On January 1, 2024, Males contributes land in a partnership with Phillips. Males purchased the land in 2019 for $100,000. A real estate appraiser now values the land at $425,000. Males wants $425,000 capital in the ne partnership, but Phillips objects. Phillips believes that Males's capital contribution should be measured by the book value of his land. Phillips and Males seek your advice. Read the requirements Requirement 1. Which value of the land is appropriate for measuring Males's capital-book value or current market value? Males's capital contribution of land should be valued at Requirement 2. Give the partnership's journal entry to record Males's contribution in the business. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

On January 1, 2024, Males contributes land in a partnership with Phillips. Males purchased the land in 2019 for $100,000. A real estate appraiser now values the land at $425,000. Males wants $425,000 capital in the ne partnership, but Phillips objects. Phillips believes that Males's capital contribution should be measured by the book value of his land. Phillips and Males seek your advice. Read the requirements Requirement 1. Which value of the land is appropriate for measuring Males's capital-book value or current market value? Males's capital contribution of land should be valued at Requirement 2. Give the partnership's journal entry to record Males's contribution in the business. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 58P

Related questions

Question

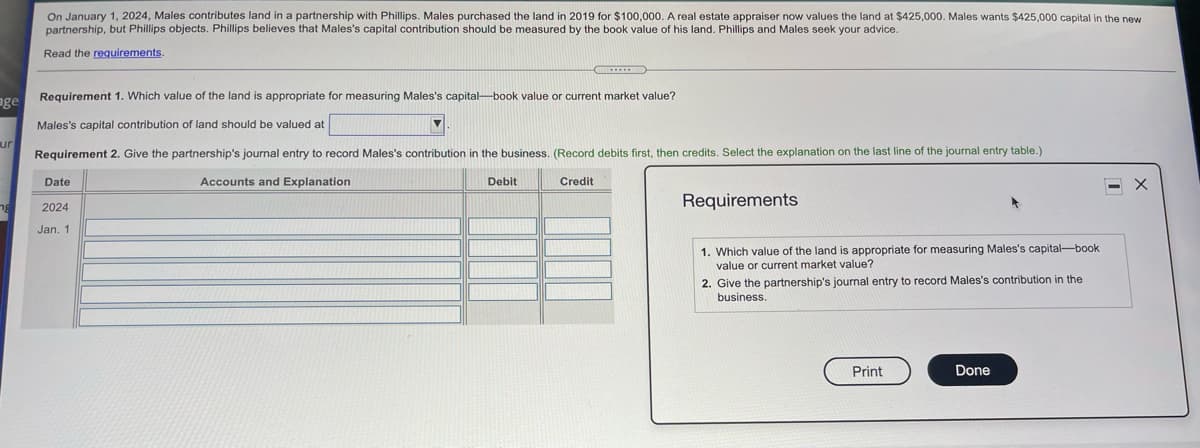

Transcribed Image Text:On January 1, 2024, Males contributes land in a partnership with Phillips. Males purchased the land in 2019 for $100,000. A real estate appraiser now values the land at $425,000. Males wants $425,000 capital in the new

partnership, but Phillips objects. Phillips believes that Males's capital contribution should be measured by the book value of his land. Phillips and Males seek your advice.

Read the requirements.

Requirement 1. Which value of the land is appropriate for measuring Males's capital-book value or current market value?

age

Males's capital contribution of land should be valued at

ur

Requirement 2. Give the partnership's journal entry to record Males's contribution in the business. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

Requirements

2024

Jan. 1

1. Which value of the land

value or current market value?

appropriate for measuring Males's capital-book

2. Give the partnership's journal entry to record Males's contribution in the

business.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you