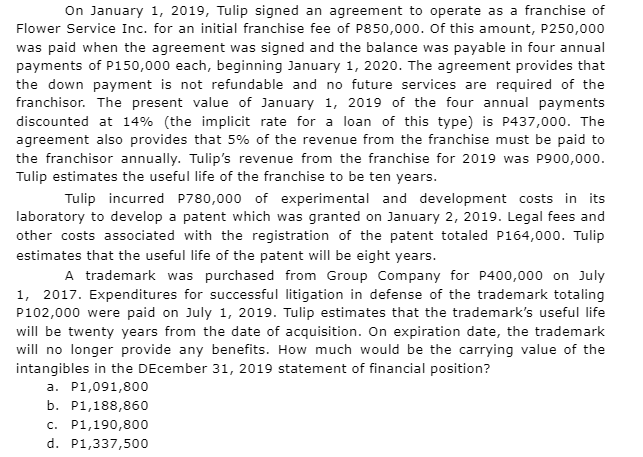

On January 1, 2019, Tulip signed an agreement to operate as a franchise of Flower Service Inc. for an initial franchise fee of P850,000. Of this amount, P250,000 was paid when the agreement was signed and the balance was payable in four annual payments of P150,000 each, beginning January 1, 2020. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value of January 1, 2019 of the four annual payments discounted at 14% (the implicit rate for a loan of this type) is P437,000. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Tulip's revenue from the franchise for 2019 was P900,000. Tulip estimates the useful life of the franchise to be ten years. Tulip incurred P780,000 of experimental and development costs in its laboratory to develop a patent which was granted on January 2, 2019. Legal fees and other costs associated with the registration of the patent totaled P164,000. Tulip estimates that the useful life of the patent will be eight years. A trademark was purchased from Group Company for P400,000 on July 1, 2017. Expenditures for successful litigation in defense of the trademark totaling P102,000 were paid on July 1, 2019. Tulip estimates that the trademark's useful life will be twenty years from the date of acquisition. On expiration date, the trademark will no longer provide any benefits. How much would be the carrying value of the intangibles in the December 31, 2019 statement of financial position? a. P1,091,800 b. P1,188,860 c. P1,190,800 d. P1,337,500

On January 1, 2019, Tulip signed an agreement to operate as a franchise of Flower Service Inc. for an initial franchise fee of P850,000. Of this amount, P250,000 was paid when the agreement was signed and the balance was payable in four annual payments of P150,000 each, beginning January 1, 2020. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value of January 1, 2019 of the four annual payments discounted at 14% (the implicit rate for a loan of this type) is P437,000. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Tulip's revenue from the franchise for 2019 was P900,000. Tulip estimates the useful life of the franchise to be ten years. Tulip incurred P780,000 of experimental and development costs in its laboratory to develop a patent which was granted on January 2, 2019. Legal fees and other costs associated with the registration of the patent totaled P164,000. Tulip estimates that the useful life of the patent will be eight years. A trademark was purchased from Group Company for P400,000 on July 1, 2017. Expenditures for successful litigation in defense of the trademark totaling P102,000 were paid on July 1, 2019. Tulip estimates that the trademark's useful life will be twenty years from the date of acquisition. On expiration date, the trademark will no longer provide any benefits. How much would be the carrying value of the intangibles in the December 31, 2019 statement of financial position? a. P1,091,800 b. P1,188,860 c. P1,190,800 d. P1,337,500

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 3RP

Related questions

Question

Transcribed Image Text:On January 1, 2019, Tulip signed an agreement to operate as a franchise of

Flower Service Inc. for an initial franchise fee of P850,000. Of this amount, P250,000

was paid when the agreement was signed and the balance was payable in four annual

payments of P150,000 each, beginning January 1, 2020. The agreement provides that

the down payment is not refundable and no future services are required of the

franchisor. The present value of January 1, 2019 of the four annual payments

discounted at 14% (the implicit rate for a loan of this type) is P437,000. The

agreement also provides that 5% of the revenue from the franchise must be paid to

the franchisor annually. Tulip's revenue from the franchise for 2019 was P900,000.

Tulip estimates the useful life of the franchise to be ten years.

Tulip incurred P780,000 of experimental and development costs in its

laboratory to develop a patent which was granted on January 2, 2019. Legal fees and

other costs associated with the registration of the patent totaled P164,000. Tulip

estimates that the useful life of the patent will be eight years.

A trademark was purchased from Group Company for P400,000 on July

1, 2017. Expenditures for successful litigation in defense of the trademark totaling

P102,000 were paid on July 1, 2019. Tulip estimates that the trademark's useful life

will be twenty years from the date of acquisition. On expiration date, the trademark

will no longer provide any benefits. How much would be the carrying value of the

intangibles in the December 31, 2019 statement of financial position?

a. P1,091,800

b. P1,188,860

c. P1,190,800

d. P1,337,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning