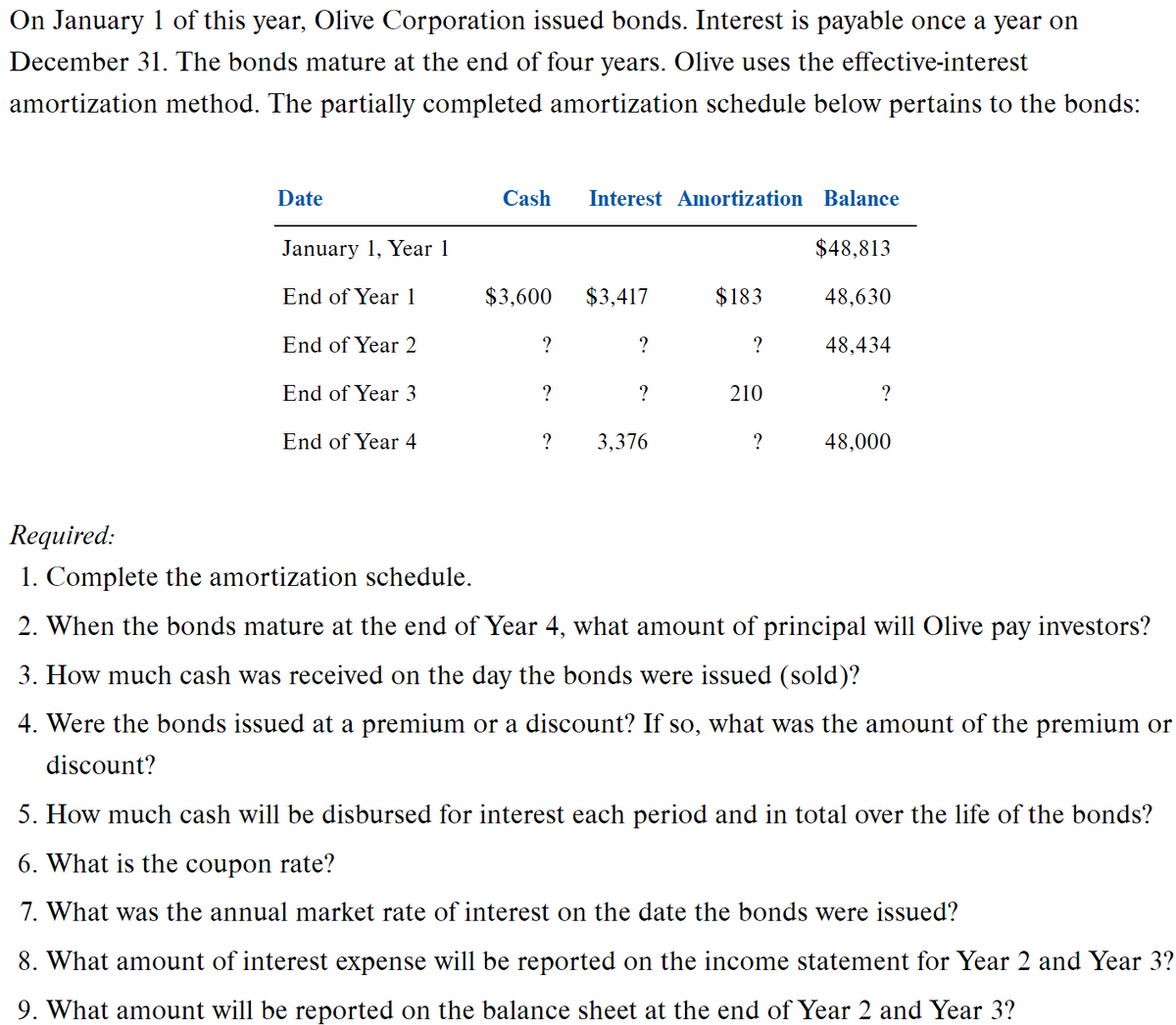

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date Cash Interest Amortization Balance January 1, Year 1 $48,813 End of Year 1 $3,600 $3,417 $183 48,630 End of Year 2 ? 48,434 End of Year 3 210 ? End of Year 4 3,376 48,000 Required: 1. Complete the amortization schedule. 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? 3. How much cash was received on the day the bonds were issued (sold)? 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium discount? 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? 6. What is the coupon rate? 7. What was the annual market rate of interest on the date the bonds were issued? 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Date Cash Interest Amortization Balance January 1, Year 1 $48,813 End of Year 1 $3,600 $3,417 $183 48,630 End of Year 2 ? 48,434 End of Year 3 210 ? End of Year 4 3,376 48,000 Required: 1. Complete the amortization schedule. 2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? 3. How much cash was received on the day the bonds were issued (sold)? 4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium discount? 5. How much cash will be disbursed for interest each period and in total over the life of the bonds? 6. What is the coupon rate? 7. What was the annual market rate of interest on the date the bonds were issued? 8. What amount of interest expense will be reported on the income statement for Year 2 and Year 9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Preparing a Bond Amortization Schedule

answer 1-3

Transcribed Image Text:On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on

December 31. The bonds mature at the end of four years. Olive uses the effective-interest

amortization method. The partially completed amortization schedule below pertains to the bonds:

Date

Cash

Interest Amortization Balance

January 1, Year 1

$48,813

End of Year 1

$3,600

$3,417

$183

48,630

End of Year 2

?

48,434

End of Year 3

?

210

?

End of Year 4

3,376

48,000

Required:

1. Complete the amortization schedule.

2. When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors?

3. How much cash was received on the day the bonds were issued (sold)?

4. Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or

discount?

5. How much cash will be disbursed for interest each period and in total over the life of the bonds?

6. What is the coupon rate?

7. What was the annual market rate of interest on the date the bonds were issued?

8. What amount of interest expense will be reported on the income statement for Year 2 and Year 3?

9. What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,