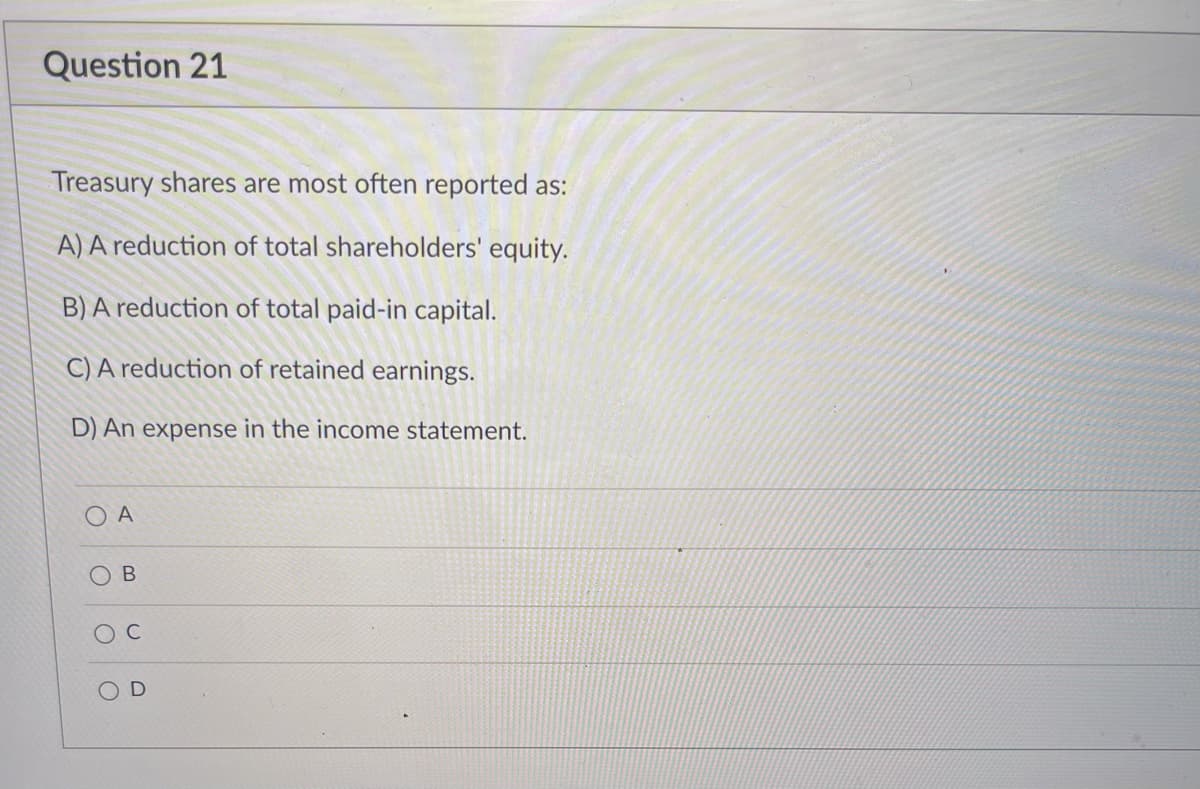

Treasury shares are most often reported as: A) A reduction of total shareholders' equity. B) A reduction of total paid-in capital. C) A reduction of retained earnings. D) An expense in the income statement. O A O B O C OD

Q: QS 9-14 (Algo) Components of performance measures LO A1, A2 Fill in the blanks in the schedule below…

A: profit margin ratio is a ratio that is calculated by taking net income on numerator and dividing it…

Q: On January 1st, XYZ Co. prepays $1,500 for one year of prepaid insurance. What is the amount of…

A: Formula: Monthly insurance expense = Prepaid insurance amount / 12Months

Q: Sales P 250,000 190,000 P 60,000 82,000 (P 22,000) Cost of sales Gross profit Expenses Net income P…

A: product elimination in such a decision that is taken in order to drop a product from portfolia…

Q: P-4***On July 1,2011, SUNSHINE Company issued P2,000,000, 10% bonds, which mature in five years. The…

A: Please see Step 2 for required information.

Q: Which of the following does describe intangible assets? a. They are not lack physical existence.…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: of 6% convertible bonds outs es of common stock. During per share on the preferred s ck. The net…

A: Diluted EPS is a calculation used to gauge the quality of a company's earnings per share (EPS) if…

Q: A factory company has compiled the following data for the last six months of 2009 to analyze utility…

A: The utility cost refers to the cost or the expense which is consumed in the reporting period or year…

Q: PRACTICE WHAT YOU KNUW Using the 2019 marginal tax rates provided in the tabe below, fnd the…

A: Federal tax is calculated as per the schedule given by IRS. Average rate of tax means the effective…

Q: Your Company’s materials quantity variance was $24,000 favorable. The standard cost per pound is…

A: Lets understand the basics. Material quantity variance indicates the difference between the actual…

Q: On January 1, 20--, Dover Company’s retained earnings accounts had the following balances:…

A: S.No Account Titles Debit Credit 5-Apr Cash Dividend Dr. ($0.30*5000 + $0.40*30000)…

Q: 1. During 2021, Thor Company was sued by a competitor for P5,000,000 for infringement of a…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: car was purchase le value of $9,3OC

A: Answer: Annual depreciation expense=$ 900 Cost of the car- $ 14900 Resale value-$9,300 Useful life-…

Q: Fully discuss in detail the characteristics that distinguish entrepreneurs from ordinary business…

A: Entrepreneur An entrepreneur is a person who helps in combining the various factors of production…

Q: Atlas Furniture Company manufactures designer home furniture. Atlas uses a standard cost system. The…

A: The practice of replacing an anticipated cost for an actual cost in accounting records is known as…

Q: Of the amount paid for the investment, how much is attributable to goodwill? How much is the…

A: Acquisition costs are the sum of the costs incurred by the business in acquiring a new client or…

Q: Wooden Grain Co. has organized a new division to manufacture and sell specially designed tables for…

A: In this question, there are 3 requirements: Unit inventorial costs under absorption costing and…

Q: A company had net income of $282,000. Depreciation expense is $26,000. During the year, accounts…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flows statements.…

Q: The equity of the corpor be $200,000. John forg rnoration

A: It refers to the individuals that provide liquidity to the company and in return, the company offers…

Q: Asset turnover Three major segments of the transportation industry are motor carriers such as…

A: The asset turnover ratio compares the value of a business's assets to its sales or revenues. The…

Q: Basic Variance Analysis, Revision of Standards, Journal Entries Petrillo Company produces engine…

A: GIVEN Petrillo Company produces engine parts for large motors. The company uses a standard cost…

Q: 26. Per the Fraud Examiners Manual, which of the following is NOT true about pass-through shell…

A: A sales representative at a real supplier sets up a shell company and convinces the budget owner or…

Q: Requirement: Calculate the investment centers': 1) Sales Margin 2) Capital Turnover 3) Return on…

A: Answer:

Q: If an auditor tours a production facility, which of the misstatements of questionable practices is…

A: In the Production Facility, the auditor would most likely detect that necessary facility maintenance…

Q: Vertical Analysis of Balance Sheet Balance sheet data for Kwan Company on December 31, the end of…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: BE5-3 Prepare the journal entries to record the following transactions on Graff Com- pany's books…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: hich of the following does describe intangible assets? They are not lack physical existence. They…

A: There are of of two types of asset 1) Tangible asset 2) Intangible asset It can be both short term…

Q: only ₱200,000 in this account. The bank account earns interest at an annual rate of 2%. Based on a…

A: The effective interest rate (EIR), the effective interest rate, the average annual rate (AER) or the…

Q: Selected accounts from the SFP of Bonang Corp. at 31 December 20X5 and 20X4 are presented below (in…

A: A statement of cash flows is a financial statement summarizing the movements of cash in and out of…

Q: The plant and machinery at cost account of a business for the year ended 30 June 20X4 was as…

A: The key transactions incurred during the period are: i) On 01.07.X3 the last year closing balance of…

Q: As a loan officer in a bank, you received an application for a real estate loan from a borrower to…

A: Value of the property refers to the market price or cost of the property that will be realized at…

Q: 1. Answer the following questions for the directors: D. True or false, the financing activities…

A: Only one main question is answerable as per bartleby guidelines. a. False, Cash flow from financing…

Q: Compute Duke’s weighted-average number of shares outstanding for 2021.

A: Answer:

Q: Litton Company invested in a two year project which produced a net present value of P 5,760…

A: Project cost = Present value of cash inflows - net present value where, Present value of cash…

Q: ther has given you OMR 130000 to do wh res you 10000 in the second year. You have ike to purchase an…

A: Given Cashflow of year 0 = -130,000 Cashflow of year 1 = -10,000 , 20,000 Cashflow of year 2 =…

Q: Partially completed budget performance reports for Delmar Company, a manufacturer of light duty…

A: The input of resources as well as the production of services for each unit within an organisation…

Q: An individual, who is a real estate dealer, sold a residential lot in Quezon City at a gain of…

A: The question is related to taxation

Q: Answer TRUE or False to the following statements/questions: D) The financing activities section of…

A: Since you have posted question with multiple sub-parts , we will do the first three sub-parts for…

Q: Ridley Corporation is in the process of adjusting and correcting its books at the end of 2020. In…

A: JOURNAL ENTRIES OF RIDELY CORPORATION Date (2021) Particular l/f Debit Credit Retained…

Q: Monique, 61, created a custodial account and transferred $15,000 to the account for the benefit of…

A: Generation-Skipping Tax: The generation-skipping tax (GST), additionally alluded to as the…

Q: Having just inherited a large sum of money, you are trying to determine how much you should save for…

A: Facts in the given question: Inheritance of a large sum of money. Interprete how much you should…

Q: Appendix statement of cash flows using indirect method for the year ending march 31-20y5-omega

A: A cash flow statement is a financial statement that describes all cash inflows received by a company…

Q: Which of the following is a false statement about scrap and by-products? Select one: a. Both scrap…

A: Scrap is the incidental residue from material used in production activities that can be recovered…

Q: Below are the actual overhead and actual activities for the three (3) production departments at…

A: Overheads are operating costs of a business which can not be directly traced to a particular unit of…

Q: Current Position Analysis The following data were taken from the balance sheet of Albertini Company…

A: Working capital, which comprises inventory, cash, accounts payable, accounts receivable, and…

Q: Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue…

A: Statement of Cash Flow - Cash Flow Statement includes movement of cash during the financial year. It…

Q: The Ski department reports sales of $625,000 and cost of goods sold of $437,500. Its expenses…

A: Departmental Income Statement: It is a sort of income statement that displays the contribution…

Q: PA9.) Use the following excerpts from Yardley Company's financial information to prepare a statement…

A: The cash flow statement is part of the financial statements of the company. It is prepared at the…

Q: I. Keep or Drop Dexter Company makes three types of GPS devices: Basic GPS model, Runner's GPS and…

A: The question is related to Keep or drop a product line. In case of continue or drop a product line,…

Q: Ricardo Aninang established business on April 1,2017 and invested P5,000 cash and a building valued…

A: The Financial transactions of the business effects two or more accounts of the business with net…

Q: Which one of the following is a correct statement about the nontax characteristics of a pooled…

A: B)The principal is distributed to the charitable beneficiary at the end of the noncharitable…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Statement of stockholders' equity The stockholders' equity T accounts of I-Cards Inc. for the fiscal year ended December 31, 20Y9, are as follows. Prepare a statement of stockholders' equity for the year ended December 31, 20Y9.Effect of transactions on stockholders equity Indicate whether each of the following types of transactions will either (A) increase stockholders equity or (B) decrease stockholders equity: 1. expenses 2. issuing common stock in exchange for cash 3. dividends 4. revenuesMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1........... 3,704,000 3,264,000 Net income.................... 600,000 550,000 Total....................... 4,304,000 3,814,000 Dividends: On preferred stock.............. 10,000 10,000 On common stock............ 100,000 100,000 Total dividends............... 110,000 110,000 Retained earnings, December 31..... 4,194,000 3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales..................... 10,850,000 10,000,000 Cost of goods sold......... 6,000,000 5,450,000 Gross profit............... 4,850,000 4,550,00 Selling expenses.......... 2,170,000 2,000,000 Administrative expenses... 1,627,500 1.500,000 Total operating expenses .. 3,797,500 3,500,000 Income from operations ... 1,052,500 1,050,000 Other revenue............ 99,500 20,000 1,152,000 1,070,000 Other expense (interest)... 132,000 120,000 Income before income tax . 1,020,000 950,000 Income tax expense....... 420,000 400.000 Net income............... 600,000 550,000 Marshall Inc. Comparative Balance Sheet December 31,20Y2 and 20Y1 20Y2 20Y1 Assets Current assets: Cash.......................................................... 1,050,000 950,000 Marketable securities........................................... 301,000 420,000 Accounts receivable (net)....................................... 585,000 500,000 Inventories.................................................... 420,000 380,000 Prepaid expenses.............................................. 108,000 20,000 Total current assets.......................................... 2,464,000 2,270,000 Long-term investments............................................ 800.000 800,000 Property, plant, and equipment (net)............................... 5,760,000 5,184,000 Total assets....................................................... 9,024,000 8,254,000 Liabilities Current liabilities.................................................. 880,000 800,000 Long-term liabilities: Mortgage note payable, 6%.............. 200,000 0 Bonds payable, 4%............................................. 3,000,000 3,000,000 Total long-term liabilities.................................... 3,200,000 3,000,000 Total liabilities.................................................... 4,080,000 3,800,000 Stockholders' Equity Preferred 4% stock, 5 par......................................... 250,000 250,000 Common stock, 5 par............................................. 500,000 500,000 Retained earnings................................................. 4,194,000 3,704,000 Total stockholders' equity.......................................... 4,944.000 4,454,000 Total liabilities and stockholders' equity............................. 9,024.000 8,254,000 Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3 Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield

- [12] True or False (Provide explanation). The market price of a company's common stock is equal to the equity reported on the balance sheet divided by the total shares outstanding.QUESTION 10 Diluted earnings per share shows dilution resulting from additional shares that may be issued for stock options or bonds that may be converted to shares of common stock in the future. True False[17] True or False (Provide explanation). The paid-in capital amount on the balance sheet affects the value of a common stock.

- Question 19 An investor uses the cost method of accounting for its investment in common stock. During the current year, the investor received $25,000 in dividends, an amount that exceeded the investor's share of the investee company's undistributed income since the investment was acquired. The investor should report dividend income of what amount? Answers: A. $25,000 as a reduction in the investment account B. $25,000 less the amount that is not in excess of its share of undistributed income since the investment was acquired C. $25,000 less recognized earnings D. $25,000 less the amount in excess of its share of undistributed income since the investment was acquired Question 20 Pitch Co. paid $50,000 in fees to its accountants and lawyers in acquiring Slope Company. Pitch will treat the $50,000 as Answers: A. additional cost to investment of Slope on the consolidated balance sheet. B.…Required: 5. The average per-share sales price of the common stock when issue $? per share 6. The cost of the treasury stock per share $? per share 7. The total stockholders' equity $? 8. The per-share book value of the common stock assuming that there are no dividends in arrears and that the preferred stock can be redeemed at its par value $? per share21. What does IAS 32 provide as regards to the gain from sale of treasury shares? Group of answer choices a. It shall be recognized in profit or loss. b. It shall be credited to share premium. c. It shall be credited to share capital. d. It shall be credited to retained earnings.