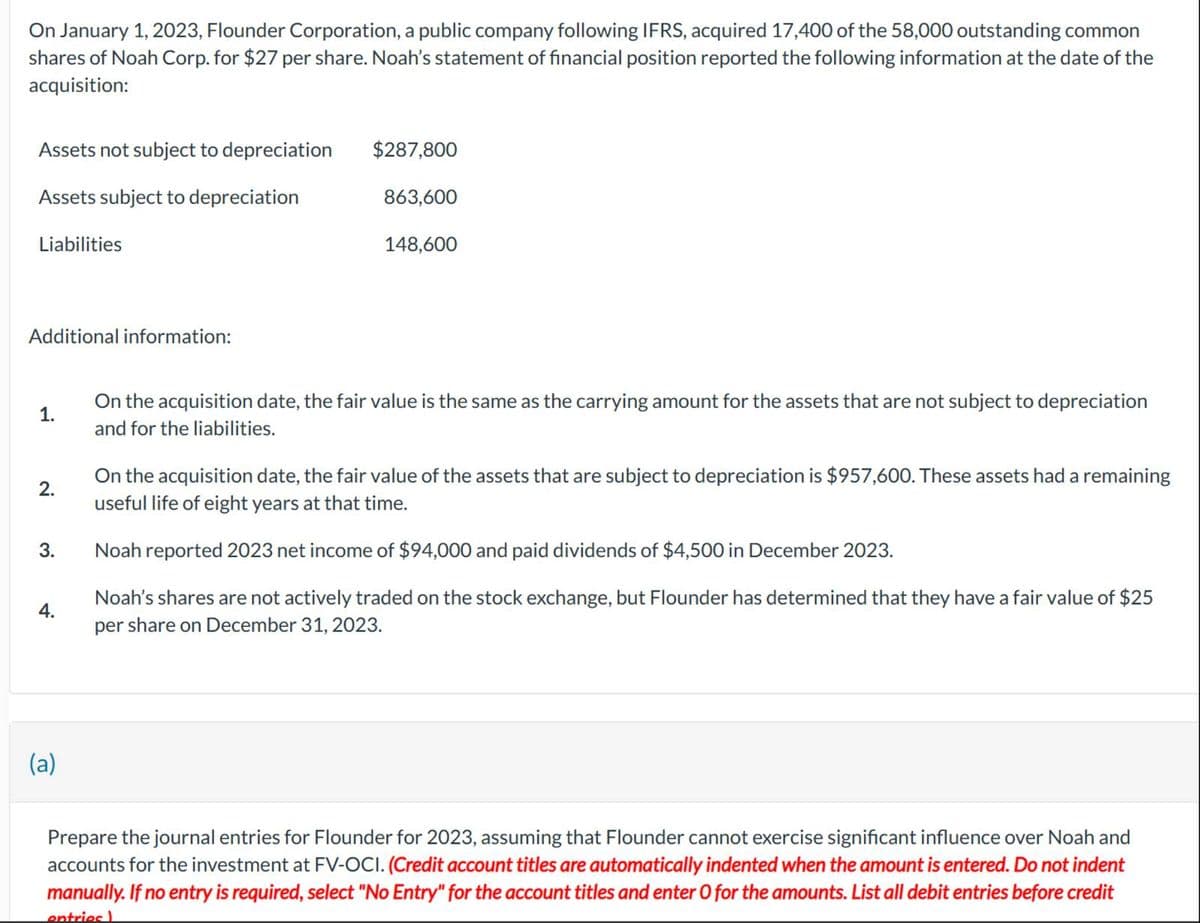

On January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal entries for Flounder for 2023, assuming that Flounder cannot exercise significant influence over Noah and accounts for the investment at FV-OCI. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries

On January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal entries for Flounder for 2023, assuming that Flounder cannot exercise significant influence over Noah and accounts for the investment at FV-OCI. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:On January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common

shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the

acquisition:

Assets not subject to depreciation

$287,800

Assets subject to depreciation

863,600

Liabilities

148,600

Additional information:

1.

On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation

and for the liabilities.

2.

3.

4.

On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining

useful life of eight years at that time.

Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023.

Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25

per share on December 31, 2023.

(a)

Prepare the journal entries for Flounder for 2023, assuming that Flounder cannot exercise significant influence over Noah and

accounts for the investment at FV-OCI. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit

entries

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub