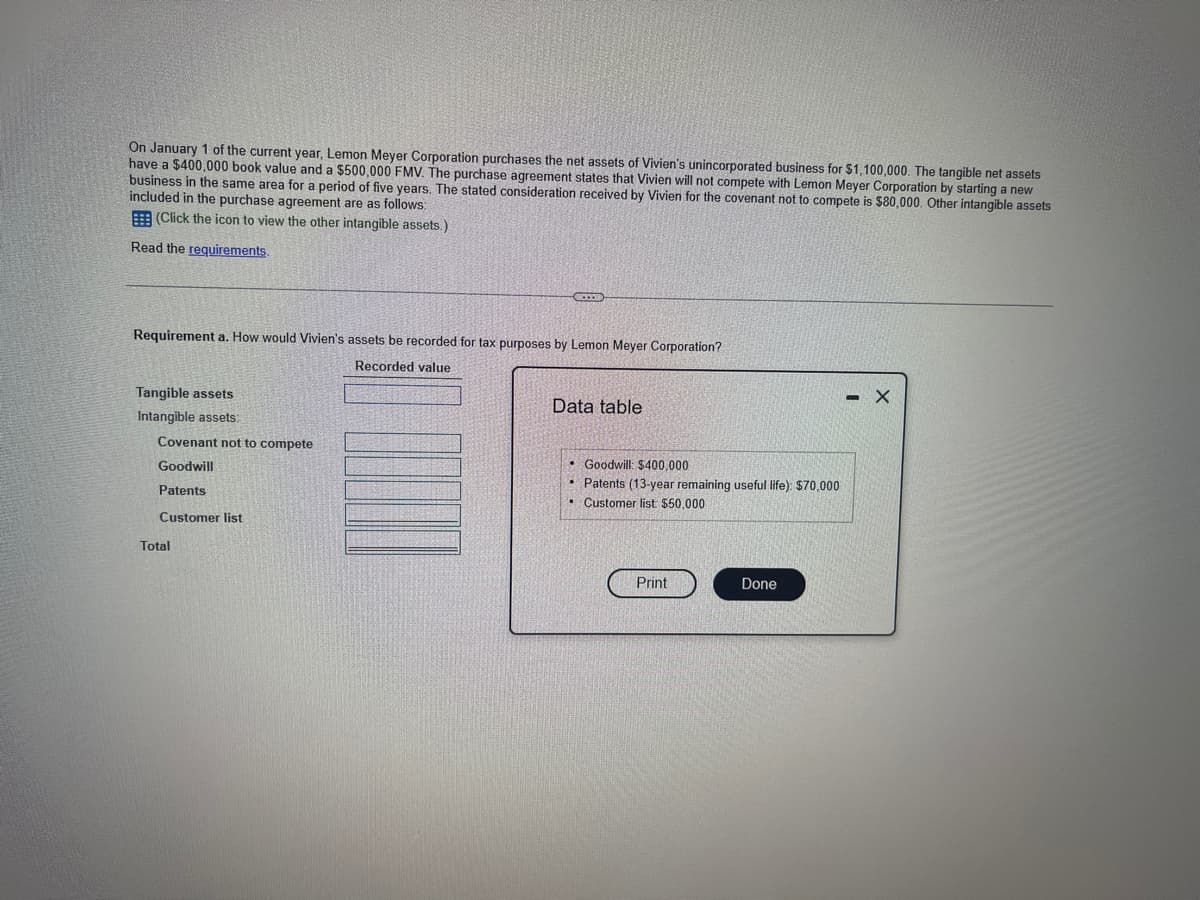

On January 1 of the current year, Lemon Meyer Corporation purchases the net assets of Vivien's unincorporated business for $1,100,000. The tangible net assets have a $400,000 book value and a $500,000 FMV. The purchase agreement states that Vivien will not compete with Lemon Meyer Corporation by starting a new business in the same area for a period of five years. The stated consideration received by Vivien for the covenant not to compete is $80,000. Other intangible assets included in the purchase agreement are as follows. E (Click the icon to view the other intangible assets.) Read the requirements Requirement a. How would Vivien's assets be recorded for tax purposes by Lemon Meyer Corporation? Recorded value Tangible assets - X Data table Intangible assets: Covenant not to compete • Goodwill: $400,000 • Patents (13-year remaining useful life): $70,000 • Customer list $50,000 Goodwill Patents Customer list Total Print Done

On January 1 of the current year, Lemon Meyer Corporation purchases the net assets of Vivien's unincorporated business for $1,100,000. The tangible net assets have a $400,000 book value and a $500,000 FMV. The purchase agreement states that Vivien will not compete with Lemon Meyer Corporation by starting a new business in the same area for a period of five years. The stated consideration received by Vivien for the covenant not to compete is $80,000. Other intangible assets included in the purchase agreement are as follows. E (Click the icon to view the other intangible assets.) Read the requirements Requirement a. How would Vivien's assets be recorded for tax purposes by Lemon Meyer Corporation? Recorded value Tangible assets - X Data table Intangible assets: Covenant not to compete • Goodwill: $400,000 • Patents (13-year remaining useful life): $70,000 • Customer list $50,000 Goodwill Patents Customer list Total Print Done

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:On January 1 of the current year, Lemon Meyer Corporation purchases the net assets of Vivien's unincorporated business for $1,100,000. The tangible net assets

have a $400,000 book value and a $500,000 FMV. The purchase agreement states that Vivien will not compete with Lemon Meyer Corporation by starting a new

business in the same area for a period of five years. The stated consideration received by Vivien for the covenant not to compete is $80,000. Other intangible assets

included in the purchase agreement are as follows:

E (Click the icon to view the other intangible assets.)

Read the requirements

Requirement a. How would Vivien's assets be recorded for tax purposes by Lemon Meyer Corporation?

Recorded value

Tangible assets

Data table

Intangible assets:

Covenant not to compete

• Goodwill: $400,000

• Patents (13-year remaining useful life): $70,000

• Customer list $50,000

Goodwill

Patents

Customer list

Total

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning