On January 1, Mitzu Company pays a lump-sum amount of $2,6C Improvements 1. Building 1 has no value and will be demolished.

On January 1, Mitzu Company pays a lump-sum amount of $2,6C Improvements 1. Building 1 has no value and will be demolished.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.6E

Related questions

Question

![Required information

Problem 8-3A (Static) Asset cost allocation; straight-llne depreclation LO C1, P1

[The following information applies to the questions displayed below.]

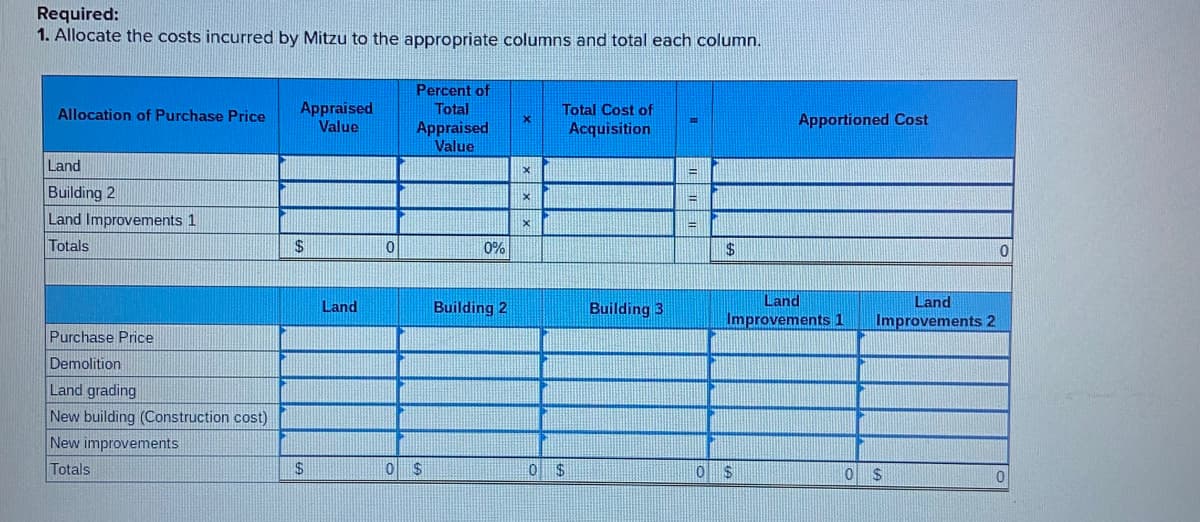

On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land

Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000,

with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to

last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following

additional costs.

Cost to demolish Building 1

Cost of additional land grading

Cost to construct Building 3, having a useful life of 25 years and a $392, 000 salvage value

Cost of neW Land Improvements 2, having a 20-year useful life and no salvage value

$ 328, 400

175, 400

2, 202, 000

164, 000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F97b5df25-1667-438a-b46e-c2a0d1ae7c86%2F0eaddae7-b8b6-4ef0-8c08-d4ec9775824b%2Fa43109e_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

Problem 8-3A (Static) Asset cost allocation; straight-llne depreclation LO C1, P1

[The following information applies to the questions displayed below.]

On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land

Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000,

with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to

last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following

additional costs.

Cost to demolish Building 1

Cost of additional land grading

Cost to construct Building 3, having a useful life of 25 years and a $392, 000 salvage value

Cost of neW Land Improvements 2, having a 20-year useful life and no salvage value

$ 328, 400

175, 400

2, 202, 000

164, 000

Transcribed Image Text:Required:

1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column.

Percent of

Appraised

Value

Total

Appraised

Value

Total Cost of

Allocation of Purchase Price

Apportioned Cost

Acquisition

Land

%3!

Building 2

Land Improvements 1

%3D

Totals

24

0%

$24

10

Land

Land

Land

Building 2

Building 3

Improvements 1

Improvements 2

Purchase Price

Demolition

Land grading

New building (Construction cost)

New improvements

Totals

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,