entory on cost 35, Tems. balance to Crop Company on November 13. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements. Date Requirement 1. Journalize Team Wholesaler's November transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Nov. 4: Purchased merchandise inventory on account from Crop Company for $15,000, terms 3/10, n/30. Debit Nov. 4 wholesa Accounts Credit Requirements 5, Team 1. 2. salers paid Journalize Team Wholesaler's November transactions. Journalize Crop Company's November transactions. Print Done X paid

entory on cost 35, Tems. balance to Crop Company on November 13. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements. Date Requirement 1. Journalize Team Wholesaler's November transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Nov. 4: Purchased merchandise inventory on account from Crop Company for $15,000, terms 3/10, n/30. Debit Nov. 4 wholesa Accounts Credit Requirements 5, Team 1. 2. salers paid Journalize Team Wholesaler's November transactions. Journalize Crop Company's November transactions. Print Done X paid

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter10: Cash Receipts And Cash Payments

Section: Chapter Questions

Problem 2PA: Preston Company sells candy wholesale, primarily to vending machine operators. Terms of sales on...

Related questions

Topic Video

Question

Complete all requiremnts in pic

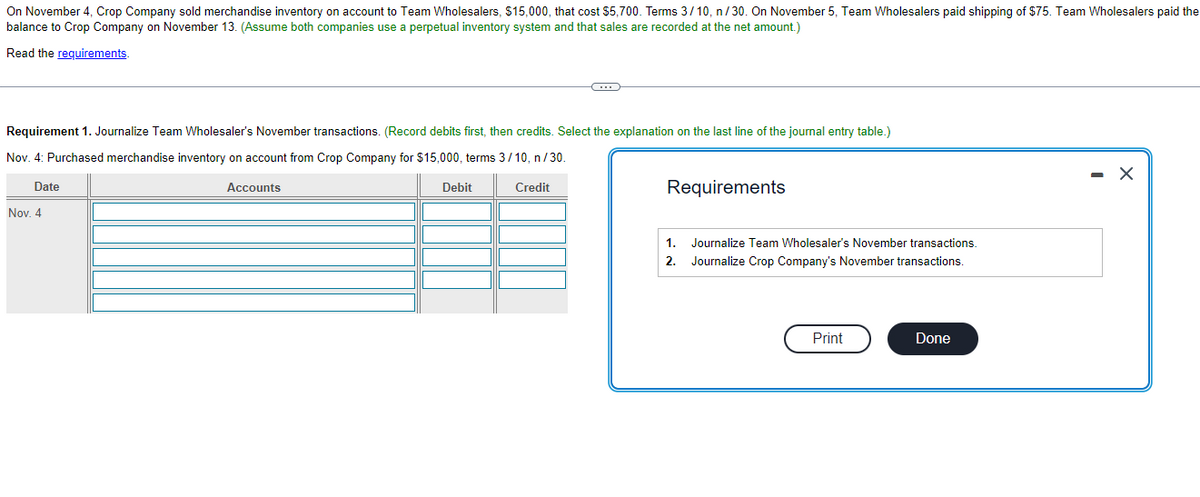

Transcribed Image Text:On November 4, Crop Company sold merchandise inventory on account to Team Wholesalers, $15,000, that cost $5,700. Terms 3/10, n/30. On November 5, Team Wholesalers paid shipping of $75. Team Wholesalers paid the

balance to Crop Company on November 13. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.)

Read the requirements.

Requirement 1. Journalize Team Wholesaler's November transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Nov. 4: Purchased merchandise inventory on account from Crop Company for $15,000, terms 3/10, n/30.

Date

Nov. 4

Accounts

Debit

C

Credit

Requirements

1. Journalize Team Wholesaler's November transactions.

Journalize Crop Company's November transactions.

2.

Print

Done

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage