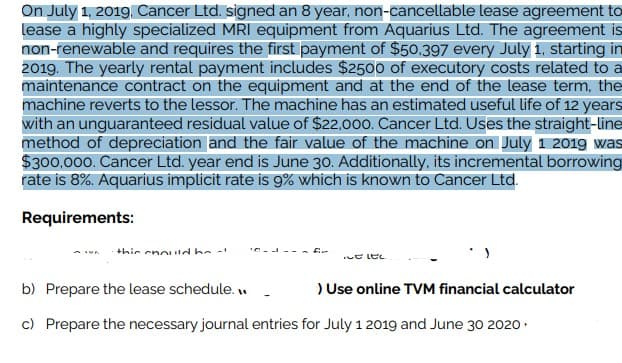

On July 1, 2019, Cance

Q: what is the variance

A: Variance states the difference among the actual amount or figure or the forecasted amount and this…

Q: d es Required information [The following information applies to the questions displayed below.] The…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Cullumber, Inc. had the following equity investment portfolio at January 1, 2020. 970 shares @ $15…

A: Journal Entries is the primary step to record the transaction in the books of accounts. Balance…

Q: of treasury stock on September 1, and issued 60000 shares on November 1. The weighted average shares…

A: Basic earnings per share = (Net income - Preferred dividend) / Weighted average no. of common shares…

Q: S. Primrose and 8. Adora have a partnership in which they share profit and loss equally. There is an…

A: Journal entries means the foremost reporting of the business transactions in the books of the…

Q: Giorgos and Eleni agree that Eleni will purchase Giorgos house in Nicosia for 250.000 dollars. Based…

A: The law governs many aspects of our daily lives, including our relationships with others, our…

Q: The inventory records for Radford Company reflected the following Beginning inventory on May 1 1,600…

A: Cost of goods sold is the amount of cost which is incurred on the making of the goods. It includes…

Q: Q.1 From the following Trial Balance of Muneeb Traders prepare Income Statement for the year ended…

A: Balance sheet is the financial statement which is prepared by the entity to depict the financial…

Q: On August 3, Cinco Construction purchased special-purpose equipment at a cost of $5,700,000. The…

A: The straight-line method of depreciation is where the cost of the assets is allocated to useful life…

Q: Based on the 2021 tax brackets, If Brian and his wife have a taxable income of $70,000 and they…

A: We have, Taxable Income = $70,000 Filing status = Married filing jointly Child credit = $7,200(for 2…

Q: (17,500 units, 10% complete with respect to Refining costs) Transferred-in costs (from Mixing) $…

A: Equivalent units of production arises in case of process costing . In most cases,not all units are…

Q: Amber Company applies revaluation accounting to plant assets with a carrying value of $800,000, a…

A: A journal entry is a written record in a company's accounting system that describes a business…

Q: Williams Incorporated produces a single product, a part used in the manufacture of automobile…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Q5. A property comparable to the single-family home you are appraising sold three months ago for…

A: The sequence of adjusting prices is the same as given in the question. First, we will adjust the…

Q: Montcalm Company is evaluating the purchase of a new machine that costs $435,000, will have a CCA…

A: To calculate the tax shield, we need to first determine the tax depreciation allowance and the tax…

Q: [The following information applies to the questions displayed below.] Warnerwoods Company uses a…

A: Perpetual inventory system: The system of material control on a continuous basis is while the…

Q: Start Me Up Incorporated manufactures a caffeinated energy drink that sells for $4.30 each. The…

A: Full costing and variable costing are the two costing systems of assigning production costs to…

Q: 4. Now, let's assume the company wants to consider producing both products. Assume that, considering…

A: Lets understand the basics. Break even point is a point at which no profit no loss condition arise.…

Q: Witco Limited patented and successfully tested a new e-cigarette. To expand its ability to produce…

A: Bonds payable refers to a type of long-term debt that a company or organization issues to borrow…

Q: Ay 1. Miguel is the managing general partner of MAR and owns a 40% interest in the partnership. For…

A: Solution: Partnership income = $ 100,000 * 40% = $ 40,000 Guaranteed payment received = $ 50,000…

Q: Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending…

A: The quantity of products still in stock and held by a corporation at the end of an accounting period…

Q: Ay 3. Item 3 On January 1, Year 1, Friedman Company purchased a truck that cost $50,000. The truck…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: Crane Marina has 300 available slips that rent for $700 per season. Payments must be made in full by…

A: The question is based on the concept of Financial Accounting. Journal entry is a set of economic…

Q: Journalize the following transactions, using the direct write-off method of accounting for…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Preparing a consolidated income statement-Equity method with noncontrolling interest, AAP and…

A: The consolidated income statement summarises the financial performance of all group firms, including…

Q: ces Required information [The following information applies to the questions displayed below.)…

A: Inventory valuation refers to the process of assigning a monetary value to the inventory of a…

Q: Required information [The following information applies to the questions displayed below.] On…

A: Statement of cash flows :— It is one of the financial statement that shows change in cash and cash…

Q: mitiating a new project may require to set up a new organization, although temporarily

A: Initiating a new project can be done in various ways, depending on the nature, scope, and complexity…

Q: On May 1, 2015, Casico Toy Inc. purchased a new piece of equipment that cost $52,000. The estimated…

A: The depreciation rate for the double declining balance method is 2 / useful life, which in this case…

Q: Al E. Butt (Fisheries) Ltd has recently undertaken net present value analysis of a new trawler. The…

A: Explanation: If the NPV of an investment is negative, it does not necessarily mean that the internal…

Q: consider a 5 year capital lease with no guranteed residual value with an economic life span of 5…

A: Lease is defined a contractual agreement incorporated between two business entities where one entity…

Q: Skyline Florists uses an activity-based costing system to compute the cost of making floral bouquets…

A: Introduction:- ABC costing means Activity based costing. It is used to allocation of manufacturing…

Q: Nickleson Company had an unadjusted cash balance of $9,841 as of May 31. The company’s bank…

A: Bank Reconciliation Statement :— This statement is prepared to reconciles balance as per bank with…

Q: a. Determine the standard unit materials cost per pound for a standard batch. If required, round…

A: The variance is the difference between actual and standard costs of production. The variance is said…

Q: At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit…

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized…

Q: Hi! I am having trouble doing my accounting homework, coudl you help me complete it. The account…

A: Premium on Bonds Payable=Bond Issue Value-Bond Face Value

Q: Mauro Products distributes a single product, a woven basket whose selling price is $22 per unit and…

A: BREAKEVEN POINT Break Even means the volume of production or sales where there is no profit or loss.…

Q: Blossom Co. had 190000 shares of common stock, 21000 shares of convertible preferred stock, and…

A: Diluated Earning per share = Adjusted Profit / Weighted Average no. of common stock after conversion…

Q: The payroll register: Question 2 A. is a worksheet. O B. keeps track of an individual employee's…

A: Payroll includes payment to employees. Payroll may contain many factors such as basic salary,…

Q: Factory Overhead Cost Variances The following data relate to factory overhead cost for the…

A: Variance :— It is the difference between standard cost and actual cost. Budgeted variable…

Q: Grove Audio is considering the introduction of a new model of wireless speakers with the following…

A: Introduction:- CVP analysis is used to identify the changes in costs and volume affect a company's…

Q: Text LO 13.2 Following is a list of scenarios, Identify if the bond was issued at par, premium or…

A: Hi student Since there are multiple questions, we will answer only first question. Bonds payable is…

Q: MAB Company acquires 32% equity interest from BAM Company on January 1, 2020 for P980, 000. On…

A: A corporation that invests in another corporation earns money by getting dividends or growing the…

Q: Oriole Company understated its 2021 ending inventory by $30,300. Determine the impact this error has…

A: Ending inventory often referred to as closing inventory, is the cost of the items that a business…

Q: 3 ces ! Required information [The following information applies to the questions displayed below.]…

A: Current asset is an cash and cash equivalent and other assets which can be realized in normal…

Q: Calculate the Predetermined Overhead Rate (round to two decimal places $ X.XX). The company…

A: PREDETERMINED OVERHEAD RATE Predetermined rate means an indirect cost rate. predetermined overhead…

Q: COMPUTE FOR YOUR CARRYING AMOUNT FOR THE YEAR ENDED 2020 *

A: Percentage which has been acquired is 45% equity interest. Acquired interest for P860,000

Q: On May 1, 2023, Farley Caterers owned two depreciable assets consisting of a delivery van and an…

A: In case of reducing balance method Depreciation to be charged on Net book value at the beginning of…

Q: Assume the following information for Kingbird Corp. Accounts receivable (beginning balance)…

A: During the year collection of Accounts receivable made is $907000

Q: Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2022…

A: Sole proprietor refers to the form of organization which is owned as well as controlled by the…

Please see all working

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.