Sunland Resort Corp. issued a 20-year, 6%, $274,000 mortgage note payable to finance the construction of a new building on December 31, 2021. The terms provide for semi-annual instalment payments on June 30 and December 31. Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a foxed principal payment of $6.850. (Round answers to O decimal places, eg. 5,276. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Issue of Note Dec. 31, 2021 (Torecord issuance of note.) First Instalment Payment

Sunland Resort Corp. issued a 20-year, 6%, $274,000 mortgage note payable to finance the construction of a new building on December 31, 2021. The terms provide for semi-annual instalment payments on June 30 and December 31. Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a foxed principal payment of $6.850. (Round answers to O decimal places, eg. 5,276. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Issue of Note Dec. 31, 2021 (Torecord issuance of note.) First Instalment Payment

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 16E

Related questions

Question

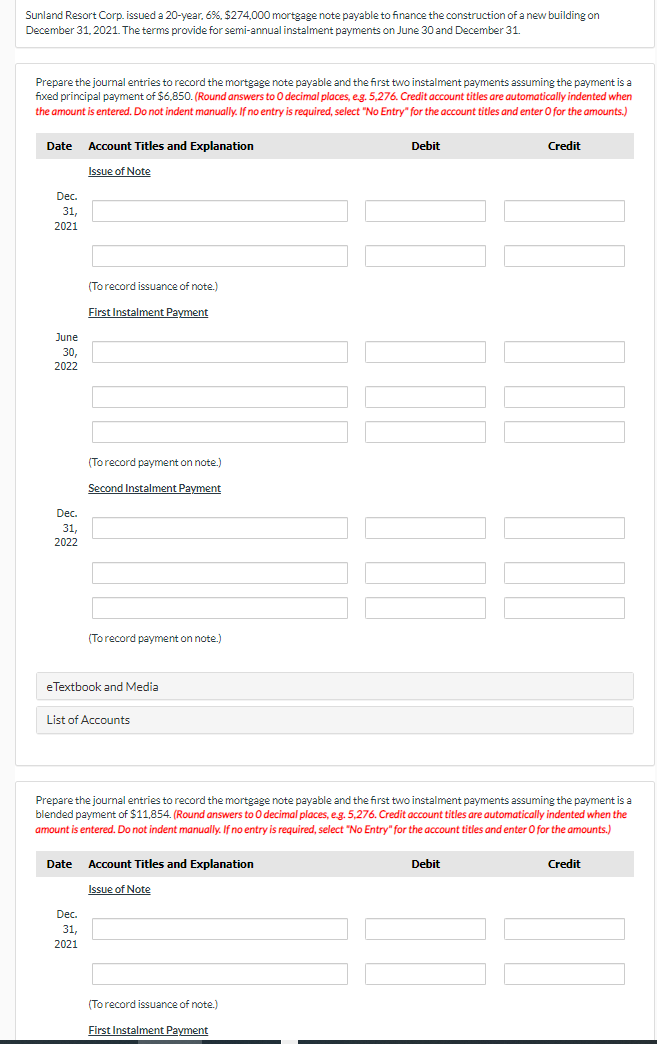

Transcribed Image Text:Sunland Resort Corp. issued a 20-year, 6%, $274.000 mortgage note payable to finance the construction of a new building on

December 31, 2021. The terms provide for semi-annual instalment payments on June 30 and December 31.

Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a

fixed principal payment of $6.850. (Round answers to O decimal places, eg. 5,276. Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Issue of Note

Dec.

31,

2021

(Torecord issuance of note.)

First Instalment Payment

June

30,

2022

(Torecord p

con note.)

Second Instalment Payment

Dec.

31,

2022

(Torecord payment on note.)

eTextbook and Media

List of Accounts

Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a

blended payment of $11,854. (Round answers to O decimal places, eg. 5,276. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Issue of Note

Dec.

31.

2021

(Torecord issuance of note.)

First Instalment Payment

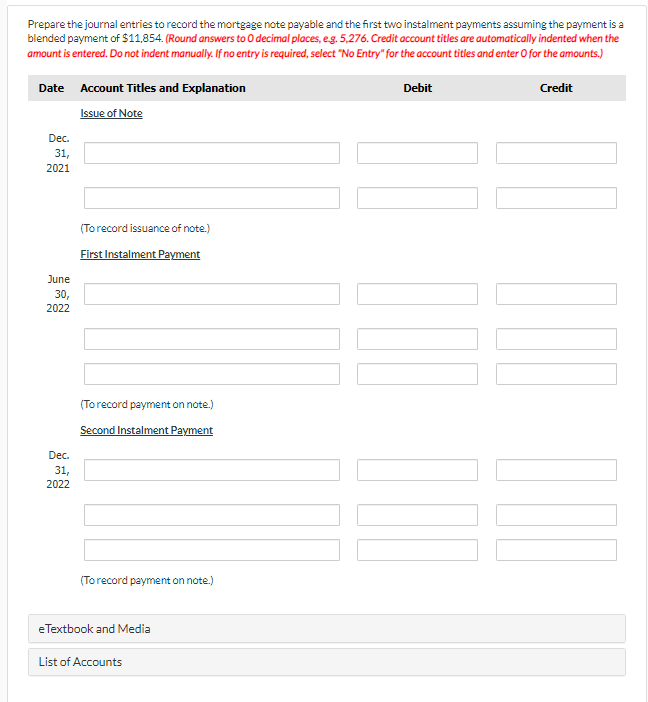

Transcribed Image Text:Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a

blended payment of $11,854. (Round answers to O decimal places, eg. 5,276. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

Debit

Credit

Issue of Note

Dec.

31,

2021

(Torecord issuance of note.)

First Instalment Payment

June

30,

2022

(Torecord payment on note.)

Second Instalment Payment

Dec.

31,

2022

(To record payment on note.)

eTextbook and Media

List of Accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning