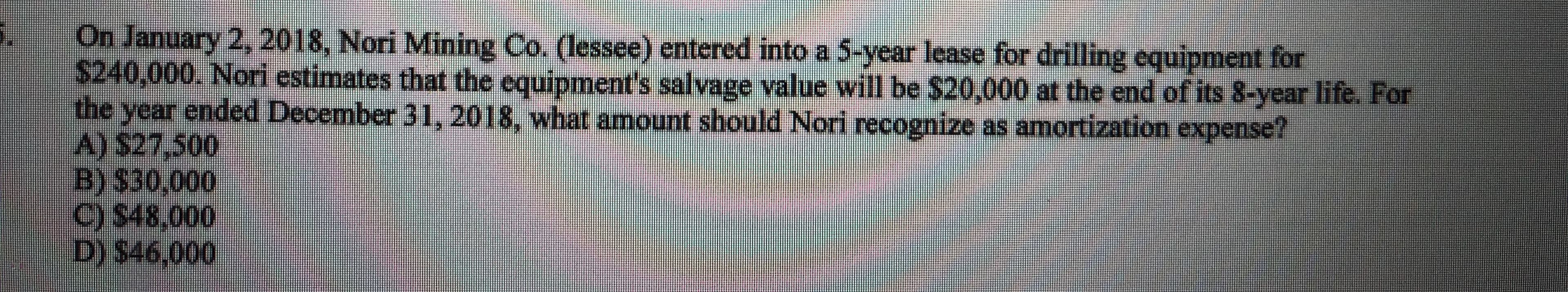

On January 2, 2018, Nori Mining Co. (lessee) entered into a 5-year lease for drilling equipment for $240,000. Nori estimates that the equipment's salvage value will be $20,000 at the end of its 8-year life. For the year ended December 31, 2018, what amnount should Nori recognize as amortization expense? A) S27,500 B) $30,000 C) $48,000 D) $46,000

Q: On December 31, 2019, Ames Company leased equipment for 10 years. The entity contracted to pay P400,…

A: The above solution can be found by preparing a lease liability account or a statement of lease…

Q: Bitag is a dealer in machinery. On January 1, 2023, a machinery was leased to another entity with…

A: A lease is an agreement or contract between two parties, in which one party provides its asset for…

Q: On January 1, 2018, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year…

A: Lease is an agreement or association between two parties in which one party provides its asset for…

Q: t January 1, 2021, Café Med leased restaurant equipment from Crescent Corporation under a nine-year…

A: Lease payment The purpose of lease is when the company required for the capital assets which are…

Q: Happy Company purchased a packing machine intended for leasing at a cost of P330,000. The machine…

A: Interest revenue is calculated by Lease liability present value *Interest rate.. Lease…

Q: Blanket Co. purchased an equipment on January 1, 2020 for $500,000 for lease purposes. It has an…

A: Lease agreement:Lease agreement can be defined as the legal agreement between the lessor (owner) and…

Q: On December 31, 2021, Maroon Co. leased an equipment with a cost of P2,000,000 to Green Co. for…

A: As per IFRS 16, Leases, Lessor will recognize Net investment in lease on lease commencement date…

Q: On January 1, 2020, MCU Company sold an equipment with carrying amount of P6,000,000 and a remaining…

A: Sale and lease back is a transaction where an entity first sells it asset to another entity and then…

Q: On December 31, 2021, Maroon Co. leased an equipment with a cost of P2,000,000 to Green Co. for…

A: In the case of lease accounting, the asset under the lease contract is a long-term asset to the…

Q: On January 1, 2019, SMB Co. entered into a 10-year lease for equipment. The acquisition was…

A: Carrying value: The face amount of bond, less unamortized discount, or plus unamortized premium, is…

Q: On January 2, 2022, Bergify Co. entered into a 5-year lease contract for drilling equipment. Bergify…

A: Under the double-declining balance method, the depreciation is charged on the declining balance of…

Q: On January 1, 2020, Windsor Co. leased a building to Wildhorse Inc. The relevant information related…

A: The following calculations are done to evaluate the building put on lease by Windsor Company.

Q: On January 1, 2021, Nori Mining Company (lessee) entered into a 5 year lease for drilling equipment.…

A: ANSWER Bargain Purchase Option allows the lessee to purchase the property at the end of the lease…

Q: On January 1, 2021, Wait Company leased equipment from a lessor with the following information:…

A: The question is related to Accounting for Lease. The lessee will records the leased assset and…

Q: On December 31, 2020, Lesley Co. signed a 10-year noncancelable lease agreement to lease a storage…

A: “Since you have asked multiple sub-parts, we will solve the first three sub-parts for you. If you…

Q: A Corp. leased a piece of equipment to a lessee on April 1, 2021. The lease is appropriately…

A: Lease - Lease agreements are contracts or instruments that transfer property from one person to…

Q: On January 1, 2021, PokemonGo Company leased equipment to Waldo Corporation under a lease agreement…

A: Solution:- Calculation of the cost of amortization in 2021 as follows under:-

Q: On January 2, 2021, Sandhill, Inc. signed a 10-year noncancelable lease for a heavy duty drill…

A: Financial lease is that lease where lessor has given right to use the assets to lessee which cover…

Q: At January 1, 2018, Butterfly, Inc. leased mining equipment from Diamond Corporation under a…

A: Solution 1 Right to use assets Annual lease payment 62000 *cumulative PV factor for…

Q: Lazy Company leased a building with useful life of 10 years on January 1, 2020 for period of 8 years…

A: Year Date Interest Rate PV of Interest Rate Annual rental payment PV of annual rental payment 1…

Q: On January 1, 2021, RM Company (lessee) entered into a 5-year lease for drilling equipment. RM…

A: A lease is a contract between two or more persons in which one party provides its asset for use to…

Q: An entity acquired an asset costing P3,165,000. The asset is leased on January 1, 2019 to another…

A: Solution: Present value of unguaranteed residual value = P500,000 *0.57 = P285,000 Cost of asset to…

Q: On January 1, 2016, Paete Company signed a 12-year lease for a building. Paete has an option to…

A: Depreciation is an expense charged on the cost of the property or asset for its use in the…

Q: On January 1, 2022, Lessee Company leased a machine with an estimated useful life of 10 years from…

A: The right of use asset is depreciated over the useful life of such asset if the ownership of the…

Q: On December 31, 2021, Maroon Co. leased an equipment with a cost of P2,000,000 to Green Co. for…

A: Residual value is of two types-one is guaranteed residual value and the other is unguaranteed…

Q: On January 1, 2019, ABC Co. entered into a 5-year lease for a construction equipment. ABC Co.…

A:

Q: On January 1, 2019, Inside Company purchased equipment at a cost of P5,000,000 with a useful life of…

A: solution given cost of equipment =5000000 useful life =10 years annual depreciation…

Q: On January 1, 2021, Crane Corporation signed a 5-year noncancelable lease for equipment. The terms…

A: The agreement of using an asset by lessee while the ownership is still with lessor is called lease…

Q: Casanova Company leased a warehouse with adjoining land for a period of 15 years starting April 1,…

A: Working notes :- The building value is 2,500,000 and…

Q: 16. On January 1, 2020, Roque Company purchased a new machine for P6,000,000 for the purpose of…

A: Monthly rental (4,800,000 x 9/12) =3,600,000 Lease bonus ( 600,000 x 9/36)…

Q: January 1, 2022, Tiktok Company leased a heavy equipment to be used in its construction business.…

A: The right-of-use asset refers to the asset taken on the lease by the lessee entity. It is recognized…

Q: On January 2, 2016, Nori Mining Co. (lessee) entered into a 5-year lease for drilling equipment.…

A:

Q: On January 4, 2022, James Nook, Inc. signed a 10-year nonrenewable lease for a building to be used…

A: Leasehold improvements are the improvements made by the lessee to the underlying leased asset. It is…

Q: a. Prepare the relevant journal entries in the first year of the lease. b. Prepare the relevant…

A: Leasee Magnitude Ltd Term of Lease 3 years Use full life of Plant 7 years Lease Rental…

Q: On January 1, 2021, CHRISTMAS Company (lessee) entered into a 5-year lease for drilling equipment.…

A: Answer: Straight line of depreciation = (Cost- Salvage )/ useful life

Q: On January 1, 2021, Sandhill Corporation signed a 5-year noncancelable lease for equipment. The…

A: Account title and explanation Calculations Amount($) Present value of minimum lease payments…

Q: Happy Company purchased a packing machine intended for leasing at a cost of P330,000. The machine…

A: In the books of Happy Company, Lease rental receivable will be accounted as a result of lease. This…

Q: Hurricane Company leased an excavator on January 1, 2018. According to the terms of the agreement,…

A: Hurricane company leased an excavator on 01.01.2018 Lease rent per annum = 20000 TL for 6 years…

Q: On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year…

A: A lease is a written agreement that indicating the conditions within which a lessor acknowledges to…

Q: On January 1, 2019, Tharn Corporation leased a machinery from Type Company on a five-year lease term…

A: The value of the right to use asset is equal to the fair value of lease liability at the inception…

Q: LMO Company incurred expenditures for leasehold improvements during the year. The relevant lease is…

A: Introduction Leasehold improvements are the modification made to leased property, to customize as…

Q: On January 1, 2021, CHRISTMAS Company (lessee) entered into a 5-year lease for drilling equipment.…

A: ANSWER- A leased asset acquired in a capital lease had to be depreciated over the period of time…

Q: th an estimated life of 12 years and no residual value. The straight line depreciation is used. The…

A: The main purpose of the income statement is to show how much profit or loss an organization…

Q: .Happy Company leased a piece of equipment to Great Company on April 1, 2021. The lease is…

A: Happy company's cost of sales= Cost of assets sold + Pv of unguaranteed residual value Cost of…

Q: Joy Company acquired an asset costing P5,239,000. The asset is leased on January 1, 2020 to another…

A:

Q: At January 1, 2018, Café Med leased restaurant equipment from Crescent Corporation under a nine-year…

A: 1.

Q: 1. On January 1, 2021, CHRISTMAS Company (lessee) entered into a 5-year lease for drilling…

A: Solution: Fair value of leased asset = P2,400,000 Estimated residual value after 8 years = P200,000

Q: March 1, 2021, Astrid Corporation purchased an equipment for P500,000 with an estimated residual…

A: Lease revenue:::36,000P Lease Bonus:::P18,000.. Less: Insurance costs:::P8,000.. Less: Maintenance…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Petes Petroleum, Inc., an SEC registrant with a calendar year-end, is in the business of constructing and operating offs] lore oil platforms. Petes Petroleum is required legally to dismantle and remove the platforms at the end of their useful lives, which is estimated to be 10 years. On January 1, 2019, Pete constructed and began operating an offshore oil platform off the coast of Brazil. The total capitalized cost to construct the platform was 3,700,000. In addition, while the future cost of dismantling the oil platform is difficult to estimate, Pete believes there is a 40% chance that the future cost will be 1,425,000, a 40% chance it will be 1,650,000, and a 20% chance that it will cost 2,125,000. The appropriate discount rate is 12%, and Pete uses the straight-line method of depreciation. Required: 1. Prepare the journal entries that Pete should record in 2019 related to the oil platform. 2. Prepare an amortization schedule for the asset retirement obligation. 3. Next Level Prepare a table showing the effect of accounting for the asset retirement obligation on assets, liabilities, shareholders equity, and net income relative to accounting for the associated costs at the end of the assets service life when the expenditure is made.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method

- Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Lease Income and Expense Reuben Company retires a machine from active use on January 2, 2019, for the express purpose of leasing it. The machine had a carrying value of 900,000 after 12 years of use and is expected to have 10 more years of economic life. The machine is depreciated on a straight-line basis. On March 2, 2019, Reuben leases the machine to Owens Company for 180,000 a year for a 5-year period ending February 28, 2024. Under the provisions of the lease, Reuben incurs total maintenance and other related costs of 20,000 for the year ended December 31, 2019. Owens pays 180,000 to Reuben on March 2, 2019. The lease was properly classified as an operating lease. Required: 1. Compute the income before income taxes derived by Reuben from this lease for the calendar year ended December 31, 2019. 2. Compute the amount of rent expense incurred by Owens from this lease for the calendar year ended December 31, 2019.

- On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring payments of 10,000 at the beginning of each year. The machine cost 40,000 and has a useful life of 8 years with no residual value. Kerns implicit interest rate is 10%, and present value factors are as follows: Present value for an annuity due of 1 at 10% for 6 periods4.791 Present value for an annuity due of 1 at 10% for 8 periods5.868 Kern appropriately recorded the lease as a sales-type lease. At the inception of the lease, the Lease Receivable account balance should be: a. 60,000 b. 58,680 c. 48,000 d. 47,910At the beginning of Year 1, Cactus Company has three employees: A, B, and C. Employee A has 3 expected years of future service. Employee B has 4 expected years of future service, and Employee C has 5 expected years of future service. Using the year-of-future-service method, compute the amortization fraction for Years 1 through 5 that Cactus would use to amortize its prior service cost.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.