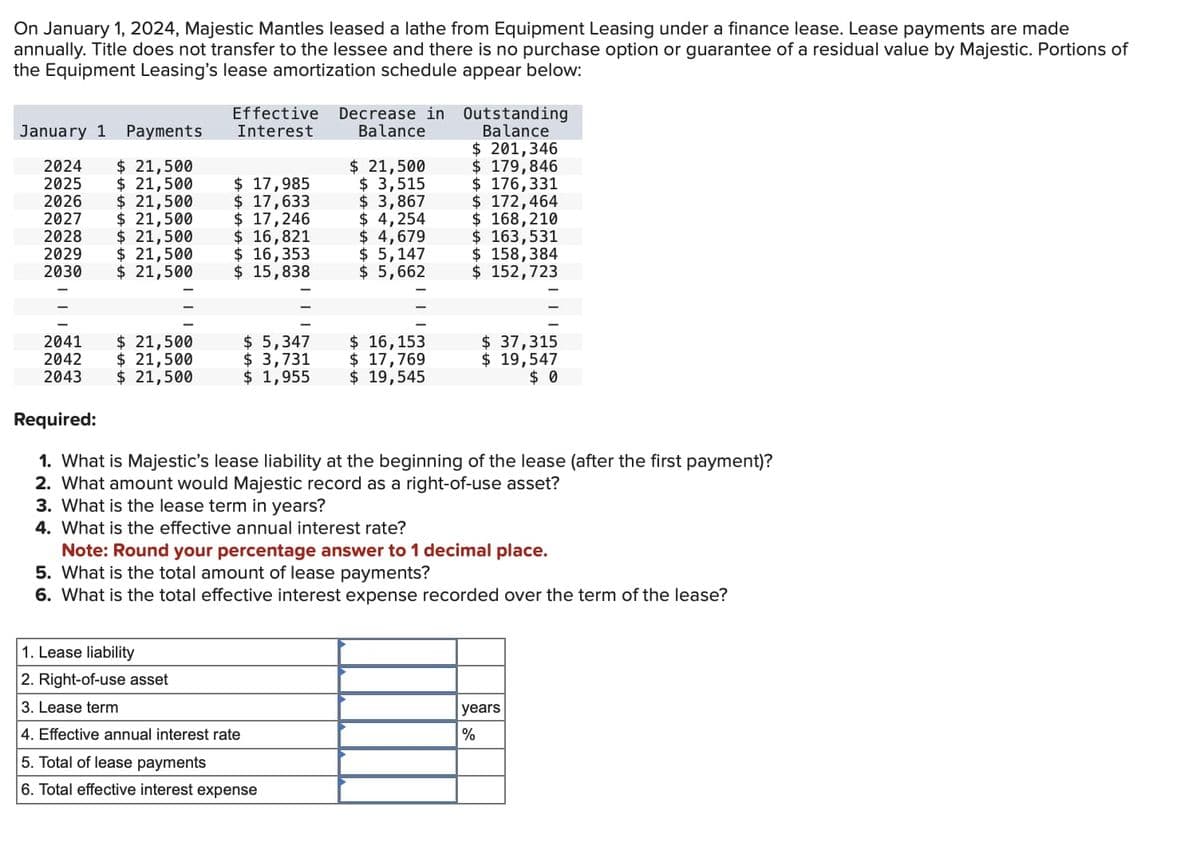

On January 1, 2024, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing's lease amortization schedule appear below: January 1 2024 2025 Payments $ 21,500 $ 21,500 2026 $ 21,500 2027 $ 21,500 2028 $ 21,500 2029 $ 21,500 2030 $ 21,500 2041 $ 21,500 2042 $ 21,500 2043 $ 21,500 Effective Interest $ 17,985 $ 17,633 $ 17,246 $ 16,821 $ 16,353 $ 15,838 $5,347 $ 3,731 $ 1,955 Decrease in Outstanding Balance Balance 1. Lease liability 2. Right-of-use asset 3. Lease term 4. Effective annual interest rate 5. Total of lease payments 6. Total effective interest expense $ 21,500 $ 3,515 $ 3,867 $ 4,254 $4,679 $ 5,147 $ 5,662 $ 16,153 $ 17,769 $ 19,545 $ 201,346 $ 179,846 $ 176,331 $ 172,464 $ 168,210 $ 163,531 $ 158,384 $152,723 $ 37,315 $ 19,547 $0 Required: 1. What is Majestic's lease liability at the beginning of the lease (after the first payment)? 2. What amount would Majestic record as a right-of-use asset? 3. What is the lease term in years? 4. What is the effective annual interest rate? Note: Round your percentage answer to 1 decimal place. 5. What is the total amount of lease payments? 6. What is the total effective interest expense recorded over the term of the lease? years %

On January 1, 2024, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing's lease amortization schedule appear below: January 1 2024 2025 Payments $ 21,500 $ 21,500 2026 $ 21,500 2027 $ 21,500 2028 $ 21,500 2029 $ 21,500 2030 $ 21,500 2041 $ 21,500 2042 $ 21,500 2043 $ 21,500 Effective Interest $ 17,985 $ 17,633 $ 17,246 $ 16,821 $ 16,353 $ 15,838 $5,347 $ 3,731 $ 1,955 Decrease in Outstanding Balance Balance 1. Lease liability 2. Right-of-use asset 3. Lease term 4. Effective annual interest rate 5. Total of lease payments 6. Total effective interest expense $ 21,500 $ 3,515 $ 3,867 $ 4,254 $4,679 $ 5,147 $ 5,662 $ 16,153 $ 17,769 $ 19,545 $ 201,346 $ 179,846 $ 176,331 $ 172,464 $ 168,210 $ 163,531 $ 158,384 $152,723 $ 37,315 $ 19,547 $0 Required: 1. What is Majestic's lease liability at the beginning of the lease (after the first payment)? 2. What amount would Majestic record as a right-of-use asset? 3. What is the lease term in years? 4. What is the effective annual interest rate? Note: Round your percentage answer to 1 decimal place. 5. What is the total amount of lease payments? 6. What is the total effective interest expense recorded over the term of the lease? years %

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 8RE: Use the following information to decide whether this equipment lease qualifies as an operating,...

Related questions

Question

(J)

Transcribed Image Text:On January 1, 2024, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made

annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of

the Equipment Leasing's lease amortization schedule appear below:

January 1 Payments

2024 $ 21,500

2025 $ 21,500

2026 $ 21,500

2027 $ 21,500

2028 $ 21,500

2029 $ 21,500

2030 $ 21,500

2041 $ 21,500

2042 $ 21,500

2043

$ 21,500

Effective

Interest

$ 17,985

$ 17,633

$ 17,246

$ 16,821

$ 16,353

$ 15,838

$ 5,347

$ 3,731

$ 1,955

Decrease in Outstanding

Balance

Balance

$ 201,346

$ 179,846

$ 176,331

$ 172,464

$ 168,210

$ 163,531

$ 158,384

$152,723

$ 21,500

$ 3,515

$ 3,867

$ 4,254

$ 4,679

$5,147

$5,662

1. Lease liability

2. Right-of-use asset

3. Lease term

4. Effective annual interest rate

5. Total of lease payments

6. Total effective interest expense

$ 16,153

$ 17,769

$ 19,545

$ 37,315

$19,547

$0

Required:

1. What is Majestic's lease liability at the beginning of the lease (after the first payment)?

2. What amount would Majestic record as a right-of-use asset?

3. What is the lease term in years?

4. What is the effective annual interest rate?

Note: Round your percentage answer to 1 decimal place.

5. What is the total amount of lease payments?

6. What is the total effective interest expense recorded over the term of the lease?

years

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning