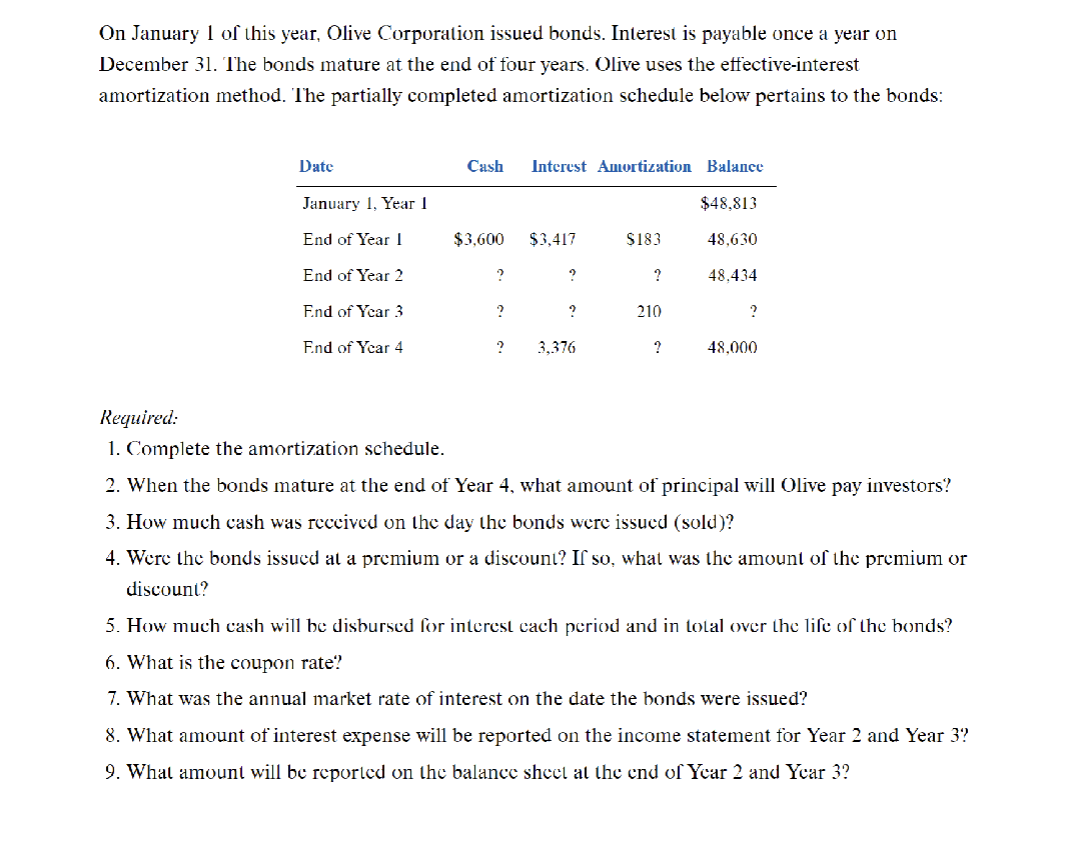

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date January 1, Year 1 End of Year I End of Year 2 End of Year 3 End of Year 4 Cash Interest Amortization Balance $48,813 48,630 48,434 $3,600 ? ? $3,417 ? 3,376 $183 ? 210 ? ? 48,000 Required: 1. Complete the amortization schedule. 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? 3. How much cash was received on the day the bonds were issued (sold)? 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount? 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? 6. What is the coupon rate? 7. What was the annual market rate of interest on the date the bonds were issued? 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3? 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date January 1, Year 1 End of Year I End of Year 2 End of Year 3 End of Year 4 Cash Interest Amortization Balance $48,813 48,630 48,434 $3,600 ? ? $3,417 ? 3,376 $183 ? 210 ? ? 48,000 Required: 1. Complete the amortization schedule. 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? 3. How much cash was received on the day the bonds were issued (sold)? 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount? 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? 6. What is the coupon rate? 7. What was the annual market rate of interest on the date the bonds were issued? 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3? 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

What does completing the amortization schedule mean? What are key ways to attack this problem? What should I pay special attention to?

Transcribed Image Text:On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on

December 31. The bonds mature at the end of four years. Olive uses the effective-interest

amortization method. The partially completed amortization schedule below pertains to the bonds:

Date

January 1, Year 1

End of Year I

End of Year 2

End of Year 3

End of Year 4

Cash

$3,600

?

?

?

Interest Amortization Balance

$48,813

48,630

48,434

$3,417

?

?

3,376

$183

?

210

?

?

48.000

Required:

1. Complete the amortization schedule.

2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors?

3. How much cash was received on the day the bonds were issued (sold)?

4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or

discount?

5. How much cash will be disbursed for interest each period and in total over the life of the bonds?

6. What is the coupon rate?

7. What was the annual market rate of interest on the date the bonds were issued?

8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3?

9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Expert Answers to Latest Homework Questions

Q: Slapshot Company makes ice hockey sticks. During the month of June, the company purchased

$125,000…

Q: The following data from the just completed year are taken from the accounting records of Mason…

Q: During May, Jimmy spent $700 to buy 20 products and sold 4 of them for $60 each. Jimmy should

record…

Q: The four key behavioral considerations in management accounting and control system design

include…

Q: Metropolitan Power and Light is a monopoly in the electrical generation and distribution industry.…

Q: Crane Company reported net income of $470000 for the year ended 12/31/21. Included in

the…

Q: help please answer in text form with proper workings and explanation for each and every part and…

Q: help please answer in text form with proper workings and explanation for each and every part and…

Q: Thaler & Co are prepared to launch their new project. They expect that, once

'operational, they will…

Q: $150

$145

$140

MC

$135

$130

$125

$120

$115

ATC

$110

$105

$100

$95

$90

$85

$80

AVC

$75

$70

$65

$60…

Q: -

Paragraph 3 On January 1, 2023 Subsidiary held

merchandise acquired from Parent for $10,000.…

Q: K

Fifty-four wild bears were anesthetized, and then their weights and chest sizes were measured and…

Q: Please help me find the hybridization (for each central atom) and the VB sketch for…

Q: Calculate the value of the cell potential, E cell for the following reaction:

2 Au(s) + 3 Ca2+(aq)-…

Q: help please answer in text form with proper workings and explanation for each and every part and…

Q: 2) Propose a synthesis of the following using 3-buten-2-one

acetoacetic ester synthesis.

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

Q: Radioactive isotopes that sit above the band of stability (N/Z too high) are most

likely to decay by…

Q: 8. Hydroboration-oxidation

H3C

CH3

CH2

1. HBR2/THF

2. HO, H2O2, H₂O

Q: Your boss has asked you to evaluate the economics of replacing 1,000 60-Watt incandescent light…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…