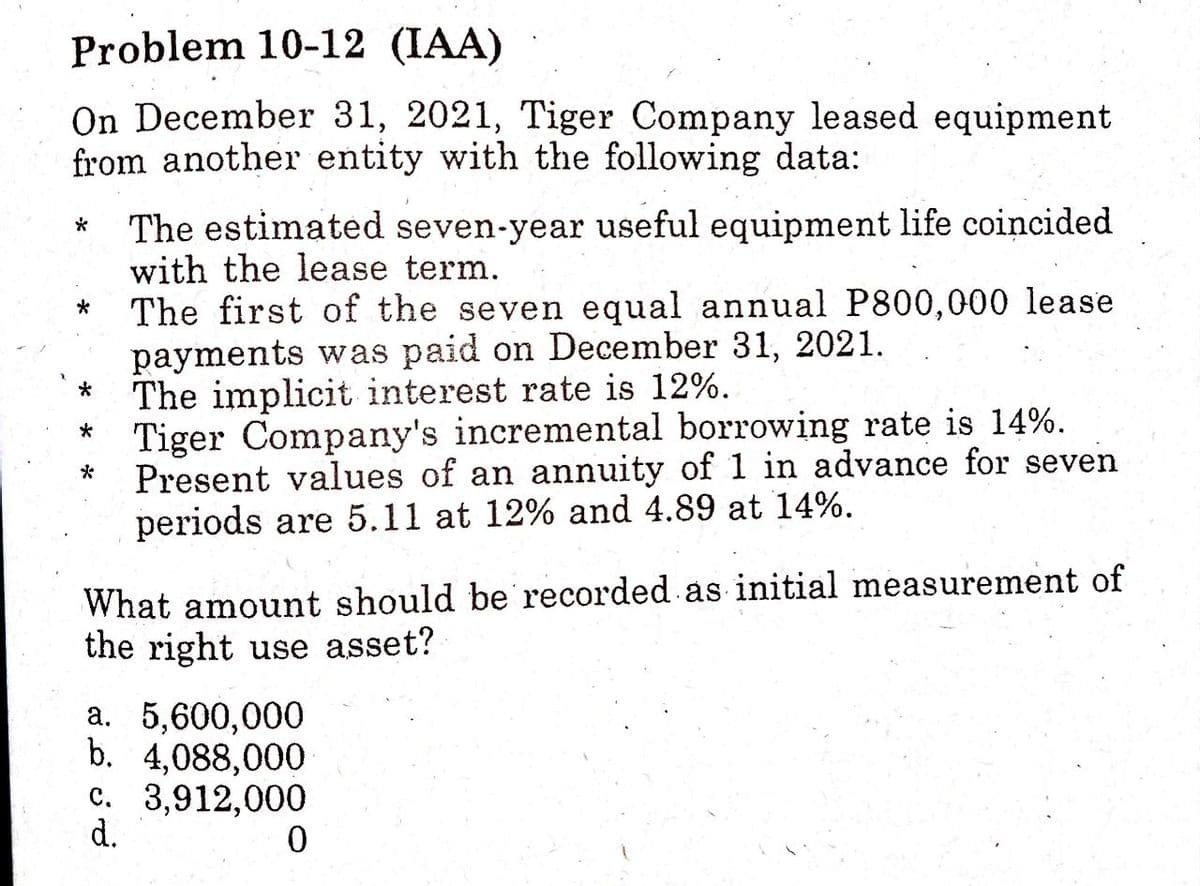

seven-year useful equipment life term. he seven equal annual P800, paid on December 31, 2021. terest rate is 12%. 's incremental borrowing rate

Q: Explain four (4) strategy used in management accounting for achieve business goals

A: Management accounting is the process of preparing reports on business operations to assist managers ...

Q: True or False. 2. A corporation can be formed by another corporat...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Measures of liquidity, Salvency, and Profitability The comparative financial statements of Marshal I...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: Bonita Limited is a merchant operating in the province of Ontario, where the HST is 13%. Bonita uses...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Q: 14. Which of the following statements disqualify someone from using Form 1040EZ to file a tax return...

A: To use the form, a taxpayer had to have taxable income of less than $100,000, less than $1,500 of in...

Q: A depreciation schedule for semitrucks owned by Ichiro Manufacturing was requested by your auditor s...

A: Balance of Trucks account, Jan. 1, 2020Truck No. 1 purchased Jan. 1, 2017, cost .......................

Q: A Sales cut-off procedure for the audit of the financial statements of Carrie Corp. resulted to the ...

A:

Q: Sunland Company has assets of $4398000, common stock of $1068000, and retained earnings of $645000. ...

A: Formula: Accounting equation: Assets = Liabilities + Owners equity

Q: Company X produces radio equipment. The company is considering the use of high- quality materials to...

A: Operating income is an accounting measure that indicates the amount of profit made by a company's op...

Q: Ass 002 Net Income, Shares Issued Accounts Receivable $4,000 $ 2,500 1,000 Miscellaneous Expense Acc...

A: Financial statements are the summaries that are prepared at the year-end to show the performance of ...

Q: Which of the following is NOT an advantage of using sensitivity analysis?

A: Which of the following is NOT an advantage of using sensitivity analysis? A It identifies the imp...

Q: Consider the PivotTable on the Max Salary worksheet. What is the maximum salary for Regional Manager...

A: A Pivot table is a tool to summarize huge worksheets and obtain facts & figures useful for the p...

Q: Assuming a December 31 fiscal year-end, prepare a depreciation schedule for the life of the asset us...

A: Depreciation is the expenses which falls under the non-cash expenses because there is no cash outflo...

Q: Risk Insurance Inc. has a board of eight directors. Risk’s bylaws do not state any quorum requiremen...

A: Solution For the board of directors, a quorum ia the Majority of members of the board. When Quorum i...

Q: P1. Let’s assume there are only 2 countries that produce 2 good. More specifically, suppose that t...

A: We have the following information given in the question The United States (US) and the United Kingd...

Q: a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decreas...

A:

Q: he following selected accounts and their current balances appear in the ledger of wymar Company are ...

A: A financial statement is a statement showing the financial position of the company. It includes vari...

Q: The Pension Trust Fund maintained by the city of Marydell had the following transactions and events ...

A: Pension plan- Employees are supplied with a pension plan, which is a retirement benefit and income p...

Q: he companative financal satements of Mara Inc. ane a follows. The markt prie of Marshal comman stock...

A: Financial Ratios- A financial ratio or accounting ratio is a relative scale of two selected mathemat...

Q: The following information relates to the defined benefit pension plan of ABC Company for the year en...

A: RECONCILITION OF PLAN ASSETS AND DEFINED BENEFIR OBLIGATION (DBO) (AMT IN Php) PARTICULARS...

Q: Provide an Market Performance Ratio analysis based on P/E, ROE and D/E.

A: P/E ratio = Share Price/Earnings per share ROE = Net Income/Average shareholder's equity D/E ratio =...

Q: The integration of corporate sodial responsibility (CSR) into business practice is a form of selfreg...

A: Corporate Social Responsibility: Corporations' social responsibility (CSR) is a self-regulatory busi...

Q: A Co. and B Co. are joint venturers of C.Co, a producer of high tech machinery. A and B, each have 5...

A: Joint ventures is a form of agreement or arrangement between two or more than two persons, in which ...

Q: Working/Application of ABC analysis?

A: Solution Activity based coating (ABC) is a method of assigning overhead and indirect cost -Such as s...

Q: Journalize for Harper and Co. each of the following transactions or state no entry required andexpla...

A: Journal entries recording is the first step of accounting cycle process, under which atleast one acc...

Q: 4...new..C Bonita Leasing Company agrees to lease equipment to Windsor Corporation on January 1, 20...

A: Lease Accounting It is important in the lease accounting which determine the present value of the le...

Q: During 2019, Bradley Corporation issued for $110 per share, 5,000 shares of $100 par value convertib...

A: There are two type of stock or shares that is being issued by the company. One is preference shares ...

Q: What amount should Citi record as dëpr the year ended December 31, 2013 using double-declining balan...

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage , ...

Q: During the month of February, Bridgeport Corp's employees earned wages of $79,920. Withholdings rela...

A: Given that total employees earned wages is $ 79920 Salaries and wages payable = Total employee earne...

Q: Soriano Corp.’s accounts receivable subsidiary ledger shows the following information: Customer Ac...

A: In the given question, the company’s accounts receivable from different customers is presented. The ...

Q: Which of the following is not included when computing Net Purchases?A. purchase discountsB. beginnin...

A: Purchases is the value of cost of goods that is being purchased or acquired from the suppliers eithe...

Q: At the beginning of the current year, David and Garrett formed the DG Partnership by transferring ca...

A: No gain or loss is recognized by either the partner of the partnership when a property is contribute...

Q: ABC Company reported pretax financial income of P 6,500,000 and P 8,200,000 for years 2019 and 2020,...

A: Deferred tax laibility is the amount of tax a company owes to the ...

Q: Jax Incorporated reports the following data for its only product. The company had no beginning finis...

A:

Q: Required information [The following information applies to the questions displayed below.] Raphael C...

A: Calculation of book value per preferred share and and common share are as follows

Q: The total assets of the Company are $81000 and its owner's equity is $61000. What is the amount of i...

A: Formula: Accounting equation: Assets = Liabilities + Owners equity

Q: Cramer Company sold 5-year, 8% bonds on October 1, 2011. The face amount of the bonds was $100,000, ...

A: Interest expense = Interest accrued - Amortization of premium where, Accrued interest = Face value o...

Q: January 25 Received $1150 cash for laundry services provided in January 2022. JOUonal eny xy

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: The official receipt reports a higher amount of cash collected while the corresponding sales invoice...

A: Solution A lapping scheme is a fraudulent practice that involves altering accounts receivables to hi...

Q: C Corp purchased 80% of the stock of D Corp. for 232,000. At the date of acquisition the consolidate...

A: Formula: Purchase value = Total Net assets of D corp x Percentage acquired

Q: ..new D Bonita Leasing Company agrees to lease equipment to Windsor Corporation on January 1, 2020....

A: Calculation of Annual Rental = {(Fair value) - (residual value x PV of $1 10% for 7 years)} / PV of ...

Q: b) State the journal entries necessary to record the following transactions in the general journal. ...

A: In this question we State the journal entries necessary to record the following transactions in the...

Q: ASSETS 2010 2009 LIABILITIES AND EQUITY 2010 2009 Cash and equivalents S 10 S 15 $60 $ 30 Accounts p...

A: Cash flow per share shows the cash generated by the company through its operating activities as a pe...

Q: In 2018, the nominal interest rate on bonds was 5 percent a year and the real interest rate was 2 pe...

A: In the given question we have the following details: 20181. The nominal interest rate on bonds - 5 ...

Q: Percent of capacity 90% 100% 110% Direct labor hours 3,600 4,000 4,400 Units of output 900 1,000 1,1...

A: Preparation of flexible budget are as follows

Q: Required A. Use the high-low method to estimate • The variable costs per unit produced . ...

A: High low method is a method of cost estimation under which fixed costs and variable costs are estima...

Q: On December 31, 2020, Sack Port Ventures Inc. borrowed $103,000 by signing a four-year, 8.0% install...

A: In the given question, the accrued interest and principal is required to be paid at the end of each ...

Q: ABC Co. sells equipment service contracts that cover a two-year period. The sales price of each cont...

A: Introduction:- Calculation of total sales value as follows:- Total sales value = No. of contracts so...

Q: 25. How much should be the underlying equity of Honda in the net assets of Hyundai?

A: Equity is the amount of money which represents to the shareholders and in the business acquisition t...

Q: Below is the trial balance of Summit Ltd. at December 31, 2021 Summit Ltd. Trial Balance December 31...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Step by step

Solved in 2 steps

- FISH CHIPS INC, PART I LEASE ANALYSIS Martha Millon, financial manager for Fish it Chips Inc., has been asked to perform a lease-versus-buy analysis on a new computer system. The Computer costs 1,200,000, and if it is purchased. Fish Chips could obtain a term loan for the full amount at a 10% cost. The loan would be amortized over the 4-year life of the computer, with payments made at the end of each year The computer is classified as special purpose; hence, it falls into the MACRS 3-year class. The applicable MACRS rates are 33%. 45%. 15%, and 7%. If the computer is purchased, a maintenance contract must be obtained at a cost of 25,000, payable at the beginning of each year. After 4 years, the computer will be sold. Millons best estimate of its residual value at that time is 125,000. Because technology is changing rapidly however, the residual value is uncertain. As an alternative. National Leasing is willing to write a 4-year lease on the computer, including maintenance, for payments of 340,000 at the beginning of each year. Fish 4c Chipss marginal federal-plus-state tax rate is 40%. Help Millon conduct her analysis by answering the following questions. a. 1. Why is leasing sometimes referred to as "off-balance-sheet" financing? 2. What is the difference between a capital lease and an operating lease? 3. What effect does leasing have on a firms capital structure? b. 1. What is Fish Chips's present value cost of owning the computer? (Hint: Set up a table whose bottom line is a time line" that shows the cash flows over the period t = 0 to t = 4. Then find the PV of these cash flows, or the PV cost of owning.) 2. Explain the rationale for the discount rate you used to find the PV. c. 1. What is Fish Chipss present value cost of leasing the computer? (Hint: Again, construct a time line.) 2. What is the net advantage to leasing? Does your analysis indicate that the firm should buy or lease the computer? Explain. d. Now assume that Millon believes that the computers residual value could be as low as 0 or as high as 250,000, but she stands by 125,000 as her expected value. She concludes that the residual value is riskier than the other cash flows in the analysis, and she wants to incorporate this differential risk into her analysis. Describe how this can be accomplished. What effect will it have on the lease decision? e. Millon knows that her firm has been considering moving its headquarters to a new location, and she is concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, the company would obtain new computers; hence, Millon would like to include a cancellation clause in the lease contract. What effect would a cancellation clause have on the risk of the lease?EQUIVALENT ANNUAL ANNUITY Corcoran Consulting is deciding which of two computer systems to purchase. It can purchase state-of-the-art equipment (System A) for 20,000, which will generate cash flows of 6,000 at the end of each of the next 6 years. Alternatively, the company can spend 12,000 for equipment that can be used for 3 years and will generate cash flows of 6,000 at the end of each year (System B). If the companys WACC is 10% and both projects can be repeated indefinitely, which system should be chosen, and what is its EAA?Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2016. Required Assume that the lease is treated as an operating lease. Will the value of the forklift appear on Koffmans balance sheet? What account will indicate that lease payments have been made? Assume that the lease is treated as a capital lease. Prepare any journal entries needed when the lease is signed. Explain why the value of the leased asset is not recorded at $6,040 (1,5104). Prepare the journal entry to record the first lease payment on December 31, 2016. Calculate the amount of depreciation expense for the year 2016. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2016?

- Short-Term Debt Expected to Be Refinanced On December 31, 2019, Atwood Table Company has 8 million of short-term notes payable owed to City National Bank. On February 1, 2020, Atwood negotiates a revolving credit agreement providing for unrestricted borrowings up to 6 million. Borrowings will bear interest at 1% over the prevailing prime rate, will have stated maturities of 120 days, and will be continuously renewable for 120-day periods for 4 years. Atwood plans to refinance as much as possible of the notes outstanding with the proceeds available from this agreement. Assume that Atwoods December 31, 2019, year-end financial statements are issued on March 30, 2020. Required: Prepare a partial December 31, 2019, balance sheet for Atwood showing how the 8 million short-term debt should be reported. Next Level What is the justification for allowing short-term debt that is expected to be refinanced to be classified as a long-term liability.Exercise Issuance and Interest Amortization for Zero Coupon Note (Straight Line) Kerwin Company borrowed $10,000 on a 2-year, zero coupon note. The note was issued on January 1, 2020. The face amount of the note, $12,544, is to be paid at maturity on December 31, 2021. Required: Assuming straight line amortization, calculate the interest expense for 2020 and 2021. Prepare the entries to recognize the borrowing, the first years interest expense, and the second years interest expense plus redemption of the note at maturity.Problem 10- 10 Troy Company prepared the following amortization schedule for the lease of a machine from another entity. The machine has an economic life of six years. The lease agreement requires four annual payments of P330,000, including executory costs of P30,000, and the machine will be retured to the lessor at the end of the lease term. Minimum lease Interest Reduction Balance of payment Expense Liability Liablity 1/1/2020 985,150 12/31/2020 300,000 98,515 201,485 783,665 12/31/2021 300,000 78,366 221,634 562,031 12/31/2022…

- Problem 10-5 On January 1, 2020, Lessee Company entered into a lease with Lessor Company for a new equipment. The lease stipulates that annual payments of P1,000,000 will be made for five years startingbDecember 31,2020. Lessee Company guaranteed a residual value of P474,060 at the end of the 5 year period. Th equipment will revert to the lessor at the lease expiration. The omplicit interest rate for the lease is 16% after considering the guaranteed residual value. The economic life of the equipment is 10 years. The present value factors at 16% for five periods are: Present value of 1 0.4761 Present value of an ordinary annuity of 1 3.2743 Required: Prepare a schedule of the annual payments showing reduction of liablity every year. Prepare a journal entries on the bools of Leese Company for 2020 and 2021. Prepare a journal entry on December 31,2024, end of lease term, to record the return…Problem 10-8 Dexter Company has maintained a policy of acquiring equipment by leasing. On January 1, 2020, Dexter Company entered into a lease agreement for an equipment. The lease stipulates an annual rental payment of P600,000 to be paid every December 31 starting Decemeber 31, 2020. The lease contains neither a transfer of tittle to the lessee nor a purchase option. The equipment has a residual value of P300,000 at the end of the 5 year lease period but us unguaranteed by the lessee. Th economic life of the equipment is 8 years. The implicit interest rate is 12% after considerimg the unguaranteed residual value. The present value of an ordinary annuity of 1 at 12% for 5 period is 3.60. Required: Prepare journal entries on the books of Dexter Company for 2020. Prepare journal entry on December 31,2024 to record the return of the equipment to the lessor as required by the contract. The fair value of the equipment is P200,000.Problem 11-2 On January 1, 2020, Gold Company entered into a 5-year lease of a floor of a building with the following terms: Annual rental for the first two years payable at thend of each year 200,000 Annual rental the next three years payable at the end of each year 300,000 Initial direct cost paid by lease 100,000 Leasehold improvement 250,000 Present value of restoration cost required by contract 50,000 Useful life of building 20 years Implicit interest rate 8% Discount rate for the restoration cost 5% PV of an ordinary annuity of 1 at 8% for two periods 1.783 PV of an ordinary annuity of 1 at 8% for three periods 2.577 PV of 1 at 8% for two periods 0.857 Required: 1.…

- Problem 11-2 On January 1,2020, Gold Company entered into a 5-year lease of a floor of a building with the following terms: Annual rental for the first two years payable at the end of each year 200,000 Annual rental for the next three years payable at the end of each year 300,000 Initial diect cost paid by lessee 100,000 Leasehold improvement 250,000 Present value of restoration cost required by contract 50,000 Useful life of building 20 years Implicit interest rate 8% Discount rate for the restoration cost…Problem 10-27 (AICPA Adapted)On December 31, 2020, Ames Company leased equipment for 10 years. Theentity contracted to pay P 400, 000 annual rent on December 31, 2020 andon December 31 of each of the next time years.The lease liability was recorded at P 2, 700, 000 on December 31, 2020before the first payment.The equipment’s useful life is 12 years and the interest rate implicit in thelease is 10%.The entity used the straight line method to depreciate all equipment.1. In recording the December 31, 2021 payment by what amount shouldthe lease liability be reduced?a. 270, 000b. 230, 000c. 225, 000d. 170, 0002. What is the interest expense for 2021?a. 270, 000b. 230, 000c. 200, 000d. 03. What is the lease liability on December 31, 2021?a. 2, 700, 000b. 2, 300, 000c. 2, 130, 000Problem 21-02 b-f On January 1, 2020, Bridgeport Company contracts to lease equipment for 5 years, agreeing to make a payment of $145,088 at the beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $605,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Bridgeport’s incremental borrowing rate is 6%, and the implicit rate in the lease is 10%, which is known by Bridgeport. Title to the equipment transfers to Bridgeport at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Prepare the journal entries that Bridgeport should record on January 1, 2020 Date Account Titles and Explanation Debit Credit January 1, 2020 enter an account title To record the lease enter a debit amount enter a credit amount enter an account title To record the lease…