On January 1, 2021, LLB Industries borrowed $400,000 from Trust Bank by issuing a two-year, 8% note, with interest payable quarterly. LLB entered into a two-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing iPhone USB ue of its debt to increase. The agreement called for the company to receive payment based on a 8% fixed interest rate on a notional amount of $400,000 and to pay interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly. Floating (LIBOR) settlement rates were 8% at January 1, 6% at March 31, and 4% June 30, 2021. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. Fair value of interest rate swap Fair value of note payable January 11 0 $400,000 March 31 $ 8,472 $408,472 June 30 $ 15,394 9415,394 Required: 1. Calculate the net cash settlement at March 31 and June 30, 2021. 2. Prepare the journal entries through June 30, 2021, to record the issuance of the note, interest, and necessary adjustments for changes in fair value.

On January 1, 2021, LLB Industries borrowed $400,000 from Trust Bank by issuing a two-year, 8% note, with interest payable quarterly. LLB entered into a two-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing iPhone USB ue of its debt to increase. The agreement called for the company to receive payment based on a 8% fixed interest rate on a notional amount of $400,000 and to pay interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly. Floating (LIBOR) settlement rates were 8% at January 1, 6% at March 31, and 4% June 30, 2021. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. Fair value of interest rate swap Fair value of note payable January 11 0 $400,000 March 31 $ 8,472 $408,472 June 30 $ 15,394 9415,394 Required: 1. Calculate the net cash settlement at March 31 and June 30, 2021. 2. Prepare the journal entries through June 30, 2021, to record the issuance of the note, interest, and necessary adjustments for changes in fair value.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 30P

Related questions

Question

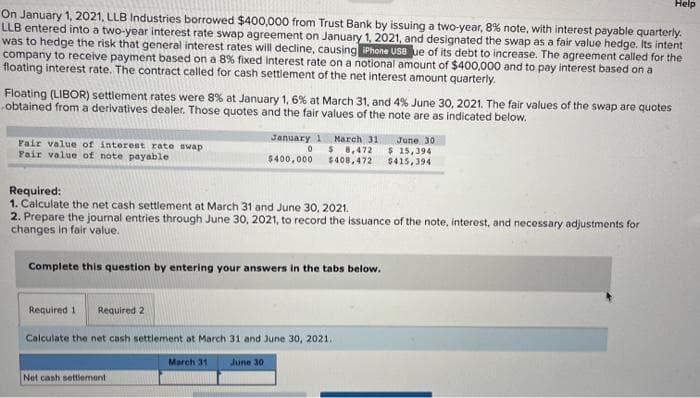

Transcribed Image Text:On January 1, 2021, LLB Industries borrowed $400,000 from Trust Bank by issuing a two-year, 8% note, with interest payable quarterly.

LLB entered into a two-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. Its intent

was to hedge the risk that general interest rates will decline, causing iPhone USB ue of its debt to increase. The agreement called for the

company to receive payment based on a 8% fixed interest rate on a notional amount of $400,000 and to pay interest based on a

floating interest rate. The contract called for cash settlement of the net interest amount quarterly.

Floating (LIBOR) settlement rates were 8% at January 1, 6% at March 31, and 4% June 30, 2021. The fair values of the swap are quotes

obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below.

Fair value of interest rate swap

Fair value of note payable

January 1

0

$400,000

Required:

1. Calculate the net cash settlement at March 31 and June 30, 2021.

2. Prepare the journal entries through June 30, 2021, to record the issuance of the note, interest, and necessary adjustments for

changes in fair value.

Complete this question by entering your answers in the tabs below.

Net cash settlement

March 311

$ 8,472

$408,472

Required 1 Required 2

Calculate the net cash settlement at March 31 and June 30, 2021.

March 31

June 30

June 30

$ 15,394

$415,394

Help

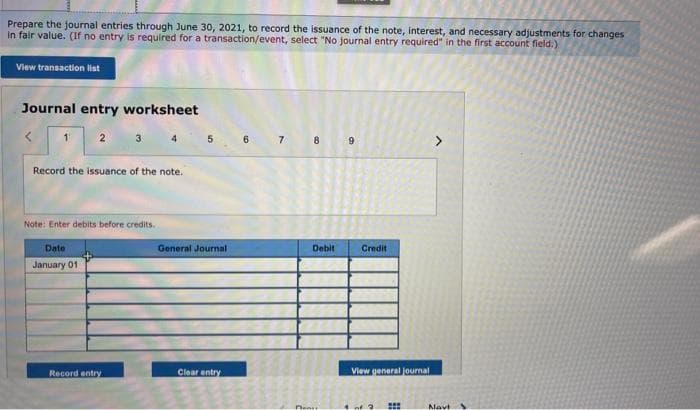

Transcribed Image Text:Prepare the journal entries through June 30, 2021, to record the issuance of the note, interest, and necessary adjustments for changes

in fair value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

2 3

Record the issuance of the note.

Note: Enter debits before credits.

Date

January 01

Record entry

5

General Journal

Clear entry

6

7

BARN

8

Debit

Pent

9

Credit

View general journal

#

Navt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning