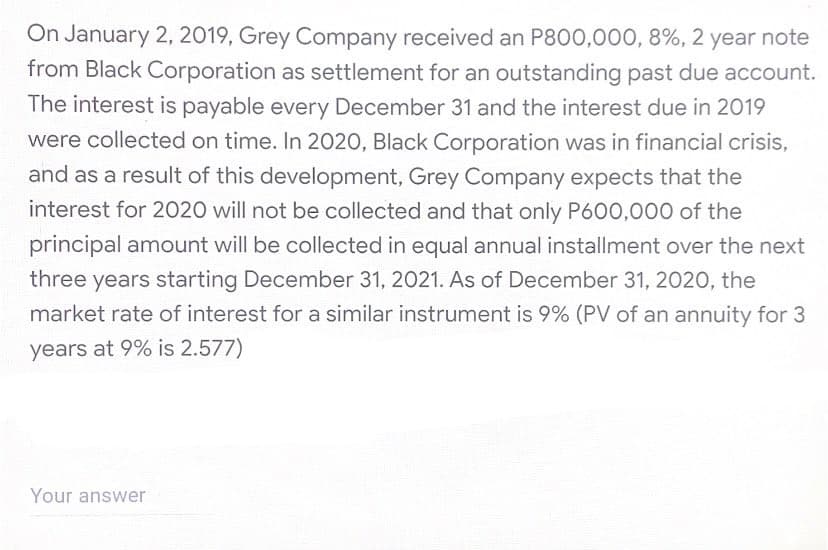

On January 2, 2019, Grey Company received an P800,000, 8%, 2 year note from Black Corporation as settlement for an outstanding past due account. The interest is payable every December 31 and the interest due in 2019 were collected on time. In 2020, Black Corporation was in financial crisis, and as a result of this development, Grey Company expects that the interest for 2020 will not be collected and that only P600,000 of the principal amount will be collected in equal annual installment over the next three years starting December 31, 2021. As of December 31, 2020, the market rate of interest for a similar instrument is 9% (PV of an annuity for 3 years at 9% is 2.577)

On January 2, 2019, Grey Company received an P800,000, 8%, 2 year note from Black Corporation as settlement for an outstanding past due account. The interest is payable every December 31 and the interest due in 2019 were collected on time. In 2020, Black Corporation was in financial crisis, and as a result of this development, Grey Company expects that the interest for 2020 will not be collected and that only P600,000 of the principal amount will be collected in equal annual installment over the next three years starting December 31, 2021. As of December 31, 2020, the market rate of interest for a similar instrument is 9% (PV of an annuity for 3 years at 9% is 2.577)

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 18DQ

Related questions

Question

What amount of impairment loss should Grey Company recognize on December 31, 2020 related to its notes receivable?

Transcribed Image Text:On January 2, 2019, Grey Company received an P800,000, 8%, 2 year note

from Black Corporation as settlement for an outstanding past due account.

The interest is payable every December 31 and the interest due in 2019

were collected on time. In 2020, Black Corporation was in financial crisis,

and as a result of this development, Grey Company expects that the

interest for 2020 will not be collected and that only P600,000 of the

principal amount will be collected in equal annual installment over the next

three years starting December 31, 2021. As of December 31, 2020, the

market rate of interest for a similar instrument is 9% (PV of an annuity for 3

years at 9% is 2.577)

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT