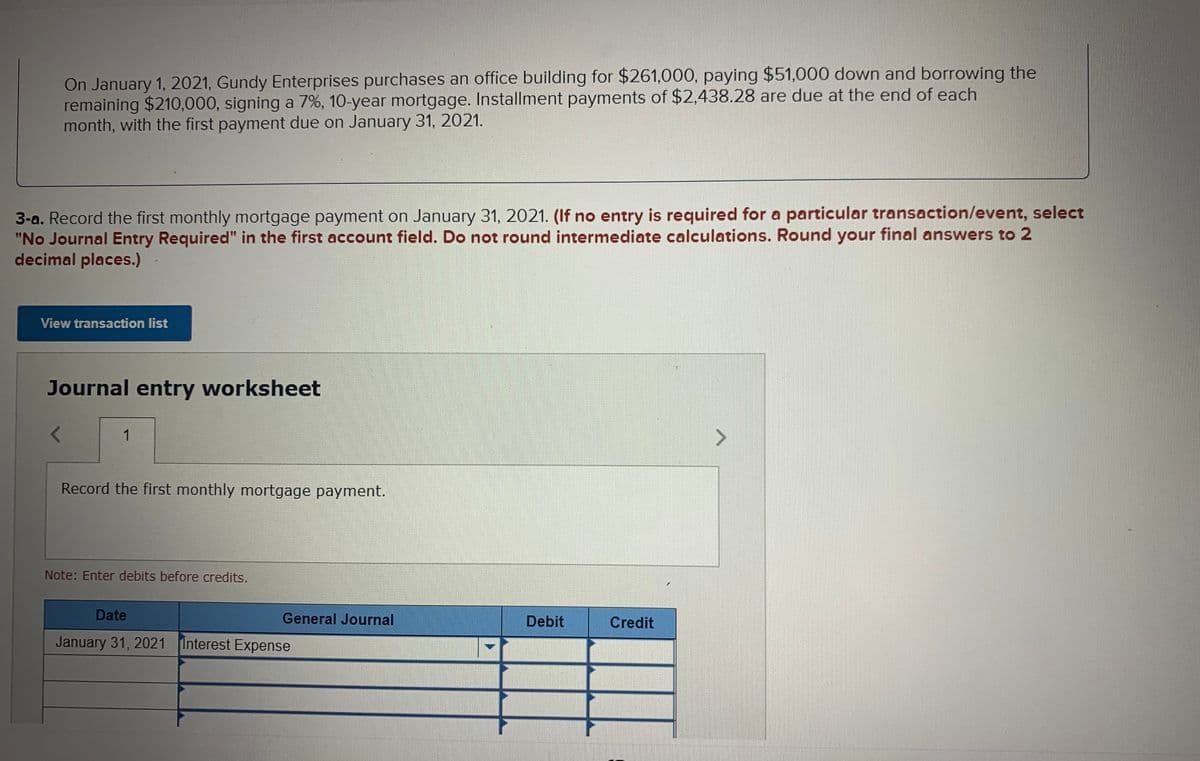

Transcribed Image Text:On January 1, 2021, Gundy Enterprises purchases an office building for $261,000, paying $51,000 down and borrowing the

remaining $210,000, signing a 7%, 10-year mortgage. Installment payments of $2,438.28 are due at the end of each

month, with the first payment due on January 31, 2021.

3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select

"No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2

decimal places.)

View transaction list

Journal entry worksheet

1

Record the first monthly mortgage payment.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31, 2021 Interest Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College