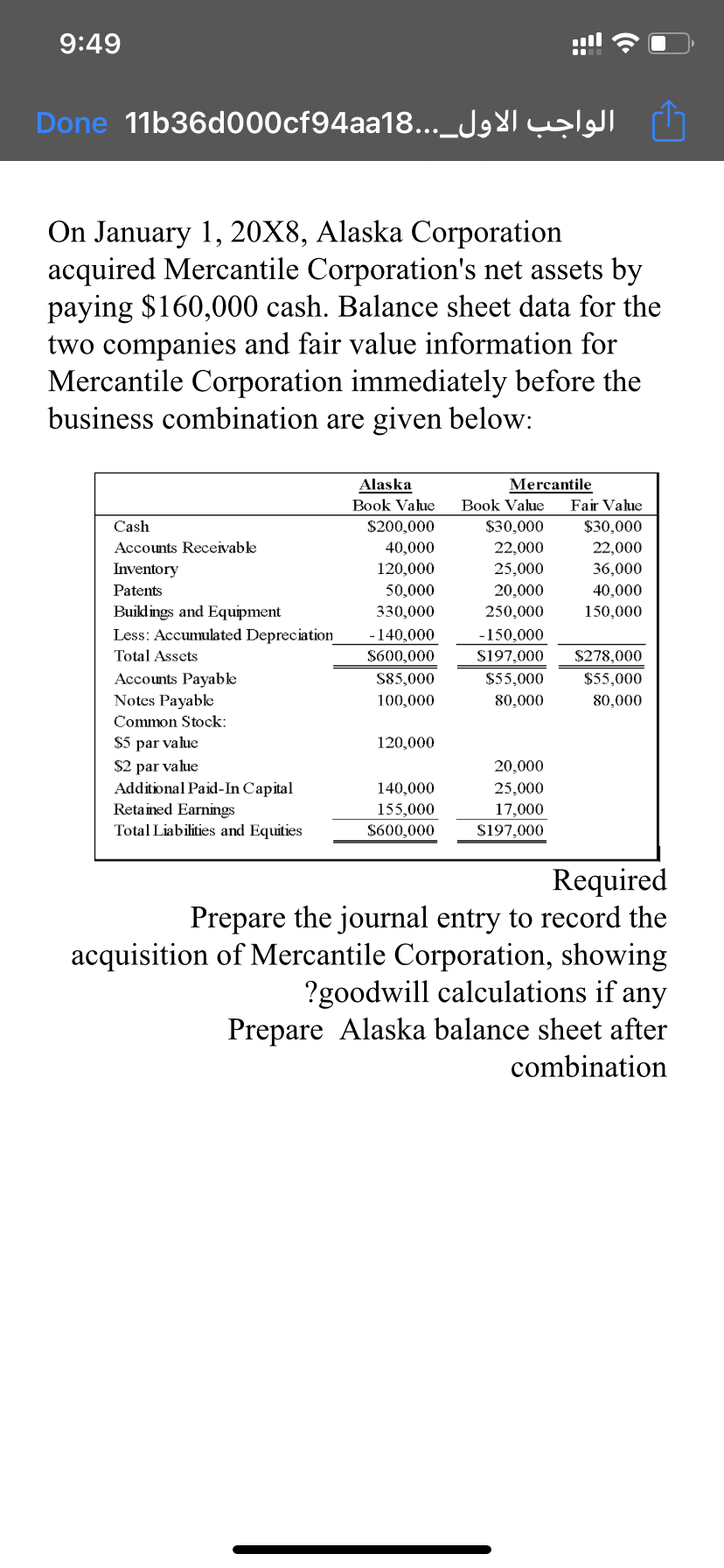

On January 1, 20X8, Alaska Corporation acquired Mercantile Corporation's net assets by paying $160,000 cash. Balance sheet data for the two companies and fair value information for Mercantile Corporation immediately before the business combination are given below: Alaska Book Value Mercantile Book Value Fair Value Cash $200,000 $30,000 22,000 25,000 20,000 $30,000 Accounts Receivable 40,000 22,000 36,000 Inventory 120,000 Patents 50,000 40,000 Buiklings and Equipment Less: Accumulated Depreciation_ Total Assets 330,000 250,000 150,000 -140,000 -150,000 $600,000 S197,000 $278,000 Accounts Payable Notes Payable S85,000 $55,000 $55,000 100,000 80,000 80,000 Common Stock: $5 par value $2 par value Additional Paid-In Capital Retained Earnings Total Liabilities and Equities 120,000 20,000 140,000 155,000 $600,000 25,000 17,000 S197,000 Required Prepare the journal entry to record the acquisition of Mercantile Corporation, showing ?goodwill calculations if any Prepare Alaska balance sheet after combination

On January 1, 20X8, Alaska Corporation acquired Mercantile Corporation's net assets by paying $160,000 cash. Balance sheet data for the two companies and fair value information for Mercantile Corporation immediately before the business combination are given below: Alaska Book Value Mercantile Book Value Fair Value Cash $200,000 $30,000 22,000 25,000 20,000 $30,000 Accounts Receivable 40,000 22,000 36,000 Inventory 120,000 Patents 50,000 40,000 Buiklings and Equipment Less: Accumulated Depreciation_ Total Assets 330,000 250,000 150,000 -140,000 -150,000 $600,000 S197,000 $278,000 Accounts Payable Notes Payable S85,000 $55,000 $55,000 100,000 80,000 80,000 Common Stock: $5 par value $2 par value Additional Paid-In Capital Retained Earnings Total Liabilities and Equities 120,000 20,000 140,000 155,000 $600,000 25,000 17,000 S197,000 Required Prepare the journal entry to record the acquisition of Mercantile Corporation, showing ?goodwill calculations if any Prepare Alaska balance sheet after combination

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.13P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:9:49

Done 11b36d000cf94aa18..._J

On January 1, 20X8, Alaska Corporation

acquired Mercantile Corporation's net assets by

paying $160,000 cash. Balance sheet data for the

two companies and fair value information for

Mercantile Corporation immediately before the

business combination are given below:

Alaska

Mercantile

Book Value

Book Value

Fair Value

Cash

$200,000

$30,000

$30,000

Accounts Receivable

40,000

22,000

22,000

Inventory

120,000

25,000

36,000

Patents

50,000

20,000

40,000

Buildings and Equipment

330,000

250,000

150,000

Less: Accumulated Depreciation

-140,000

-150,000

Total Assets

$600,000

$197,000

$278,000

Accounts Payable

Notes Payable

S85,000

$55,000

$55,000

100,000

80,000

80,000

Common Stock:

$5 par value

$2 par value

Additional Paid-In Capital

Retained Earnings

Total Liabilities and Equities

120,000

20,000

140,000

25,000

155,000

$600,000

17,000

S197,000

Required

Prepare the journal entry to record the

acquisition of Mercantile Corporation, showing

?goodwill calculations if any

Prepare Alaska balance sheet after

combination

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning