On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract balance is payable in four (4) equal annual installments starting December 31, 20X1. The ap discount rate is 10%. The contract also requires Marc Company to transfer equipment to the customer. The equipment has P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P3 Marc Company regularly sells the license and the equipment separately. The equipment is transferred customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1. REQUIRED:

On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract balance is payable in four (4) equal annual installments starting December 31, 20X1. The ap discount rate is 10%. The contract also requires Marc Company to transfer equipment to the customer. The equipment has P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P3 Marc Company regularly sells the license and the equipment separately. The equipment is transferred customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1. REQUIRED:

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 18PC

Related questions

Question

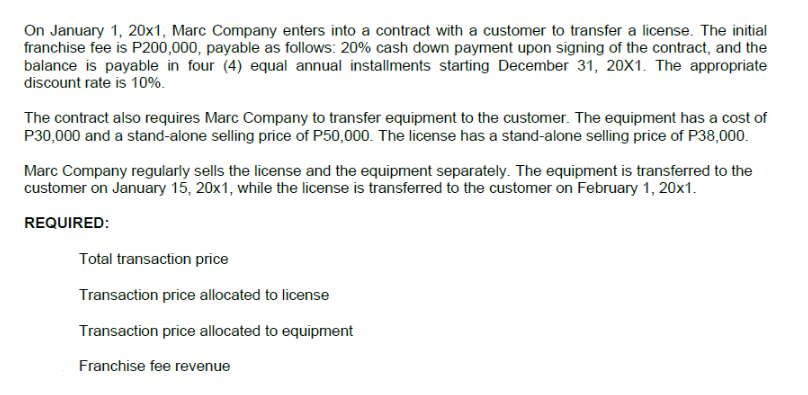

Transcribed Image Text:On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. The initial

franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract, and the

balance is payable in four (4) equal annual installments starting December 31, 20X1. The appropriate

discount rate is 10%.

The contract also requires Marc Company to transfer equipment to the customer. The equipment has a cost of

P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P38,000.

Marc Company regularly sells the license and the equipment separately. The equipment is transferred to the

customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1.

REQUIRED:

Total transaction price

Transaction price allocated to license

Transaction price allocated to equipment

Franchise fee revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT